- Australia

- /

- Professional Services

- /

- ASX:CPU

Computershare (ASX:CPU): Assessing Valuation After a Recent Pullback From Its Highs

Reviewed by Simply Wall St

Computershare (ASX:CPU) has quietly pulled back over the past month, shedding about 5% and now sitting roughly 7% below recent highs. This naturally raises the question: does this dip offer fair value?

See our latest analysis for Computershare.

That pullback comes after a solid run, with the share price delivering a modest year to date gain while total shareholder returns over five years remain very strong. This suggests momentum is pausing rather than breaking.

If Computershare’s move has you rethinking your watchlist, this could be a good moment to explore fast growing stocks with high insider ownership for other compelling growth stories with skin in the game.

With shares trading below both recent highs and analyst targets, yet still reflecting years of strong gains, investors now face a key question: is this a genuine value opportunity, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 8.7% Undervalued

With Computershare last closing at A$34.92 versus a narrative fair value of about A$38.25, the story leans toward upside if the projections hold.

The completion of EquatePlus rollout in Employee Share Plans, combined with strong equity markets, supports double digit revenue growth and margin expansion, suggesting improved revenue and net margins in this segment.

Curious what underpins that higher valuation line? The narrative leans on steadier top line growth, widening margins, and a future earnings multiple that might surprise you.

Result: Fair Value of $38.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat view still hinges on interest rate sensitivity and successful execution of its digitisation plans, both of which could easily disappoint.

Find out about the key risks to this Computershare narrative.

Another Angle on Valuation

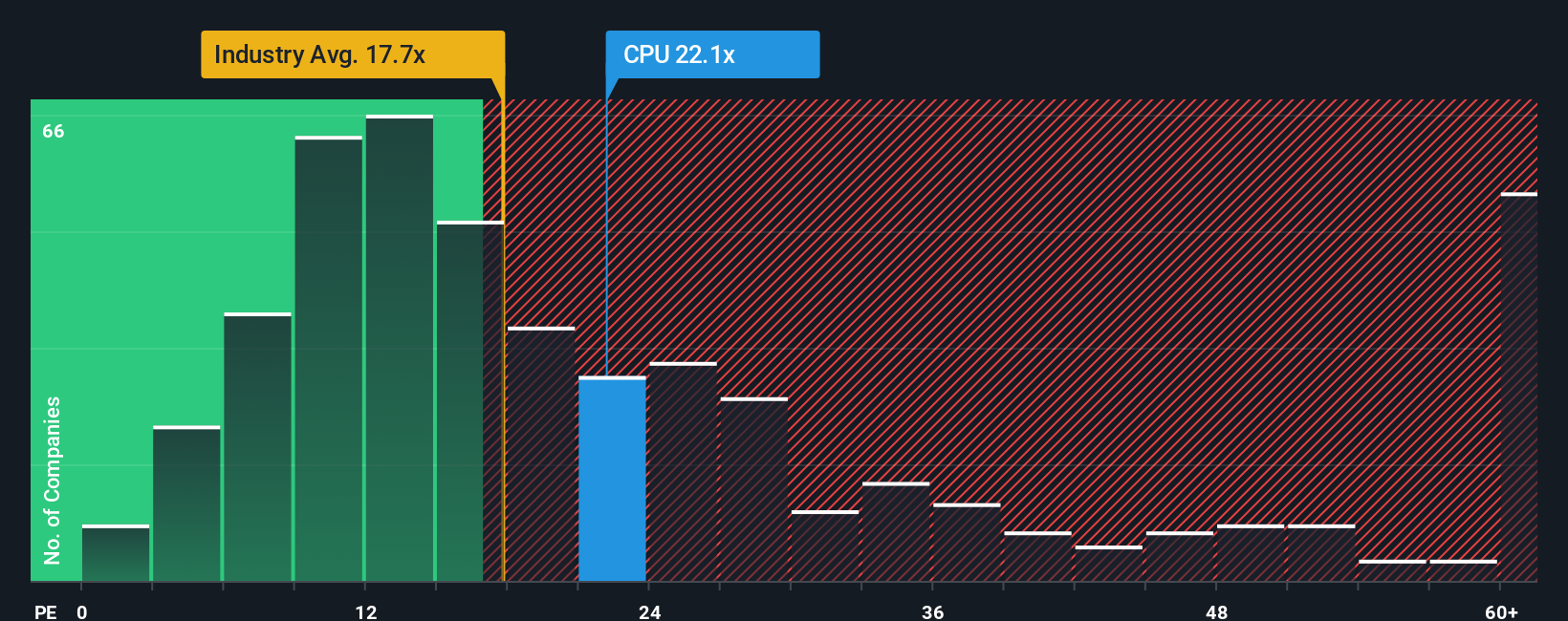

On pure earnings, the picture is less generous. Computershare trades at about 22.2 times earnings, well above the global professional services average of 17.7 times. It is below its own fair ratio of 30.5 times and peers at 36.4 times. Is this a cushion or a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Computershare Narrative

If this perspective does not quite match your own view, dive into the numbers yourself and build a custom story in minutes, Do it your way.

A great starting point for your Computershare research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, take a moment to hunt for your next edge using the Simply Wall St Screener, where fresh ideas can quickly sharpen your portfolio.

- Target dependable income by assessing these 15 dividend stocks with yields > 3% that may strengthen your portfolio with robust, recurring cash returns.

- Capitalize on market mispricing by scanning these 908 undervalued stocks based on cash flows that could offer meaningful upside based on future cash flows.

- Ride the next wave of innovation by reviewing these 26 AI penny stocks positioned at the forefront of artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CPU

Computershare

Provides issuer, corporate trust, employee share plans and voucher, communication and utilities, technology and operations, and mortgage and property rental services.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Micron Technology will experience a robust 16.5% revenue growth

Amazon will rebound as AI investments start paying off by late 2026

Inside Harvey Norman: Asset-Heavy Retail in an Online World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion