- Australia

- /

- Electrical

- /

- ASX:SKS

Discovering Australia's Hidden Stock Gems In November 2025

Reviewed by Simply Wall St

As the Australian market navigates a turbulent period, with tech indices taking a significant hit and broad market sentiment weighed down by global economic uncertainties, investors are keenly observing sectors like lithium for potential opportunities. In such challenging conditions, identifying promising small-cap stocks requires a focus on companies with robust fundamentals and growth potential that can withstand broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Euroz Hartleys Group | NA | 1.82% | -25.32% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| Energy World | NA | -47.50% | -44.86% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Peet | 53.46% | 12.70% | 31.21% | ★★★★☆☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Emeco Holdings (ASX:EHL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emeco Holdings Limited provides surface and underground mining equipment rental and related services in Australia, with a market capitalization of approximately A$630.25 million.

Operations: Emeco Holdings generates revenue primarily through its rental segment, contributing A$615.39 million, and workshops, adding A$273.47 million. The company's financial performance is influenced by its net profit margin trend over recent periods.

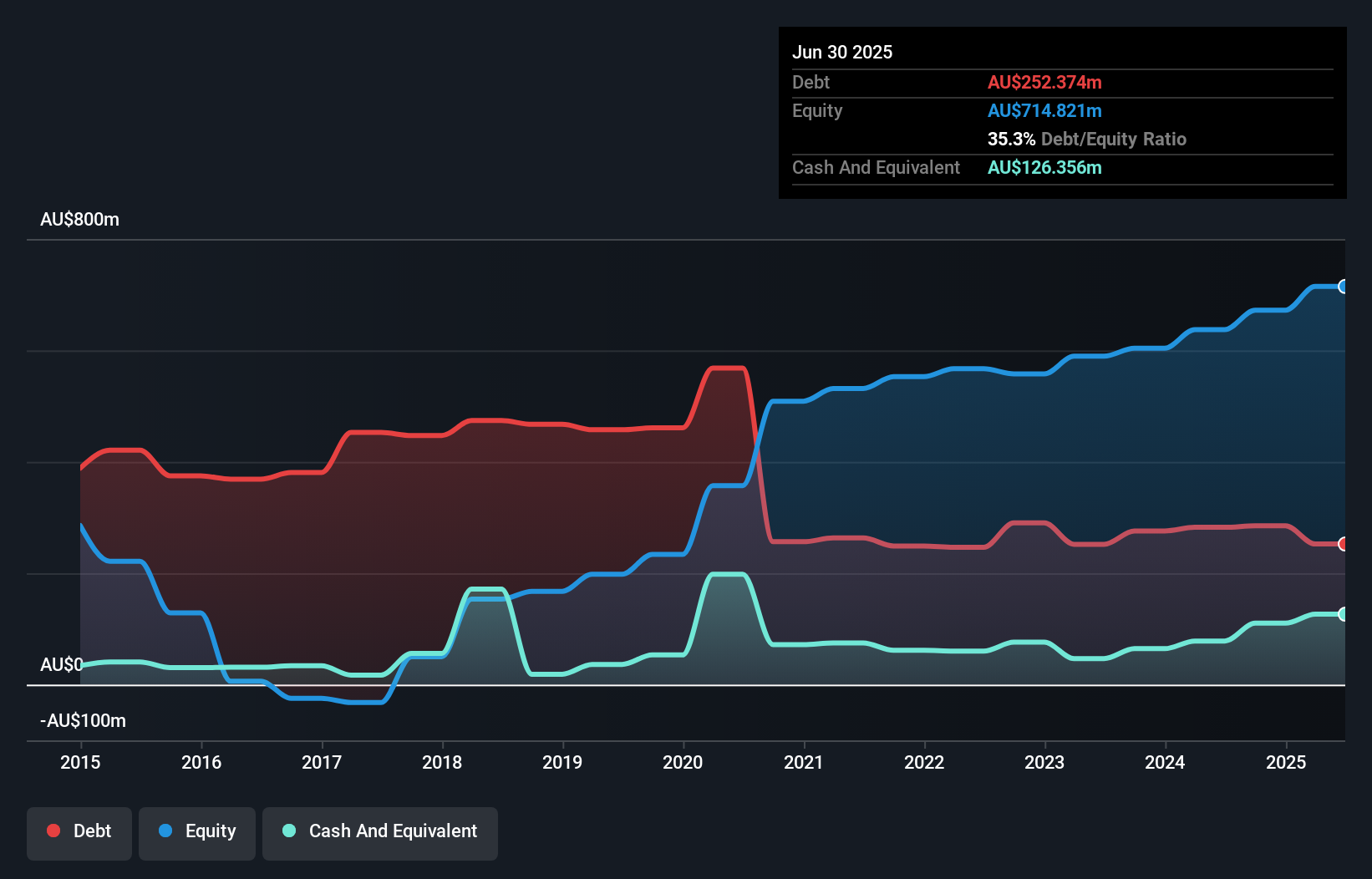

Emeco Holdings, a notable player in the equipment rental sector, is trading at 65% below its estimated fair value, offering potential upside. Its net debt to equity ratio stands at a satisfactory 17.6%, reflecting prudent financial management as it reduced from 159.1% to 35.3% over five years. Emeco's earnings surged by an impressive 42.7% last year, outpacing industry growth of 17.1%. The company is expanding into ESG-compliant services and modernizing its fleet for sustainable growth while facing challenges like high capital requirements and reliance on traditional mining practices amidst industry shifts toward electrification and automation.

SKS Technologies Group (ASX:SKS)

Simply Wall St Value Rating: ★★★★★★

Overview: SKS Technologies Group Limited operates in Australia, focusing on the design, supply, and installation of audio visual, electrical, and communication products and services with a market cap of A$388.86 million.

Operations: SKS Technologies Group generates revenue primarily from the lighting and audio-visual markets, amounting to A$261.66 million. The company's focus on these segments influences its financial performance, with a notable emphasis on optimizing its cost structure to enhance profitability.

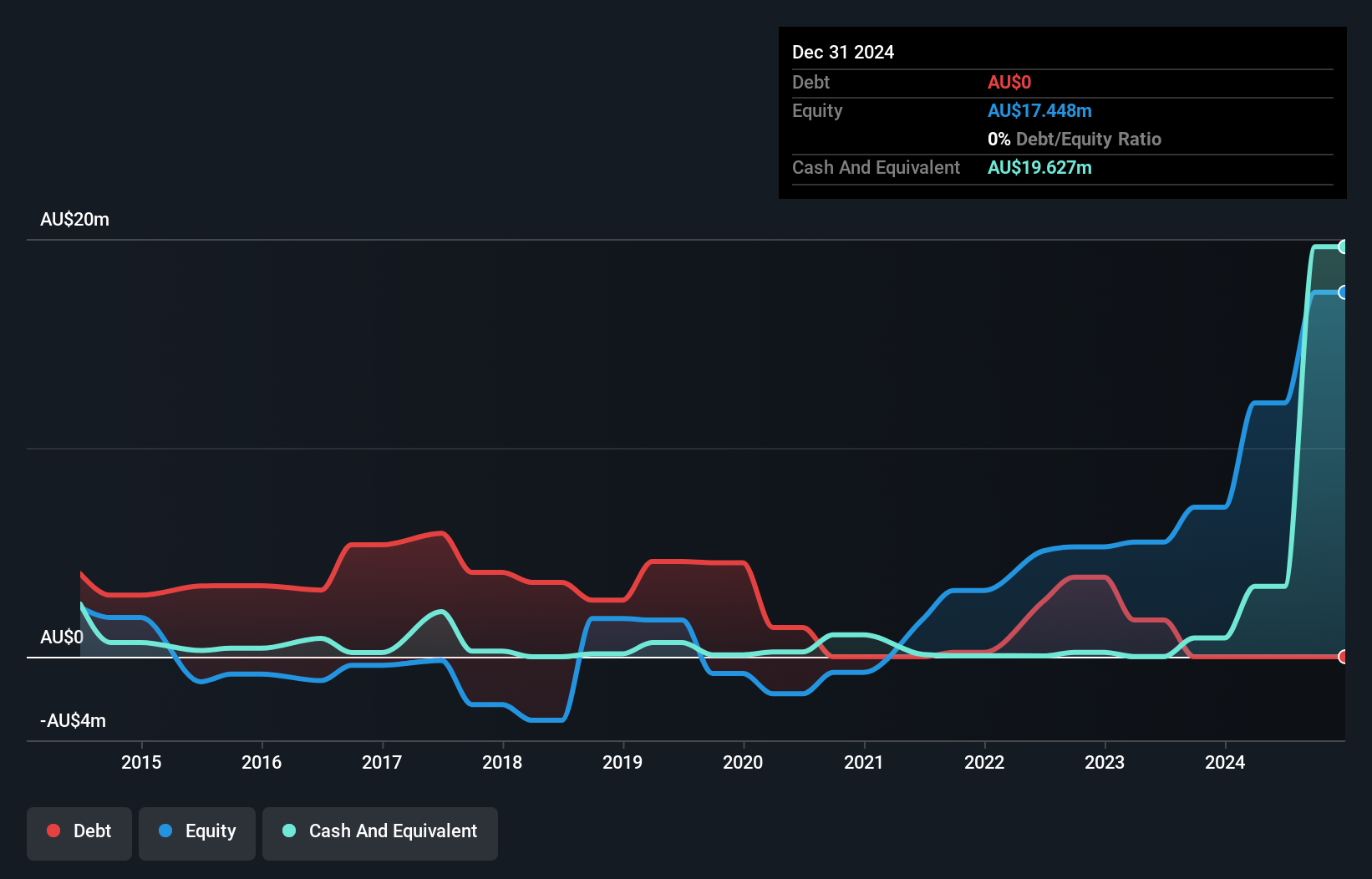

SKS Technologies Group has shown impressive growth, with earnings surging by 111.8% over the past year, significantly outpacing the Electrical industry average of 8.6%. The company is debt-free and boasts a robust order book valued at A$200 million as it continues to capitalize on digital infrastructure demand. Revenue for the year ended June 30, 2025, soared to A$263.23 million from A$136.52 million previously, while net income reached A$14.03 million from A$6.62 million a year ago. Despite operational risks tied to large contracts and rising costs, SKS's strategic investments in technical capabilities position it well for future growth opportunities within its sector.

Servcorp (ASX:SRV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Servcorp Limited offers executive serviced and virtual offices, coworking spaces, and IT, communications, and secretarial services across various regions globally with a market cap of A$712.60 million.

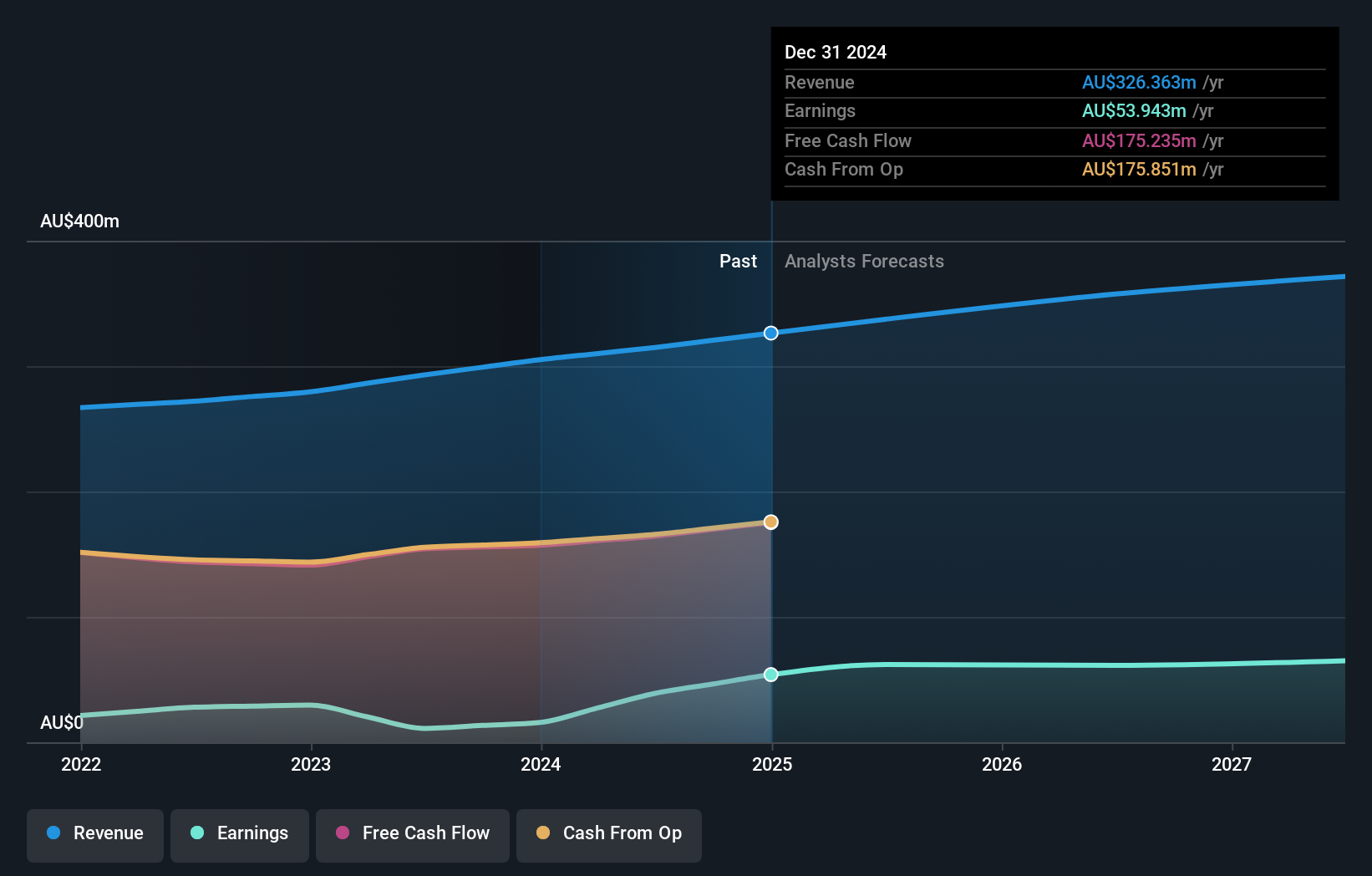

Operations: Servcorp Limited's primary revenue stream is derived from real estate rental, which amounts to A$349.86 million. The company's financial performance can be assessed through its net profit margin, which provides insight into its profitability after accounting for all expenses.

Servcorp is carving a niche in the flexible workspace sector, leveraging its global presence and IT infrastructure to boost growth. The company, offering services like virtual offices and coworking spaces across regions including Australia and the Middle East, has seen earnings grow 29.5% annually over five years. Despite being debt-free and trading at 9.7% below fair value estimates, it faces challenges such as high operational costs and market competition. With projected revenue growth of 5.5% annually, profit margins are expected to rise from 15.2% to 18.5%, suggesting potential for steady performance at its A$6.8 share price against a target of A$7.2.

Summing It All Up

- Navigate through the entire inventory of 55 ASX Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SKS

SKS Technologies Group

Engages in the design, supply, and installation of audio visual, electrical, and communication products and services in Australia.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives