- Australia

- /

- Trade Distributors

- /

- ASX:SGI

Here's Why I Think Stealth Global Holdings (ASX:SGI) Might Deserve Your Attention Today

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Stealth Global Holdings (ASX:SGI). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Stealth Global Holdings

How Fast Is Stealth Global Holdings Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. It is therefore awe-striking that Stealth Global Holdings's EPS went from AU$0.001 to AU$0.0056 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While Stealth Global Holdings did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

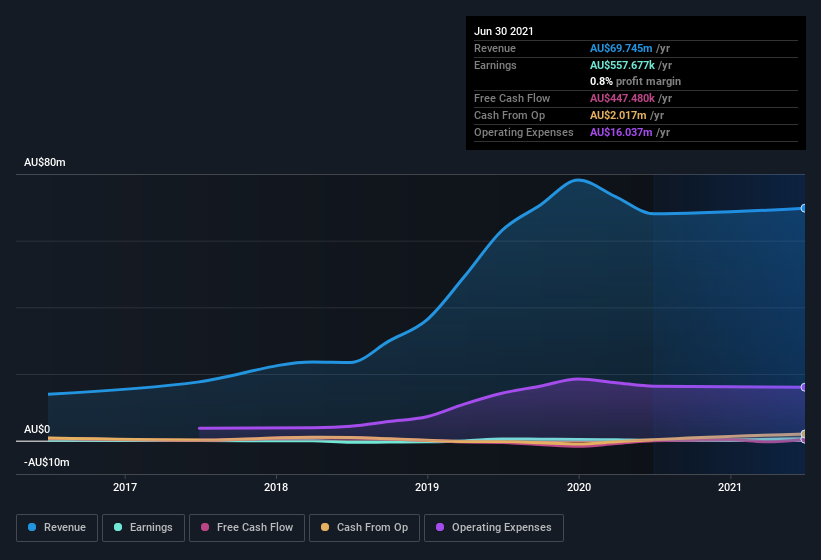

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Stealth Global Holdings isn't a huge company, given its market capitalization of AU$11m. That makes it extra important to check on its balance sheet strength.

Are Stealth Global Holdings Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's good to see Stealth Global Holdings insiders walking the walk, by spending AU$770k on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. We also note that it was the , Narelle Edmunds, who made the biggest single acquisition, paying AU$239k for shares at about AU$0.17 each.

On top of the insider buying, we can also see that Stealth Global Holdings insiders own a large chunk of the company. In fact, they own 42% of the shares, making insiders a very influential shareholder group. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. Of course, Stealth Global Holdings is a very small company, with a market cap of only AU$11m. So despite a large proportional holding, insiders only have AU$4.7m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Should You Add Stealth Global Holdings To Your Watchlist?

Stealth Global Holdings's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. What's more insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Stealth Global Holdings deserves timely attention. What about risks? Every company has them, and we've spotted 4 warning signs for Stealth Global Holdings (of which 1 is significant!) you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Stealth Global Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SGI

Stealth Group Holdings

Operates as an industrial distribution company in Australia and internationally.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives