If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. With that in mind, we've noticed some promising trends at EVZ (ASX:EVZ) so let's look a bit deeper.

Return On Capital Employed (ROCE): What Is It?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for EVZ, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.045 = AU$1.4m ÷ (AU$56m - AU$26m) (Based on the trailing twelve months to June 2022).

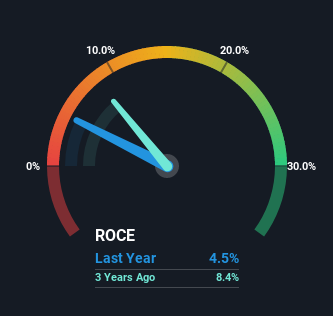

Thus, EVZ has an ROCE of 4.5%. In absolute terms, that's a low return and it also under-performs the Construction industry average of 14%.

View our latest analysis for EVZ

Historical performance is a great place to start when researching a stock so above you can see the gauge for EVZ's ROCE against it's prior returns. If you're interested in investigating EVZ's past further, check out this free graph of past earnings, revenue and cash flow.

The Trend Of ROCE

EVZ has recently broken into profitability so their prior investments seem to be paying off. About five years ago the company was generating losses but things have turned around because it's now earning 4.5% on its capital. Not only that, but the company is utilizing 52% more capital than before, but that's to be expected from a company trying to break into profitability. We like this trend, because it tells us the company has profitable reinvestment opportunities available to it, and if it continues going forward that can lead to a multi-bagger performance.

On a side note, EVZ's current liabilities are still rather high at 46% of total assets. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

The Bottom Line

Long story short, we're delighted to see that EVZ's reinvestment activities have paid off and the company is now profitable. Considering the stock has delivered 29% to its stockholders over the last five years, it may be fair to think that investors aren't fully aware of the promising trends yet. Given that, we'd look further into this stock in case it has more traits that could make it multiply in the long term.

One more thing: We've identified 4 warning signs with EVZ (at least 1 which is significant) , and understanding these would certainly be useful.

While EVZ may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Valuation is complex, but we're here to simplify it.

Discover if EVZ might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:EVZ

Flawless balance sheet and fair value.

Market Insights

Community Narratives