- Australia

- /

- Metals and Mining

- /

- ASX:RND

ASX Penny Stocks Spotlight: Bravura Solutions And 2 More To Watch

Reviewed by Simply Wall St

As Australian shares are poised for a potential upswing, driven by positive sentiments from the U.S. market and upcoming domestic economic data releases, investors are keeping a keen eye on various market segments. Penny stocks, often associated with smaller or newer companies, continue to capture interest due to their affordability and growth potential despite being considered an outdated term. In this context, we explore three intriguing penny stocks that stand out for their financial strength and potential opportunities in the current market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Dusk Group (ASX:DSK) | A$0.82 | A$51.06M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.96 | A$454.92M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.60 | A$265.91M | ✅ 4 ⚠️ 2 View Analysis > |

| Veris (ASX:VRS) | A$0.066 | A$34.76M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Praemium (ASX:PPS) | A$0.79 | A$377.96M | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.11 | A$1.29B | ✅ 4 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.68 | A$248.12M | ✅ 3 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.39 | A$132.75M | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.38 | A$624.51M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 414 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Bravura Solutions (ASX:BVS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bravura Solutions Limited offers software solutions for the wealth management and transfer agency sectors across Australia, the United Kingdom, New Zealand, and other international markets, with a market cap of A$1.11 billion.

Operations: Bravura Solutions generates revenue from two primary segments: APAC, contributing A$72.63 million, and EMEA, accounting for A$186.07 million.

Market Cap: A$1.11B

Bravura Solutions has demonstrated significant earnings growth, with a 745.7% increase over the past year, surpassing industry averages. The company is debt-free and maintains strong short-term asset coverage over liabilities. Despite recent insider selling, Bravura's return on equity is outstanding at 79.3%. Recent board changes and inclusion in the S&P/ASX indices may impact future stability and visibility. The company's revenue guidance for fiscal year 2026 aligns closely with previous years, suggesting steady performance rather than rapid expansion. Trading below estimated fair value presents potential investment appeal within the penny stock category in Australia.

- Navigate through the intricacies of Bravura Solutions with our comprehensive balance sheet health report here.

- Examine Bravura Solutions' earnings growth report to understand how analysts expect it to perform.

Emeco Holdings (ASX:EHL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Emeco Holdings Limited provides surface and underground mining equipment rental, complementary equipment, and mining services in Australia, with a market cap of A$653.40 million.

Operations: The company's revenue is derived from two primary segments: Rental, which accounts for A$615.39 million, and Workshops, contributing A$273.47 million.

Market Cap: A$653.4M

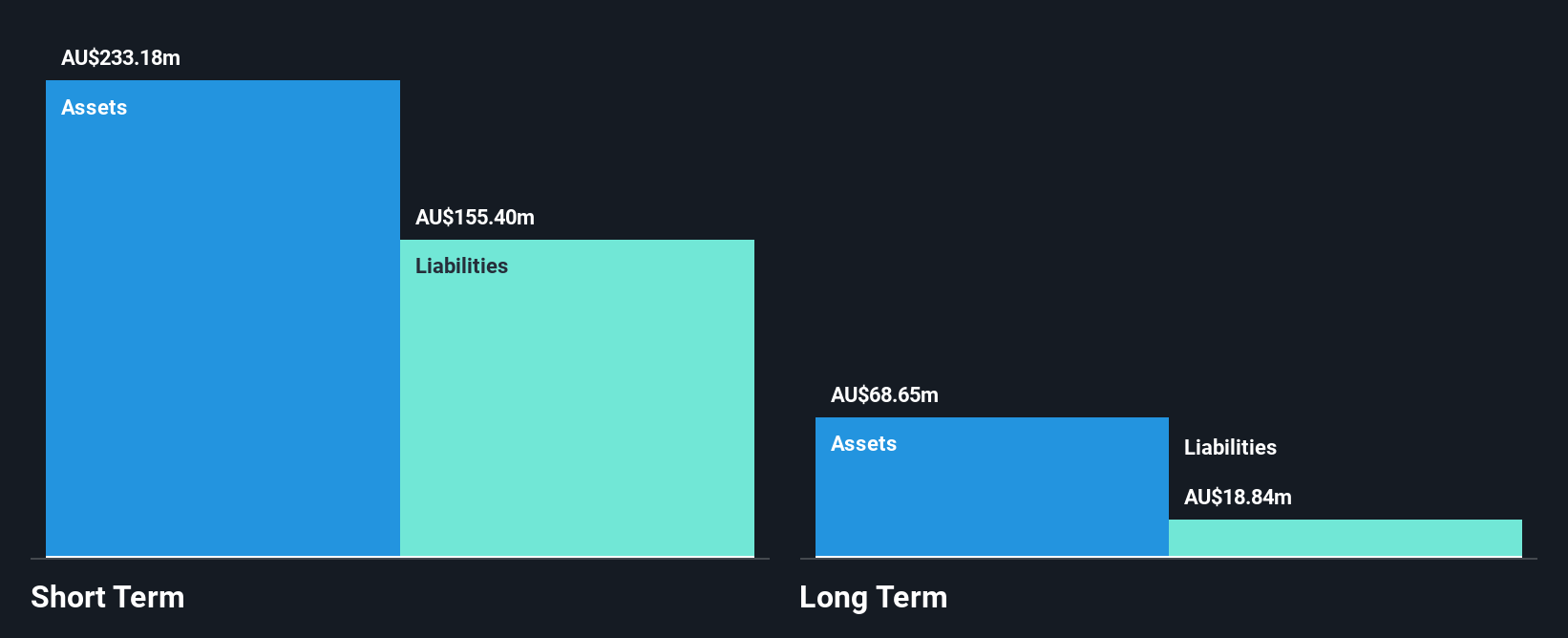

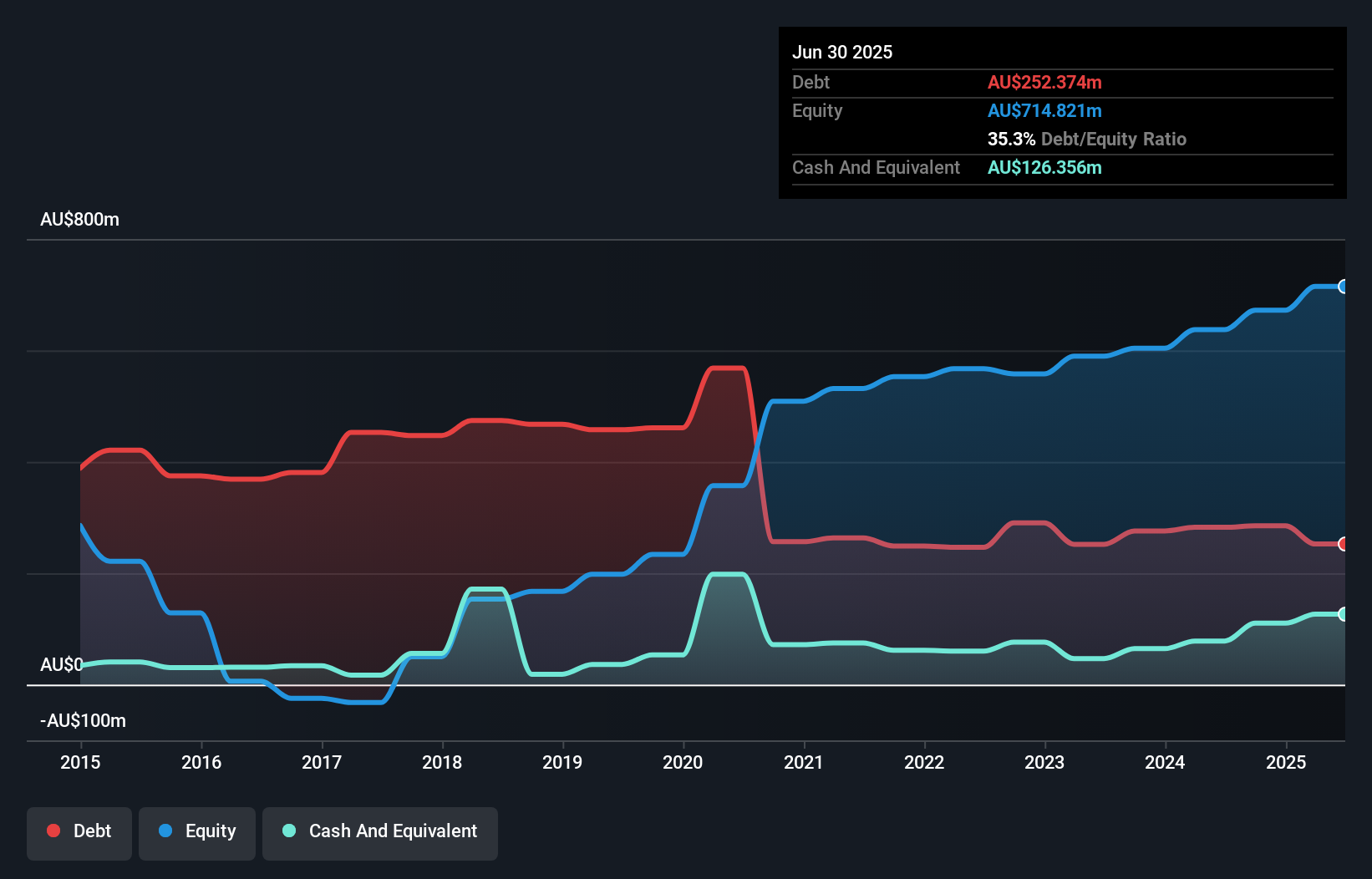

Emeco Holdings has shown robust earnings growth, with a 42.7% increase over the past year, outperforming its five-year average and industry peers. The company trades at a significant discount to estimated fair value and maintains satisfactory debt levels with interest well-covered by EBIT. Recent board changes include the appointment of Shaun Treacy, bringing extensive finance expertise. Despite short-term assets not fully covering long-term liabilities, Emeco's operating cash flow adequately covers its debt. Market speculation around potential acquisitions has spurred share price activity, reflecting interest from US-based entities amid favorable currency conditions.

- Jump into the full analysis health report here for a deeper understanding of Emeco Holdings.

- Learn about Emeco Holdings' future growth trajectory here.

Rand Mining (ASX:RND)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rand Mining Limited is involved in the exploration, development, and production of mineral properties in Australia with a market cap of A$136.50 million.

Operations: The company generates revenue primarily from its Metals & Mining segment, focusing on Gold & Other Precious Metals, with earnings of A$43.28 million.

Market Cap: A$136.5M

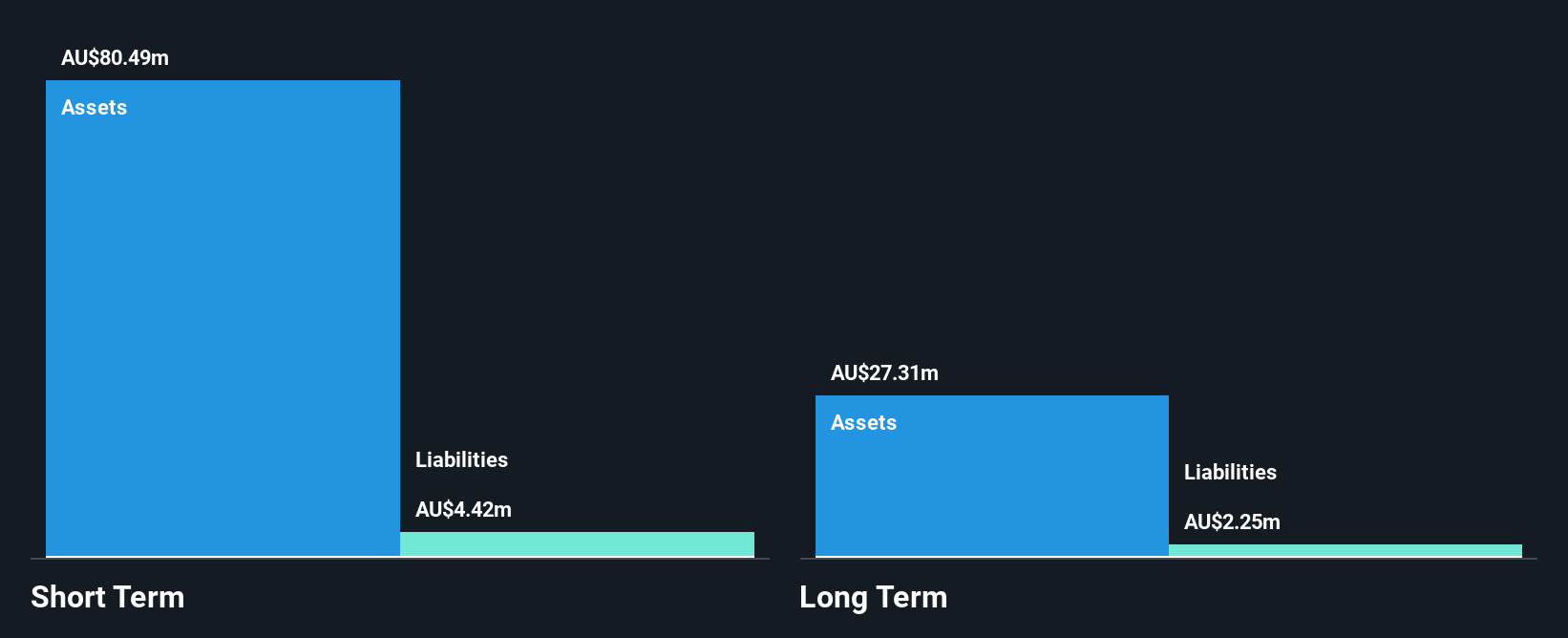

Rand Mining has demonstrated impressive financial performance, with earnings growing by 97.1% over the past year, significantly outpacing its five-year average and industry benchmarks. The company is debt-free, eliminating concerns about interest coverage and highlighting a strong balance sheet where short-term assets substantially exceed liabilities. Despite trading at a substantial discount to estimated fair value, Rand's dividend yield of 4.17% raises sustainability questions due to inadequate free cash flow coverage. With a seasoned management team and board averaging over two decades of experience each, Rand Mining offers high-quality earnings but presents low return on equity at 12.4%.

- Dive into the specifics of Rand Mining here with our thorough balance sheet health report.

- Evaluate Rand Mining's historical performance by accessing our past performance report.

Summing It All Up

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 411 more companies for you to explore.Click here to unveil our expertly curated list of 414 ASX Penny Stocks.

- Curious About Other Options? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RND

Rand Mining

Engages in the exploration, development, and production of mineral properties in Australia.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives