Does Westpac’s Earnings Beat and Dividend Hike Signal Sustainable Momentum for ASX:WBC Investors?

Reviewed by Sasha Jovanovic

- Westpac Banking Corporation recently announced a fully franked interim dividend of A$0.77 per share for the six months ended September 30, 2025, with the payment scheduled for December 19, 2025.

- This announcement follows Westpac's 2025 results exceeding analyst expectations, reflecting strong growth in business lending and operational efficiencies from ongoing transformation programs.

- We'll explore how Westpac's earnings beat and dividend declaration influence its investment narrative amid ongoing technology and mortgage division reforms.

Find companies with promising cash flow potential yet trading below their fair value.

Westpac Banking Investment Narrative Recap

To be a shareholder in Westpac Banking Corporation, you’d likely need confidence in the bank’s ability to maintain resilient earnings growth, manage competitive pressure in lending, and achieve operational gains from technology investments like Project Unite. The recent interim dividend increase to A$0.77 per share underscores Westpac’s ongoing commitment to shareholder returns. However, this news does not materially change the primary short-term catalyst, cost control through technology upgrades, nor does it lessen the most significant risk: margin compression amid fierce mortgage competition and rising technology costs.

Among the latest announcements, the sale of Westpac’s RAMS home loan business ties closely to current catalysts and risks. By divesting from RAMS, Westpac is focusing on its technology consolidation efforts, seeking efficiency improvements that may help offset margin pressures and cost inflation in the core mortgage business. This development connects directly with the bank’s ambitions to streamline operations as outlined in their transformation agenda.

Yet, in contrast to the dividend optimism, investors should be aware that competitive mortgage margins and ongoing tech costs...

Read the full narrative on Westpac Banking (it's free!)

Westpac Banking’s narrative projects A$24.7 billion revenue and A$6.8 billion earnings by 2028. This requires 4.5% yearly revenue growth and a decrease of A$0.3 billion in earnings from the current A$7.1 billion.

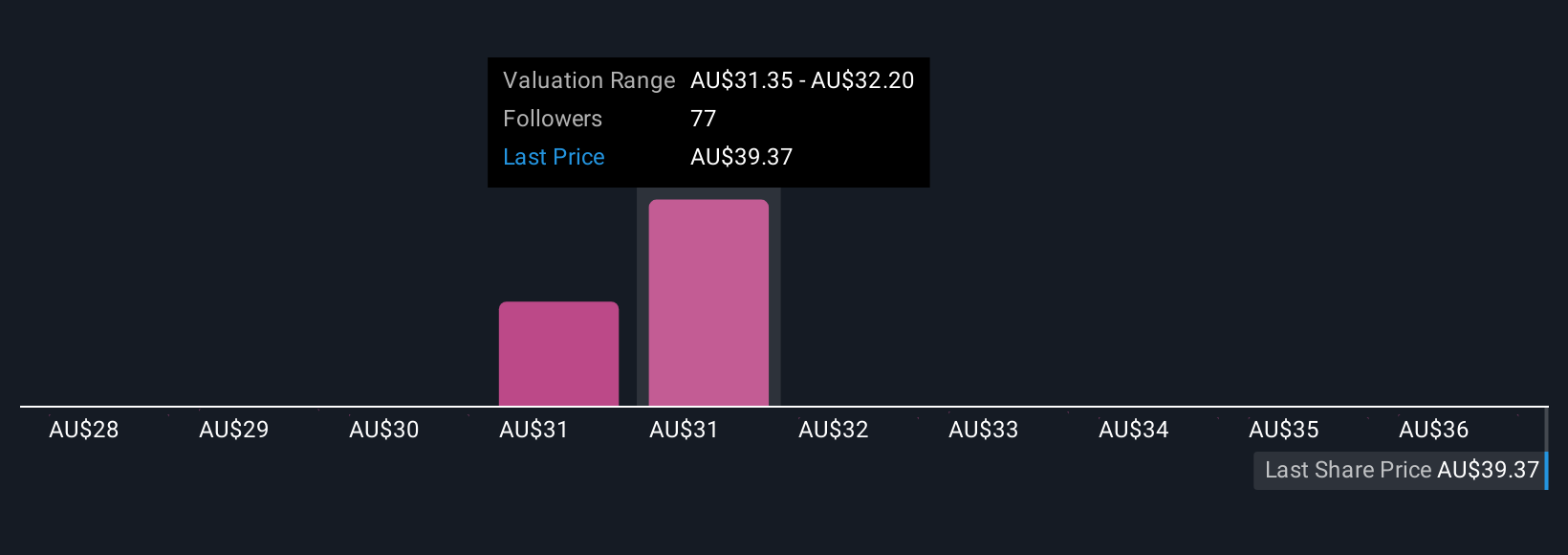

Uncover how Westpac Banking's forecasts yield a A$32.23 fair value, a 17% downside to its current price.

Exploring Other Perspectives

Fair value estimates from 11 Simply Wall St Community members for Westpac Banking span from A$27.95 to A$36.45 per share. While opinions differ widely on the stock's value, many still weigh the impact of margin pressures and technology spending on future returns, explore how your outlook compares to these viewpoints.

Explore 11 other fair value estimates on Westpac Banking - why the stock might be worth 28% less than the current price!

Build Your Own Westpac Banking Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Westpac Banking research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Westpac Banking research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Westpac Banking's overall financial health at a glance.

No Opportunity In Westpac Banking?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westpac Banking might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WBC

Westpac Banking

Provides banking and other financial services in Australia, New Zealand, the Pacific Islands, Asia, the Americas, and Europe.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives