- Australia

- /

- Trade Distributors

- /

- ASX:REH

Reece (ASX:REH) Valuation in Focus Following Leadership Changes and Boardroom Activism

Reviewed by Simply Wall St

Reece (ASX:REH) has announced two governance changes that could shape how investors view the company’s leadership. The company named Jacqueline Chow as an Independent Non-Executive Director and Chair of the Remuneration Committee. It also addressed investor activism ahead of its upcoming Annual General Meeting.

See our latest analysis for Reece.

Despite these high-profile governance changes and some investor activism leading up to the AGM, Reece’s momentum has been mixed. The share price has bounced 4.2% over the past week and 6.9% across the past month, hinting at short-term optimism following recent announcements. However, its longer-term performance tells another story, with a year-to-date share price return of -46.6% and a one-year total shareholder return of -46.3%, signaling more sustained challenges for holders.

If leadership shifts like these have you thinking about what else is out there, it might be time to discover fast growing stocks with high insider ownership.

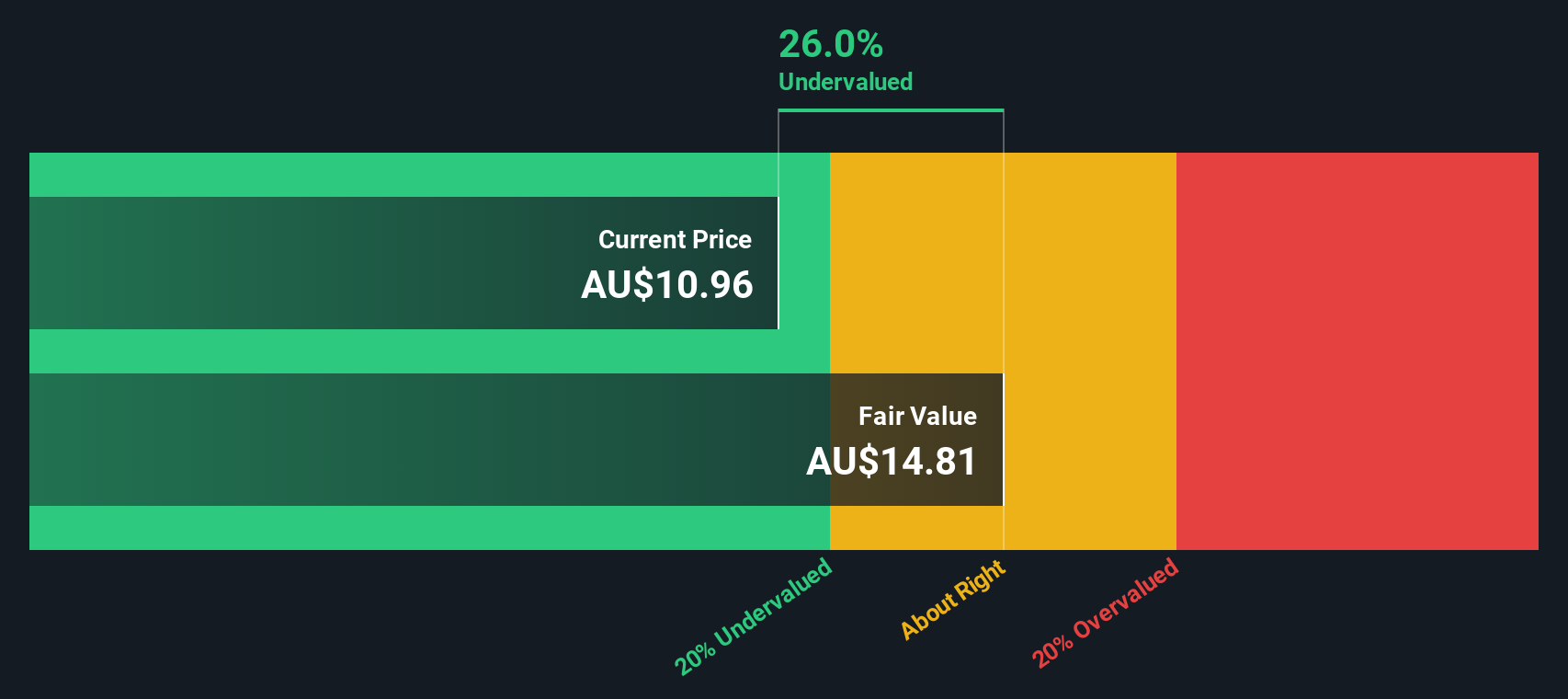

With the stock underperforming over the long term but showing some recent gains, the question remains: is Reece currently trading below its intrinsic worth, or has the market already factored in possible future growth?

Most Popular Narrative: 2% Overvalued

Reece’s consensus fair value estimate sits slightly below the last close price, suggesting limited room for upside right now. All eyes are on whether management’s long-term expansion and innovation bets can deliver enough growth to justify this market optimism.

Sustained commitment to product innovation and premiumisation (for example, launches like WiFi-compatible heat pumps and enhanced digital tools) aligns with a rising market preference for sustainable, efficient solutions. This should enable higher margin product mix and improved net margins as demand trends shift toward eco-friendly offerings.

How does a long-term, innovation-heavy playbook really stack up against stiff market headwinds? The answer lies in a bold projection for future profits and margins. Want to unpack which underlying assumptions are shaping this valuation? The most surprising drivers could challenge everything you expect about Reece’s financial trajectory.

Result: Fair Value of $11.82 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in core end markets or intensifying competition could undermine these growth assumptions and put additional pressure on margins, which may challenge the long-term outlook.

Find out about the key risks to this Reece narrative.

Another View: Discounted Cash Flow

Looking through the lens of our SWS DCF model, Reece is trading at A$12.07, which is roughly 18% below the estimated fair value of A$14.71. This suggests the market could be undervaluing future cash flows, so whose view will ultimately prove closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Reece for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Reece Narrative

If these findings don’t quite align with your perspective, take a few minutes to work through the numbers yourself and shape your own view. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Reece.

Looking for more investment ideas?

Don’t settle for just one opportunity. Give yourself the edge by jumping on a list of investment ideas poised for growth, resilience, and innovation this year, before everyone else does.

- Spot explosive growth potential by targeting these 3582 penny stocks with strong financials that combine strong fundamentals with overlooked value to give your portfolio a real edge.

- Secure reliable income streams when you select these 24 dividend stocks with yields > 3%, packed with companies delivering high yields and steady cash flows, ideal for long-term holders.

- Ride the momentum of artificial intelligence by acting on these 26 AI penny stocks that are transforming industries and setting the pace for tomorrow’s market leaders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:REH

Reece

Engages in the distribution of plumbing, waterworks, heating, ventilation, air-conditioning, and refrigeration products to commercial and residential customers in Australia, New Zealand, and the United States.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives