3 ASX Stocks That May Be Trading Below Their Intrinsic Value Estimates

Reviewed by Simply Wall St

The ASX200 made a small recovery today after the torrid start to the week, closing up a quarter of a per cent to about 7700 points. Real Estate made the biggest recovery, adding nearly 1.3%, followed by Utilities and Telecommunications – which were both up around 1%. In such fluctuating market conditions, identifying stocks that may be trading below their intrinsic value can offer potential opportunities for investors seeking long-term growth. Here are three ASX stocks that might currently be undervalued based on intrinsic value estimates.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Elders (ASX:ELD) | A$9.08 | A$18.11 | 49.9% |

| Shine Justice (ASX:SHJ) | A$0.70 | A$1.34 | 47.9% |

| Regal Partners (ASX:RPL) | A$3.33 | A$6.39 | 47.9% |

| Nanosonics (ASX:NAN) | A$2.98 | A$5.84 | 49% |

| Infomedia (ASX:IFM) | A$1.62 | A$3.06 | 47.1% |

| HMC Capital (ASX:HMC) | A$7.63 | A$13.73 | 44.4% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Life360 (ASX:360) | A$15.10 | A$27.76 | 45.6% |

| Sandfire Resources (ASX:SFR) | A$8.31 | A$16.50 | 49.7% |

| Airtasker (ASX:ART) | A$0.27 | A$0.52 | 48.4% |

Underneath we present a selection of stocks filtered out by our screen.

Judo Capital Holdings (ASX:JDO)

Overview: Judo Capital Holdings Limited offers a range of banking products and services tailored for small and medium-sized businesses in Australia, with a market cap of A$1.44 billion.

Operations: Judo Capital Holdings generates revenue of A$328.70 million from its banking segment, focusing on small and medium-sized businesses in Australia.

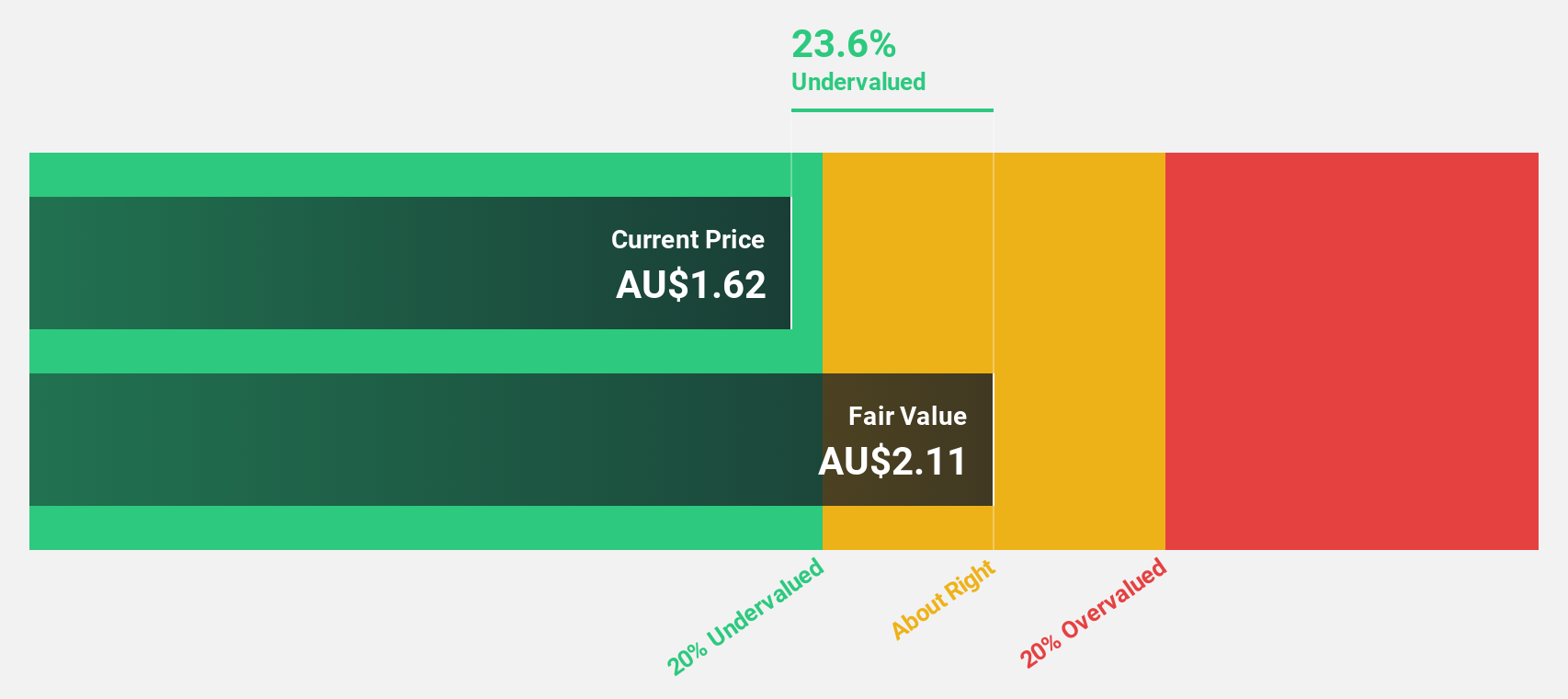

Estimated Discount To Fair Value: 13.2%

Judo Capital Holdings, recently added to the S&P/ASX 200 Index, is trading at A$1.3, roughly 12.5% below its estimated fair value of A$1.48. Despite a modest undervaluation based on discounted cash flows, Judo's earnings grew by 87% last year and are forecasted to grow significantly at 27% per year over the next three years, outpacing the broader Australian market's growth rate of 12.9%.

- Our expertly prepared growth report on Judo Capital Holdings implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Judo Capital Holdings stock in this financial health report.

Nuix (ASX:NXL)

Overview: Nuix Limited offers investigative analytics and intelligence software solutions across the Asia Pacific, the Americas, Europe, the Middle East, and Africa with a market cap of approximately A$1.01 billion.

Operations: The company's revenue from Software & Programming amounts to A$193.27 million.

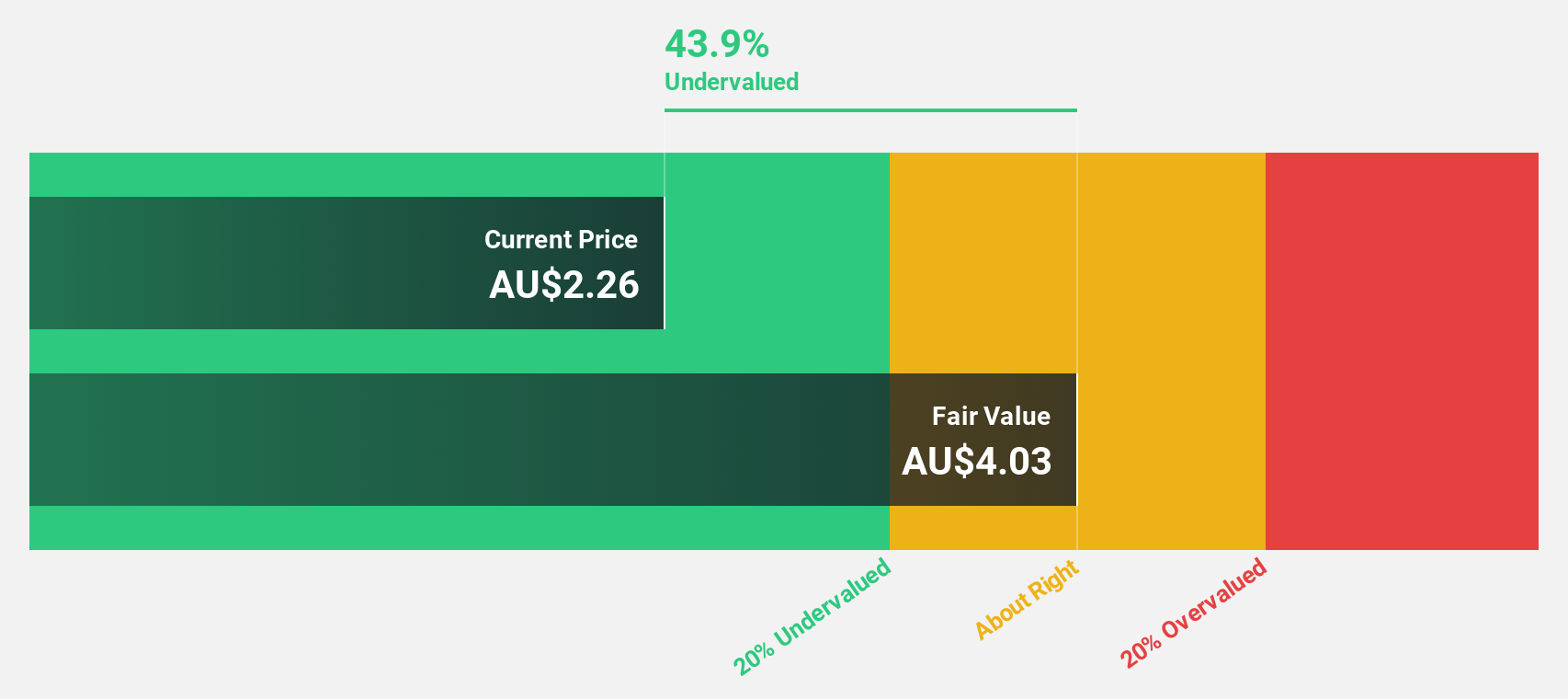

Estimated Discount To Fair Value: 11.9%

Nuix is trading at A$3.12, approximately 11.9% below its estimated fair value of A$3.54, indicating it may be undervalued based on discounted cash flows. Revenue is forecast to grow at 12.2% per year, outpacing the broader Australian market's growth rate of 4.9%. Recent strategic partnership expansion with Consilio enhances future revenue prospects and operational capabilities despite upcoming executive changes with the departure of COO and CFO Chad Barton in August 2024.

- Insights from our recent growth report point to a promising forecast for Nuix's business outlook.

- Click to explore a detailed breakdown of our findings in Nuix's balance sheet health report.

RPMGlobal Holdings (ASX:RUL)

Overview: RPMGlobal Holdings Limited develops and provides mining software solutions across Australia, Asia, the Americas, Africa, and Europe with a market cap of A$559.63 million.

Operations: The company's revenue segments include Advisory at A$28.56 million and Software at A$71.72 million.

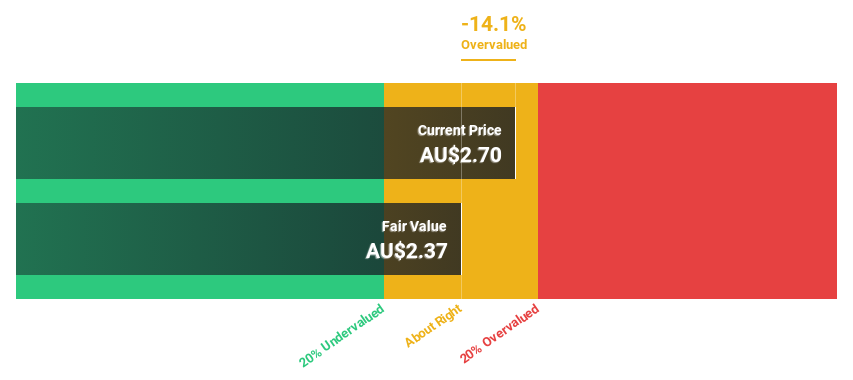

Estimated Discount To Fair Value: 10.4%

RPMGlobal Holdings, trading at A$2.53, is undervalued relative to its estimated fair value of A$2.82. Earnings are forecast to grow significantly at 24% per year over the next three years, outpacing both its revenue growth of 10.2% per year and the broader Australian market's earnings growth rate of 12.9%. Recent developments include an increased equity buyback plan, enhancing shareholder value and extending the plan duration until June 2025.

- Our earnings growth report unveils the potential for significant increases in RPMGlobal Holdings' future results.

- Take a closer look at RPMGlobal Holdings' balance sheet health here in our report.

Make It Happen

- Unlock our comprehensive list of 38 Undervalued ASX Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NXL

Nuix

Provides investigative analytics and intelligence software solutions in the Asia Pacific, the Americas, Europe, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.