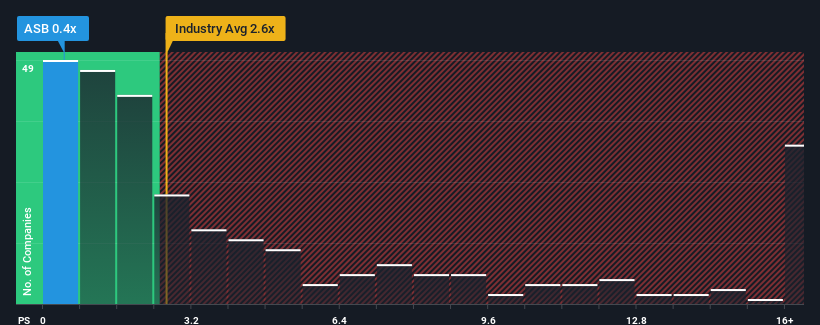

With a median price-to-sales (or "P/S") ratio of close to 0.9x in the Aerospace & Defense industry in Australia, you could be forgiven for feeling indifferent about Austal Limited's (ASX:ASB) P/S ratio of 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Austal

How Has Austal Performed Recently?

Recent times haven't been great for Austal as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Austal.How Is Austal's Revenue Growth Trending?

In order to justify its P/S ratio, Austal would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. However, this wasn't enough as the latest three year period has seen an unpleasant 24% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 11% per annum as estimated by the five analysts watching the company. With the industry predicted to deliver 10% growth each year, the company is positioned for a comparable revenue result.

With this information, we can see why Austal is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What Does Austal's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A Austal's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Aerospace & Defense industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Austal that you need to be mindful of.

If you're unsure about the strength of Austal's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ASB

Austal

Engages in the design, manufacture, and support of vessels for commercial and defense customers in the United States, Australia, Europe, Asia, and South America.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives