- Australia

- /

- Construction

- /

- ASX:VNT

Peel Mining And 2 Other ASX Penny Stocks For Your Watchlist

Reviewed by Simply Wall St

The Australian market has been experiencing a rollercoaster ride, with the ASX200 showing volatility as it approaches 8,500 points amidst global uncertainties and sector-specific challenges. Penny stocks, though often considered a relic of past market eras, continue to offer intriguing opportunities for investors seeking growth at lower price points. By focusing on companies with strong financials and potential for expansion, investors can uncover hidden gems in this segment of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lindsay Australia (ASX:LAU) | A$0.695 | A$220.43M | ✅ 4 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.85 | A$149.01M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.85 | A$1.11B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.545 | A$72.88M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.59 | A$399.33M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.63 | A$120.24M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.42 | A$162.28M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.28 | A$766.45M | ✅ 4 ⚠️ 3 View Analysis > |

| Tasmea (ASX:TEA) | A$3.15 | A$737.22M | ✅ 3 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.72 | A$454.78M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,001 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Peel Mining (ASX:PEX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Peel Mining Limited is an Australian company focused on exploring economic mineral deposits, with a market cap of A$48.23 million.

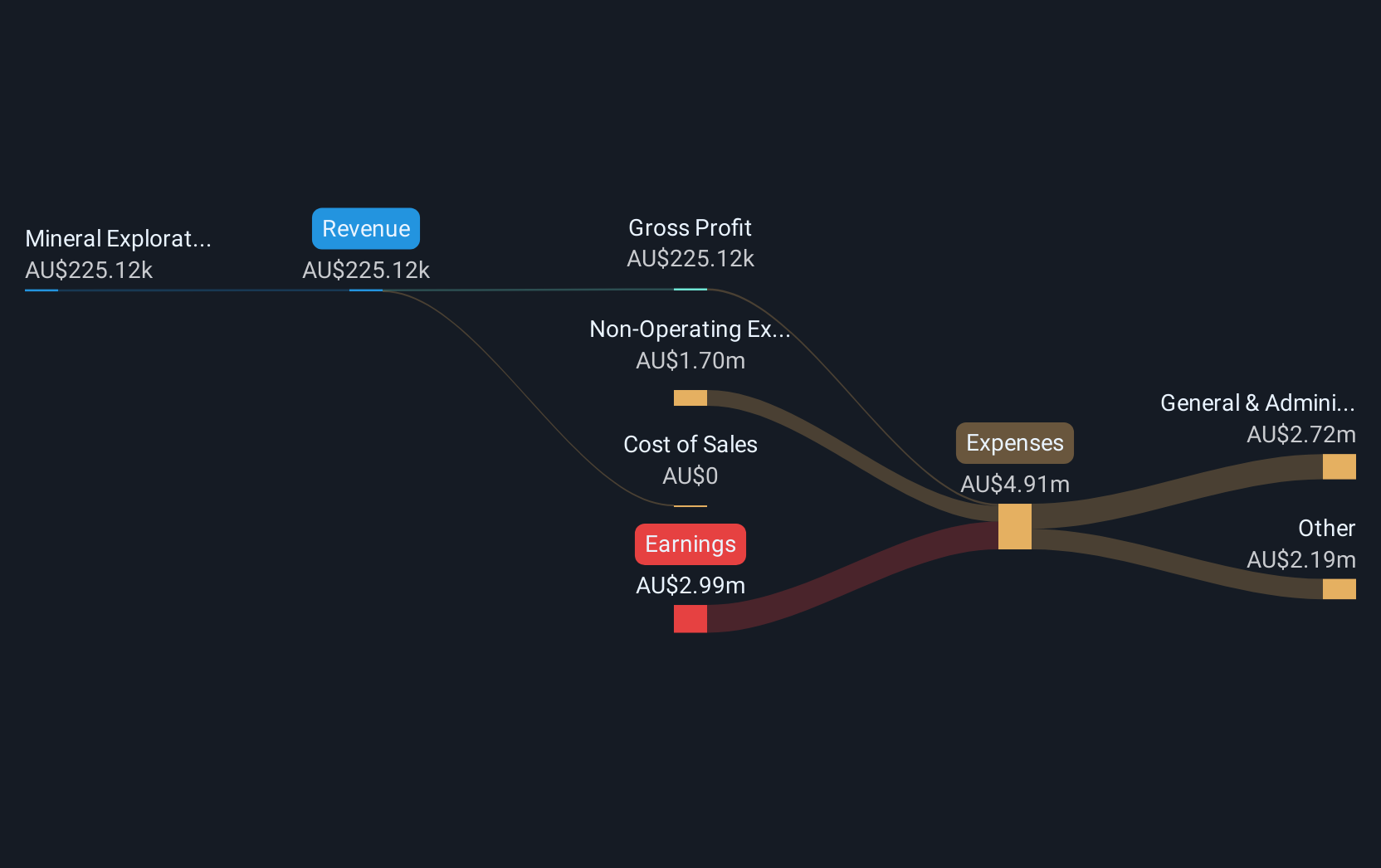

Operations: The company's revenue is derived entirely from its mineral exploration and development activities, amounting to A$0.23 million.

Market Cap: A$48.23M

Peel Mining Limited, with a market cap of A$48.23 million, is pre-revenue, generating less than US$1 million in revenue from its mineral exploration activities. The company reported a net loss of A$1.09 million for the half-year ending December 2024. While the management and board are experienced, Peel faces financial constraints with less than a year of cash runway and negative return on equity at -2.76%. Despite being debt-free and having short-term assets exceeding liabilities, its profitability has declined over five years by 44.7% annually, highlighting significant challenges in achieving sustainable growth in the penny stock realm.

- Jump into the full analysis health report here for a deeper understanding of Peel Mining.

- Gain insights into Peel Mining's historical outcomes by reviewing our past performance report.

SKS Technologies Group (ASX:SKS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SKS Technologies Group Limited operates in Australia, focusing on the design, supply, and installation of audio visual, electrical, and communication products and services, with a market cap of A$197.87 million.

Operations: The company generates revenue of A$198.59 million from its operations in the lighting and audio-visual markets.

Market Cap: A$197.87M

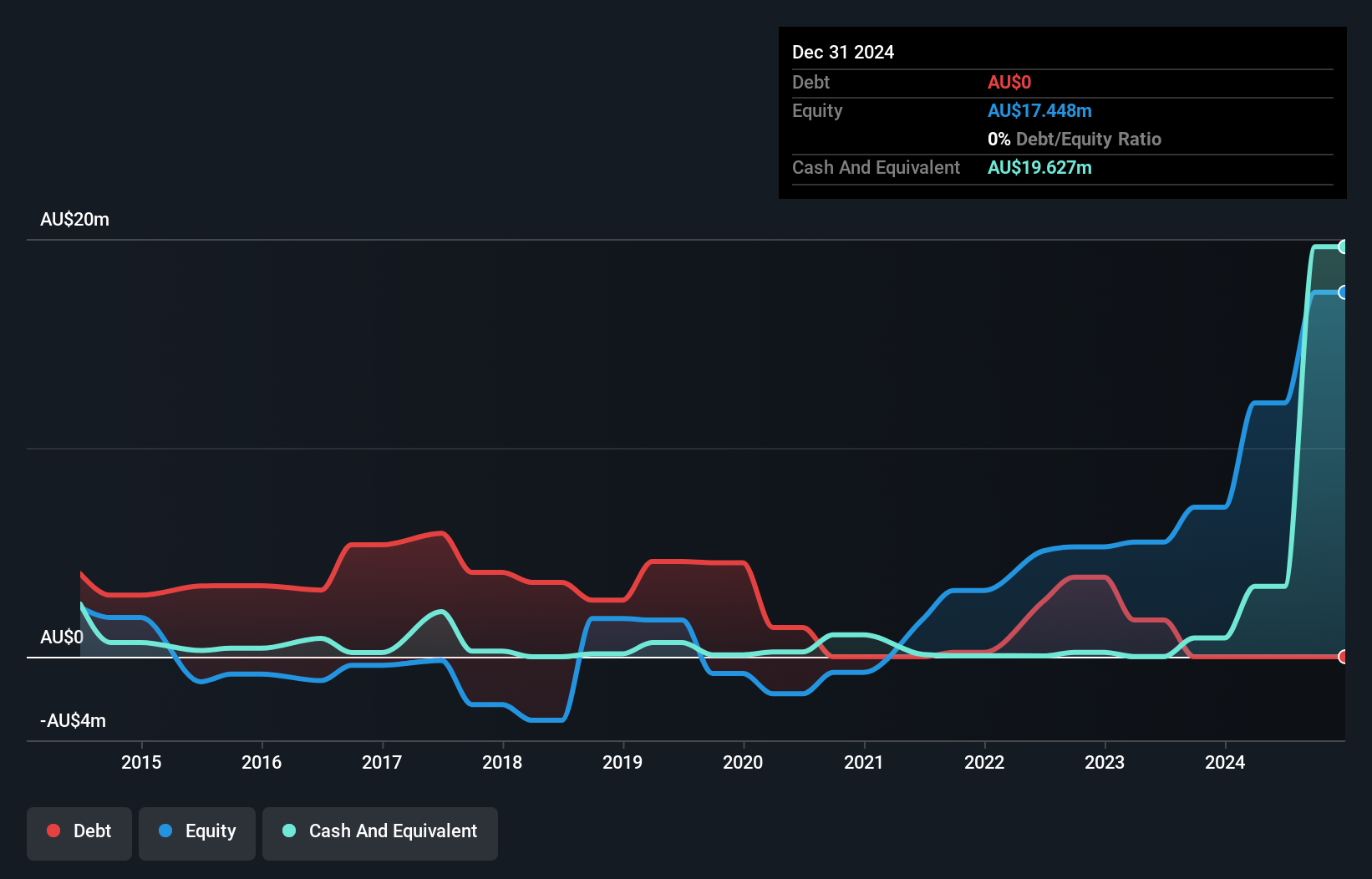

SKS Technologies Group Limited, with a market cap of A$197.87 million, has shown impressive financial performance in the penny stock sector. The company is debt-free, eliminating concerns about interest coverage and cash flow adequacy for liabilities. Its earnings have surged by 437.6% over the past year, significantly outpacing industry growth rates. SKS's return on equity is outstanding at 60.6%, reflecting efficient management and high-quality earnings despite moderate volatility (11%). Recent inclusion in the S&P/ASX All Ordinaries and Emerging Companies Indexes underscores its growing market recognition while trading below estimated fair value suggests potential upside.

- Click here and access our complete financial health analysis report to understand the dynamics of SKS Technologies Group.

- Review our growth performance report to gain insights into SKS Technologies Group's future.

Ventia Services Group (ASX:VNT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ventia Services Group Limited offers infrastructure services across Australia and New Zealand, with a market cap of A$3.98 billion.

Operations: The company's revenue is derived from four main segments: Transport (A$632.4 million), Telecommunications (A$1.58 billion), Infrastructure Services (A$1.32 billion), and Defence and Social Infrastructure (A$2.58 billion).

Market Cap: A$3.98B

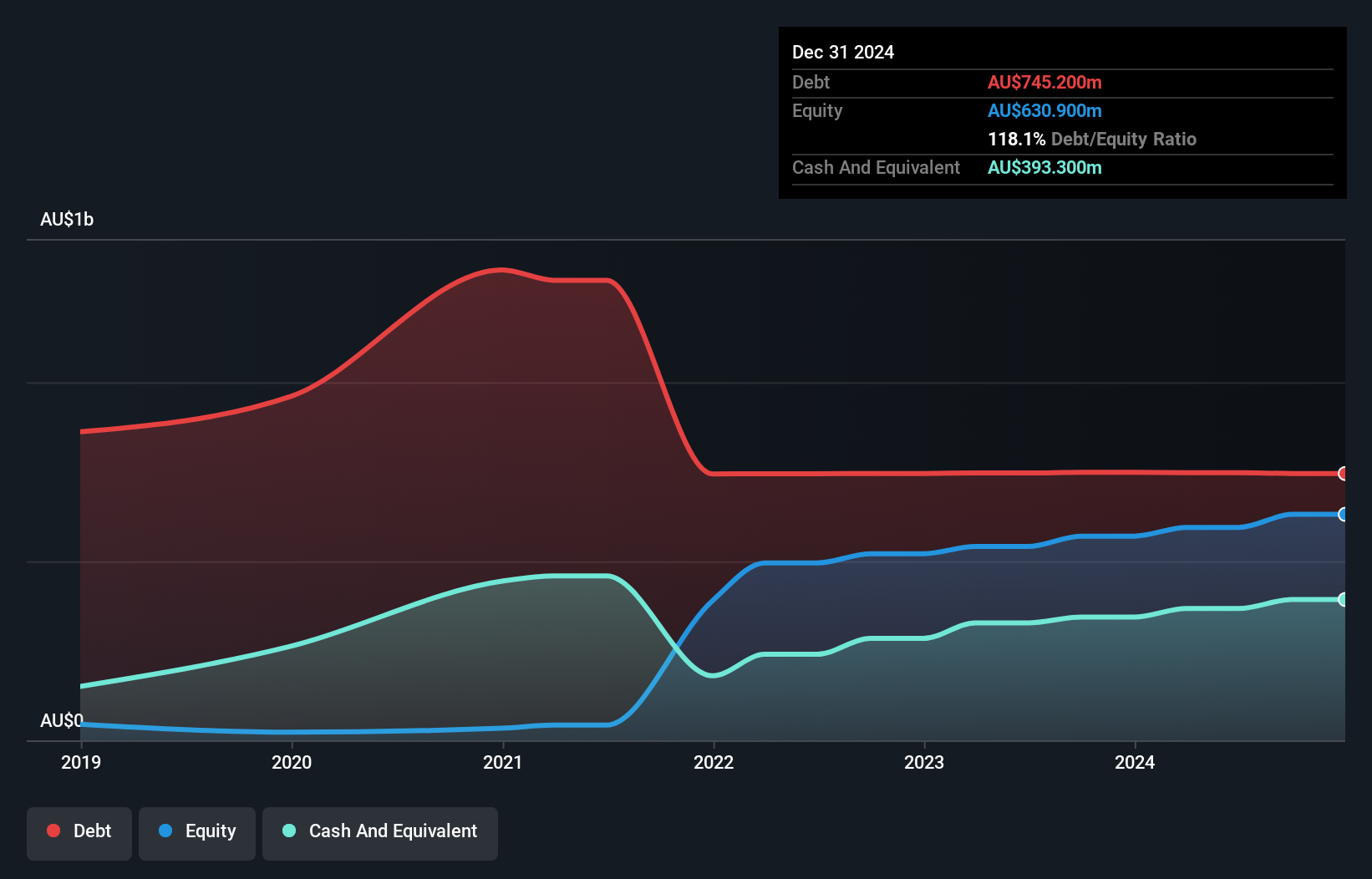

Ventia Services Group Limited, with a market cap of A$3.98 billion, operates across four key segments generating substantial revenue. Despite its high net debt to equity ratio of 55.8%, Ventia's financials are robust, with short-term assets exceeding both its short and long-term liabilities. The company's earnings have grown significantly at 39.4% annually over five years, although recent growth has slowed to 16%. Ventia's return on equity is high at 34.9%, though influenced by leverage. Recent contract extensions with the Department of Defence add significant value and stability to its revenue stream while trading below fair value presents potential investment appeal.

- Get an in-depth perspective on Ventia Services Group's performance by reading our balance sheet health report here.

- Explore Ventia Services Group's analyst forecasts in our growth report.

Where To Now?

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 998 more companies for you to explore.Click here to unveil our expertly curated list of 1,001 ASX Penny Stocks.

- Curious About Other Options? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VNT

Ventia Services Group

Provides infrastructure services in Australia and New Zealand.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives