- Australia

- /

- Real Estate

- /

- ASX:PPC

ASX Dividend Stocks Commonwealth Bank of Australia And 2 More For Your Portfolio

Reviewed by Simply Wall St

As the Australian market kicked off the week on a positive note, with most sectors in the green, investors are keeping a close eye on potential catalysts like European investments in critical mineral projects. In this environment of cautious optimism, dividend stocks such as Commonwealth Bank of Australia offer attractive opportunities for those seeking steady income and stability amidst fluctuating market conditions.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Treasury Wine Estates (ASX:TWE) | 7.08% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 5.94% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.90% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.70% | ★★★★★☆ |

| Smartgroup (ASX:SIQ) | 5.99% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.83% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 5.89% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.84% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.18% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 7.22% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top ASX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Commonwealth Bank of Australia (ASX:CBA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Commonwealth Bank of Australia offers retail and commercial banking services across Australia, New Zealand, and internationally with a market cap of A$259.10 billion.

Operations: Commonwealth Bank of Australia's revenue segments include Retail Banking Services (including Bankwest) at A$12.87 billion, Business Banking at A$8.75 billion, New Zealand operations at A$2.96 billion, and Institutional Banking and Markets at A$2.76 billion.

Dividend Yield: 3.1%

Commonwealth Bank of Australia's dividend payments have been volatile over the past decade, with a current payout ratio of 80% indicating they are covered by earnings. However, the bank's dividend yield is relatively low at 3.13%, compared to the top quartile in Australia. Recent executive changes and substantial fixed-income offerings suggest strategic shifts but do not directly impact dividends. While earnings grew by 6.9% last year, future growth is forecasted at a modest rate of 3.99% per annum.

- Take a closer look at Commonwealth Bank of Australia's potential here in our dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Commonwealth Bank of Australia shares in the market.

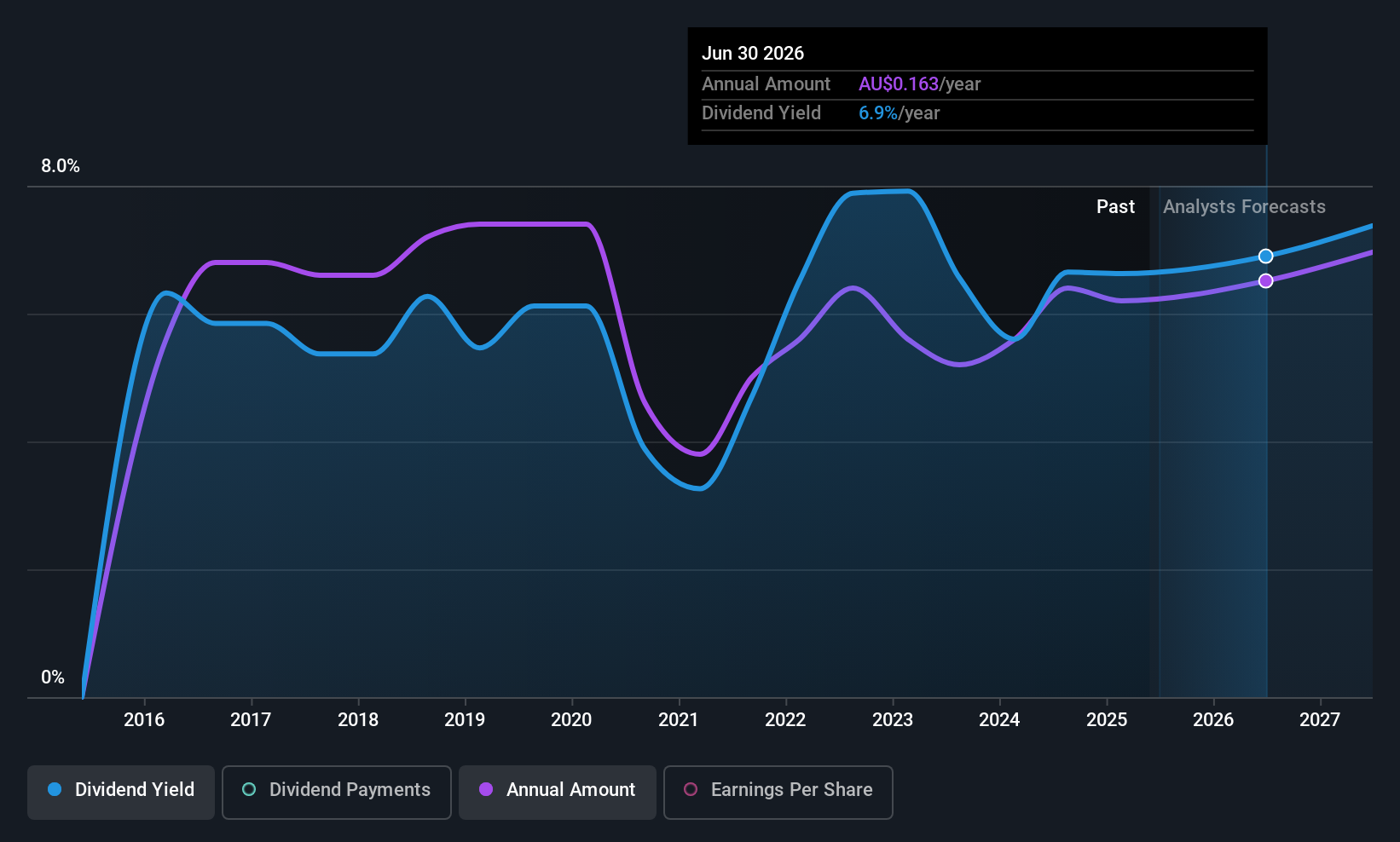

GWA Group (ASX:GWA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GWA Group Limited is involved in the research, design, manufacture, import, and marketing of building fixtures and fittings for residential and commercial properties across Australia, New Zealand, the United Kingdom, and other international markets with a market cap of A$645.50 million.

Operations: GWA Group's revenue primarily comes from its Water Solutions segment, which generated A$418.48 million.

Dividend Yield: 6.3%

GWA Group's dividend yield of 6.3% ranks in the top quartile among Australian stocks, yet its high payout ratio of 94.8% suggests dividends are not well covered by earnings, though cash flows provide some support with a 61.3% cash payout ratio. The stock trades at a significant discount to estimated fair value and offers good relative value compared to peers. Recent board changes, including Nicola Page's appointment, may influence strategic directions but don't directly affect dividend sustainability.

- Get an in-depth perspective on GWA Group's performance by reading our dividend report here.

- Our expertly prepared valuation report GWA Group implies its share price may be lower than expected.

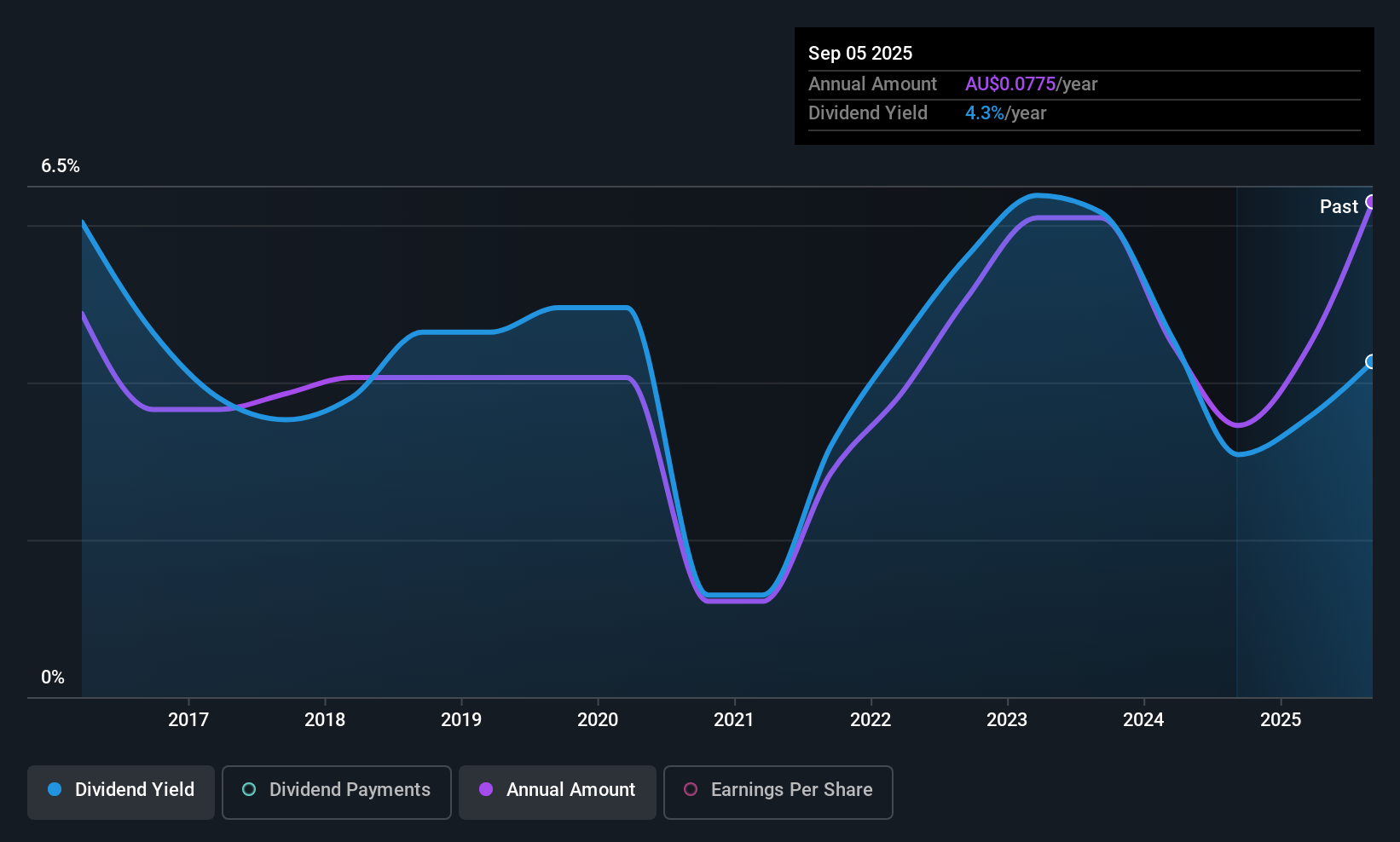

Peet (ASX:PPC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Peet Limited acquires, develops, and markets residential land in Australia with a market cap of A$941 million.

Operations: Peet Limited's revenue is derived from three main segments: Funds Management (A$56.39 million), Joint Arrangements (A$51.88 million), and Company Owned Projects (A$313.24 million).

Dividend Yield: 3.9%

Peet's dividend yield of 3.86% is below the top quartile in Australia, and while its payout ratio of 62.1% indicates dividends are covered by earnings, past payments have been volatile with significant annual drops. The cash payout ratio is a comfortable 34.1%, suggesting strong coverage by cash flows despite high debt levels. Recent organizational changes, including the redundancy of COO Tony Gallagher, may impact future strategies but not immediate dividend sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of Peet.

- Our valuation report unveils the possibility Peet's shares may be trading at a discount.

Summing It All Up

- Take a closer look at our Top ASX Dividend Stocks list of 31 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PPC

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives