- Australia

- /

- Aerospace & Defense

- /

- ASX:DRO

Why DroneShield (ASX:DRO) Is Up 15.8% After Ukraine Deal and ASX 200 Inclusion

Reviewed by Sasha Jovanovic

- On September 19, 2025, Critical Infrastructure Technologies Ltd announced it had signed a confidentiality agreement with DroneShield Limited to develop and integrate Counter-Unmanned Aerial Systems for Ukraine's Nexus 20 defense platform, alongside new collaborations with major telecom partners.

- This move coincided with DroneShield's addition to the S&P/ASX 200 Index and the expansion of its U.S. R&D operations, highlighting increased international recognition and growing demand for advanced counter-drone solutions.

- We'll explore how DroneShield's addition to the ASX 200 and its enhanced U.S. R&D capabilities could influence its investment outlook.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

DroneShield Investment Narrative Recap

To back DroneShield as a shareholder, you’ll need confidence in sustained demand for counter-drone security, underpinned by rising global defense needs and regulatory changes. The September agreement to support Ukraine and partnerships with telecom giants could accelerate short-term revenue momentum by securing new contracts. However, the most significant risk remains the company’s dependence on sizeable government deals, which can be unpredictable; the recent news appears to provide incremental support but does not materially eliminate that volatility.

The September 19 announcement of DroneShield’s addition to the S&P/ASX 200 Index stands out as especially relevant. This milestone increases the company’s visibility to institutional investors and could boost short-term liquidity, complementing the broader catalyst of surging adoption of counter-drone solutions across global defense markets.

By contrast, investors should be aware of the unpredictable timing of large government contracts and the potential for...

Read the full narrative on DroneShield (it's free!)

DroneShield's narrative projects A$359.8 million revenue and A$96.1 million earnings by 2028. This requires 49.7% yearly revenue growth and an A$90.5 million earnings increase from A$5.6 million today.

Uncover how DroneShield's forecasts yield a A$3.65 fair value, in line with its current price.

Exploring Other Perspectives

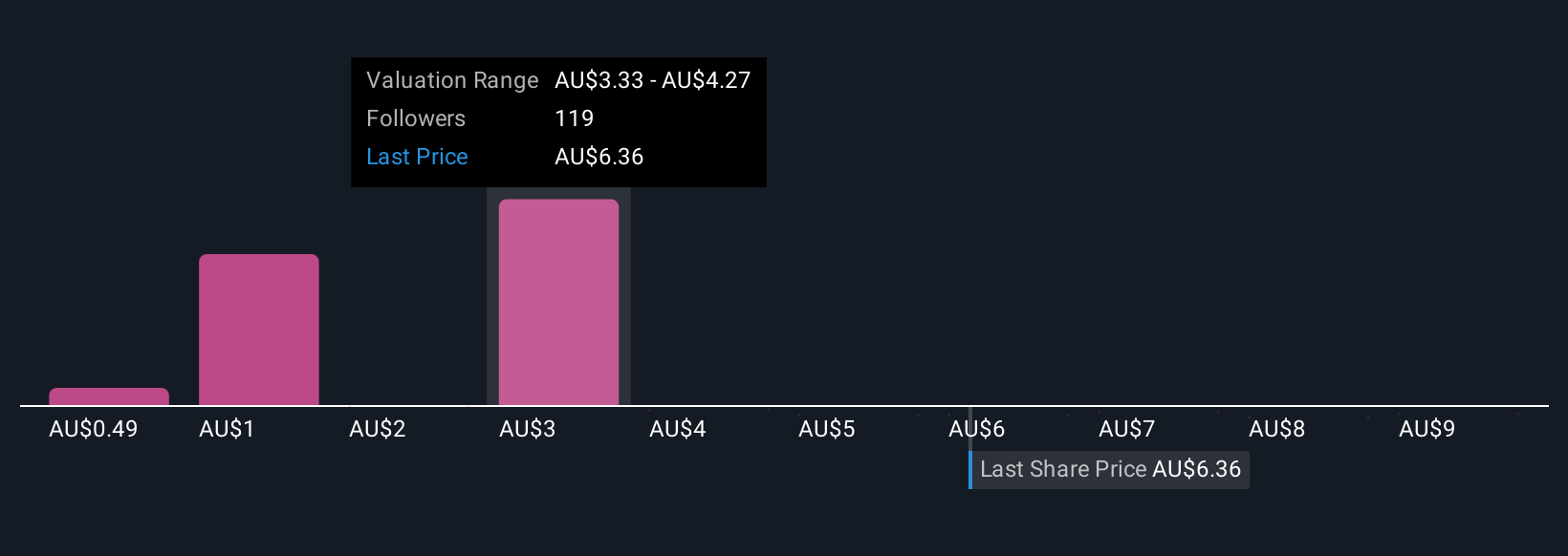

Forty-one members of the Simply Wall St Community estimate DroneShield’s fair value anywhere from A$0.41 to A$7.50 per share. While many anticipate rapid revenue growth, the timing and size of government contracts could shape future results and affect the path to profitability, so consider exploring several viewpoints.

Explore 41 other fair value estimates on DroneShield - why the stock might be worth over 2x more than the current price!

Build Your Own DroneShield Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DroneShield research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free DroneShield research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DroneShield's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DRO

DroneShield

Engages in the development, commercialization, and sale of hardware and software technology for drone detection and security in Australia and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives