- Australia

- /

- Retail Distributors

- /

- ASX:SNL

Discover 3 Undiscovered Gems In Australia With Strong Potential

Reviewed by Simply Wall St

The Australian market has shown promising performance, rising 1.1% over the last week and 18% over the past year, with earnings projected to grow by 12% annually. In this environment, a good stock often combines strong fundamentals with growth potential, making it an attractive prospect for investors seeking undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Bisalloy Steel Group | 0.95% | 10.27% | 24.14% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| SKS Technologies Group | NA | 34.65% | 47.39% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

DroneShield (ASX:DRO)

Simply Wall St Value Rating: ★★★★★★

Overview: DroneShield Limited specializes in creating and selling hardware and software solutions for drone detection and security across Australia and the United States, with a market capitalization of approximately A$1.22 billion.

Operations: DroneShield Limited generates revenue primarily from its Aerospace & Defense segment, amounting to A$67.52 million.

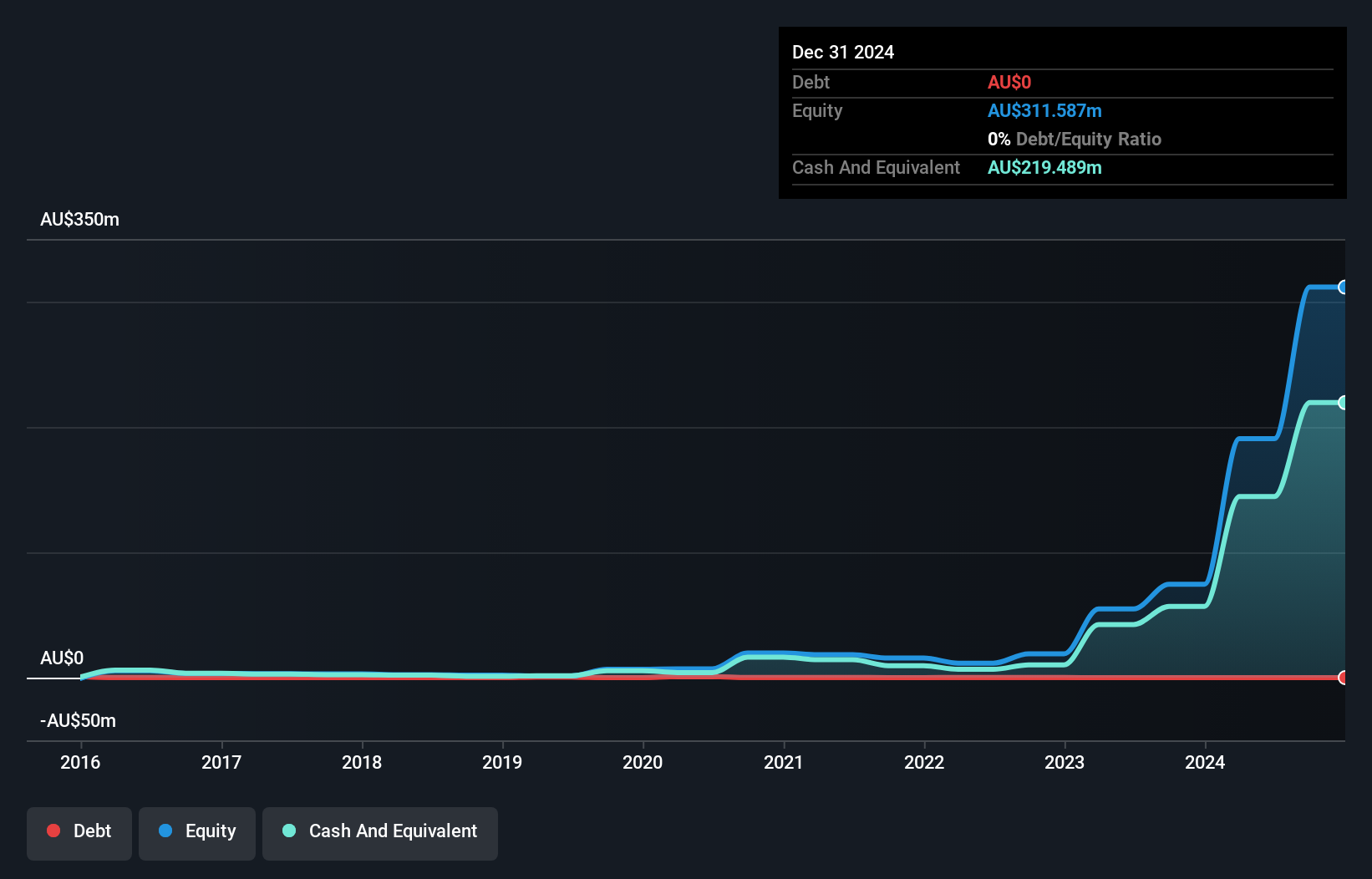

DroneShield, a nimble player in the defense sector, has seen its earnings soar by 612% over the past year, outpacing industry growth. Despite being debt-free and trading at 48% below estimated fair value, it faces volatility with recent share price fluctuations. The company reported A$23.99 million in sales for H1 2024 but also a net loss of A$4.8 million compared to A$2.94 million last year. Recent board additions could bolster strategic direction as it joins key indices like S&P/ASX Small Ordinaries and S&P/ASX 300 Indexes.

- Dive into the specifics of DroneShield here with our thorough health report.

Assess DroneShield's past performance with our detailed historical performance reports.

Redox (ASX:RDX)

Simply Wall St Value Rating: ★★★★★★

Overview: Redox Limited is a company that supplies and distributes chemicals, ingredients, and raw materials across Australia, New Zealand, the United States, and internationally, with a market capitalization of A$1.76 billion.

Operations: Redox generates revenue primarily from its wholesale segment, specifically in drugs, amounting to A$1.14 billion.

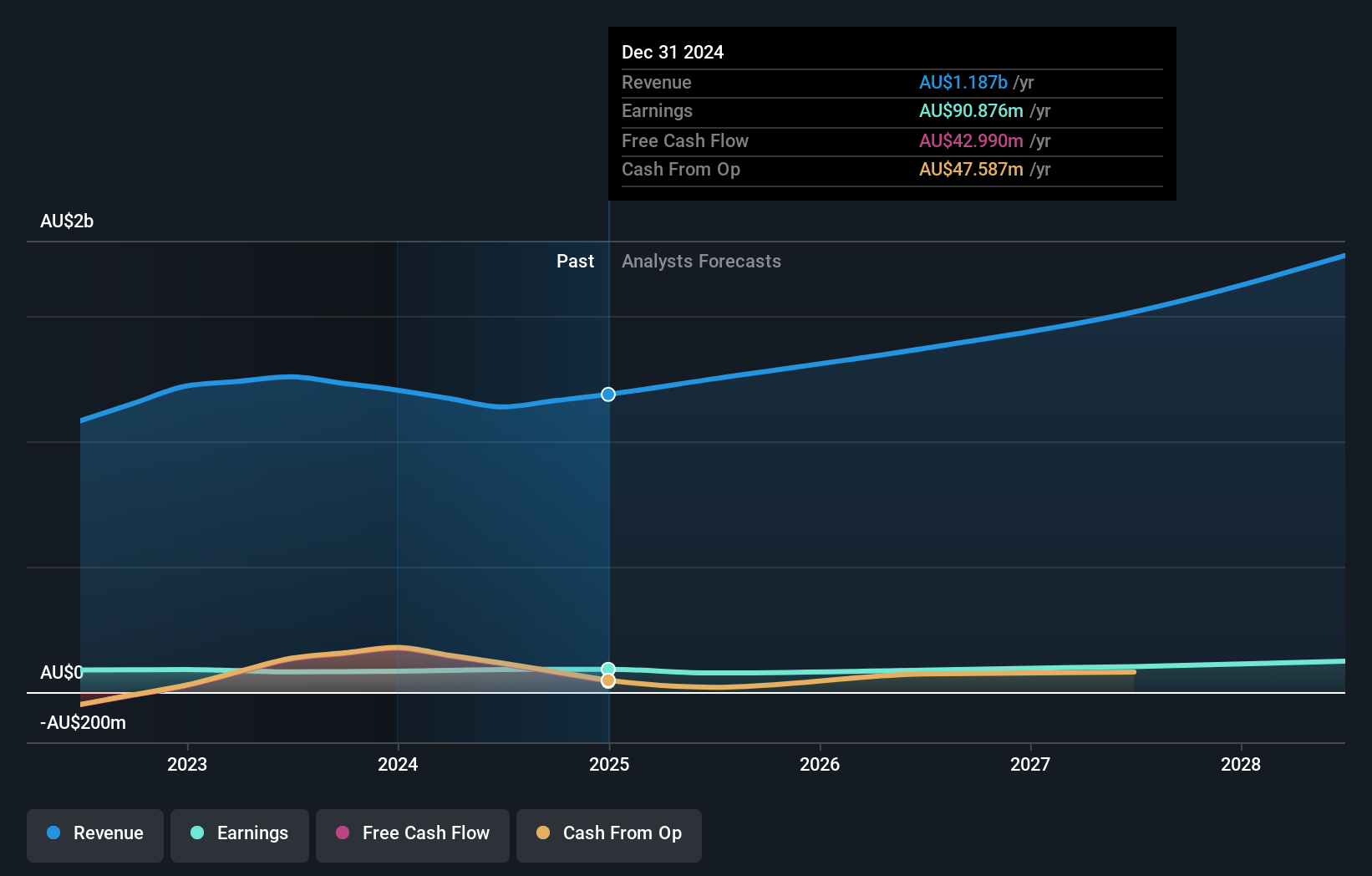

In the Australian market, Redox stands out with its robust financial health and strategic positioning. The company reported A$90.24 million in net income for 2024, up from A$80.73 million the previous year, despite a dip in sales to A$1.14 billion from A$1.26 billion. With high-quality earnings and a significant reduction in debt-to-equity ratio from 69.6% to 2.6% over five years, Redox seems well-poised for steady growth at an estimated rate of 7.63% annually, while trading at an attractive value slightly below fair estimate by about 8%.

- Take a closer look at Redox's potential here in our health report.

Gain insights into Redox's historical performance by reviewing our past performance report.

Supply Network (ASX:SNL)

Simply Wall St Value Rating: ★★★★★★

Overview: Supply Network Limited supplies aftermarket parts to the commercial vehicle industry in Australia and New Zealand, with a market cap of A$1.28 billion.

Operations: Supply Network Limited generates revenue of A$302.72 million from supplying aftermarket parts to the commercial vehicle industry in Australia and New Zealand.

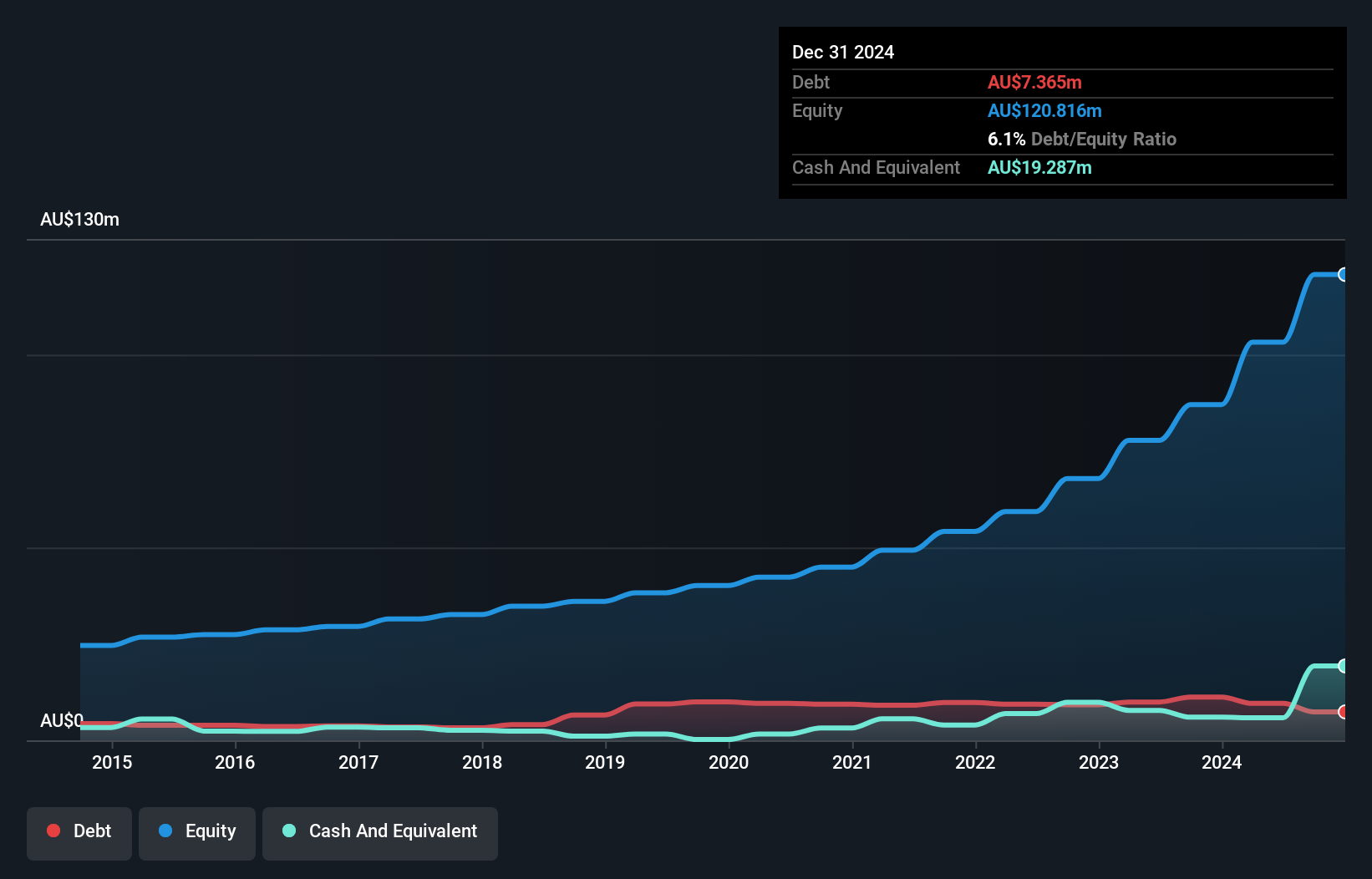

Supply Network, a nimble player in the Australian market, reported a solid A$302.6 million in sales for the year ending June 2024, up from A$252.25 million previously. Net income reached A$33.03 million, reflecting robust earnings growth of 20.5%, outpacing its industry peers significantly at -0.02%. Despite shareholder dilution over the past year, its net debt to equity ratio stands at a satisfactory 3.6%. The company anticipates steady revenue growth around 14% annually moving forward.

- Delve into the full analysis health report here for a deeper understanding of Supply Network.

Explore historical data to track Supply Network's performance over time in our Past section.

Next Steps

- Take a closer look at our ASX Undiscovered Gems With Strong Fundamentals list of 57 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SNL

Supply Network

Provides aftermarket parts to the commercial vehicle industry in Australia and New Zealand.

Flawless balance sheet with reasonable growth potential.