- Australia

- /

- Aerospace & Defense

- /

- ASX:QHL

Quickstep Holdings Limited's (ASX:QHL) Shares Leap 30% Yet They're Still Not Telling The Full Story

Those holding Quickstep Holdings Limited (ASX:QHL) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 19% in the last twelve months.

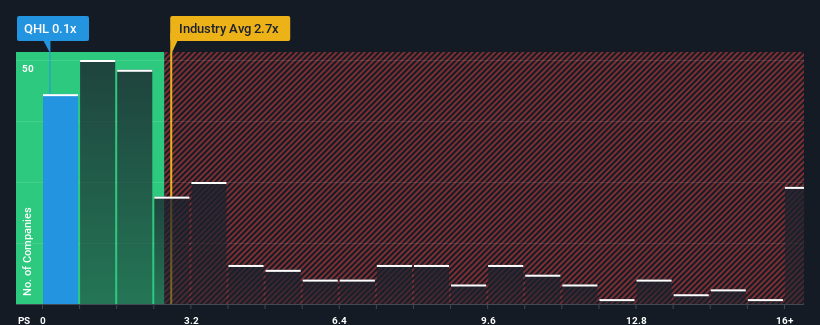

In spite of the firm bounce in price, when close to half the companies operating in Australia's Aerospace & Defense industry have price-to-sales ratios (or "P/S") above 0.7x, you may still consider Quickstep Holdings as an enticing stock to check out with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Quickstep Holdings

How Has Quickstep Holdings Performed Recently?

Revenue has risen firmly for Quickstep Holdings recently, which is pleasing to see. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. Those who are bullish on Quickstep Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Quickstep Holdings will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Quickstep Holdings' is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 19%. Revenue has also lifted 18% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 6.9% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this information, we find it odd that Quickstep Holdings is trading at a P/S lower than the industry. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

What Does Quickstep Holdings' P/S Mean For Investors?

The latest share price surge wasn't enough to lift Quickstep Holdings' P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

The fact that Quickstep Holdings currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Quickstep Holdings that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Quickstep Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:QHL

Quickstep Holdings

Manufactures and sells advanced composites for the defense and commercial aerospace, automotive, and other industry sectors in Australia, the United Kingdom, and the United States.

Good value with mediocre balance sheet.

Market Insights

Community Narratives