Reliance Worldwide (ASX:RWC) Might Be Having Difficulty Using Its Capital Effectively

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. Although, when we looked at Reliance Worldwide (ASX:RWC), it didn't seem to tick all of these boxes.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on Reliance Worldwide is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.11 = US$215m ÷ (US$2.1b - US$195m) (Based on the trailing twelve months to December 2022).

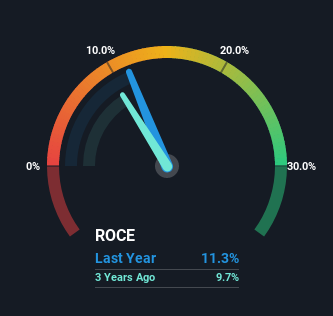

Therefore, Reliance Worldwide has an ROCE of 11%. That's a pretty standard return and it's in line with the industry average of 11%.

Check out our latest analysis for Reliance Worldwide

Above you can see how the current ROCE for Reliance Worldwide compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Reliance Worldwide here for free.

SWOT Analysis for Reliance Worldwide

- Debt is well covered by earnings and cashflows.

- Dividends are covered by earnings and cash flows.

- Earnings growth over the past year underperformed the Building industry.

- Dividend is low compared to the top 25% of dividend payers in the Building market.

- Annual earnings are forecast to grow for the next 3 years.

- Good value based on P/E ratio and estimated fair value.

- Annual earnings are forecast to grow slower than the Australian market.

How Are Returns Trending?

We weren't thrilled with the trend because Reliance Worldwide's ROCE has reduced by 51% over the last five years, while the business employed 388% more capital. Usually this isn't ideal, but given Reliance Worldwide conducted a capital raising before their most recent earnings announcement, that would've likely contributed, at least partially, to the increased capital employed figure. The funds raised likely haven't been put to work yet so it's worth watching what happens in the future with Reliance Worldwide's earnings and if they change as a result from the capital raise. It's also worth noting the company's latest EBIT figure is within 10% of the previous year, so it's fair to assign the ROCE drop largely to the capital raise.

In Conclusion...

Even though returns on capital have fallen in the short term, we find it promising that revenue and capital employed have both increased for Reliance Worldwide. These trends are starting to be recognized by investors since the stock has delivered a 0.4% gain to shareholders who've held over the last five years. Therefore we'd recommend looking further into this stock to confirm if it has the makings of a good investment.

One more thing, we've spotted 2 warning signs facing Reliance Worldwide that you might find interesting.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:RWC

Reliance Worldwide

Engages in the design, manufacture, and supply of water flow, control, and monitoring products and solutions for the plumbing and heating industries.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026