- Australia

- /

- Commercial Services

- /

- ASX:BXB

Should You Be Adding Brambles (ASX:BXB) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Brambles (ASX:BXB). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Brambles with the means to add long-term value to shareholders.

View our latest analysis for Brambles

How Fast Is Brambles Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. We can see that in the last three years Brambles grew its EPS by 16% per year. That's a good rate of growth, if it can be sustained.

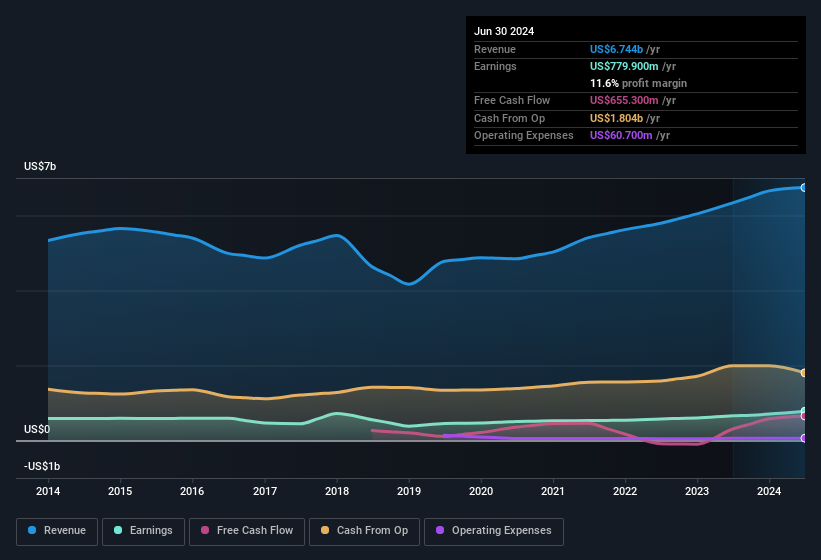

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Our analysis has highlighted that Brambles' revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. EBIT margins for Brambles remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 6.4% to US$6.7b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Brambles' future EPS 100% free.

Are Brambles Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But the bigger deal is that the Independent Non-Executive Director, James Miller, paid US$90k to buy shares at an average price of US$16.29. Purchases like this clue us in to the to the faith management has in the business' future.

Is Brambles Worth Keeping An Eye On?

One important encouraging feature of Brambles is that it is growing profits. While some companies are struggling to grow EPS, Brambles seems free from that morose affliction. The cherry on top is that we have an insider buying shares. A further encouragement to keep an eye on this stock. We should say that we've discovered 2 warning signs for Brambles that you should be aware of before investing here.

Keen growth investors love to see insider activity. Thankfully, Brambles isn't the only one. You can see a a curated list of Australian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Brambles might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BXB

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives