Should Bendigo and Adelaide Bank’s (ASX:BEN) Goodwill Impairment Loss Influence Investor Strategy?

Reviewed by Simply Wall St

- Bendigo and Adelaide Bank recently reported a statutory net loss of A$97.1 million for the year ended June 30, 2025, mainly due to goodwill impairment, alongside stable net interest income of A$1.65 billion and a maintained dividend of A$0.33 per share.

- Despite the reported loss, the bank highlighted growth in digital banking and reinforced its commitment to sustainability and long-term financial targets in its 2025 Annual Financial Report.

- We will now assess how the bank's transition to a net loss, driven by goodwill impairment, influences its future investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Bendigo and Adelaide Bank Investment Narrative Recap

Owning Bendigo and Adelaide Bank stock requires faith in its ability to grow digital banking and maintain a strong customer base despite recent earnings volatility. The transition to a statutory net loss, largely due to goodwill impairment, does not materially alter the biggest short-term catalyst, which remains the shifting mix of deposit products impacting net interest margins. The principal risk continues to be higher funding costs from more expensive deposit and wholesale funding sources.

The newly declared dividend of A$0.33 per share, even in a year with a reported net loss, stands out as it affirms the bank’s ongoing intent to return value to shareholders. This aligns with management’s focus on sustainability and steady dividends, but rising funding costs, especially as deposit competition heats up, remain in focus as the biggest headwind to short-term profit growth.

However, investors should be aware that as deposit competition intensifies, the bank’s margin and earnings growth face…

Read the full narrative on Bendigo and Adelaide Bank (it's free!)

Bendigo and Adelaide Bank's outlook points to A$2.1 billion in revenue and A$503.9 million in earnings by 2028. This reflects a 3.2% annual revenue growth rate and a A$24.4 million increase in earnings from the current A$479.5 million.

Uncover how Bendigo and Adelaide Bank's forecasts yield a A$10.94 fair value, a 17% downside to its current price.

Exploring Other Perspectives

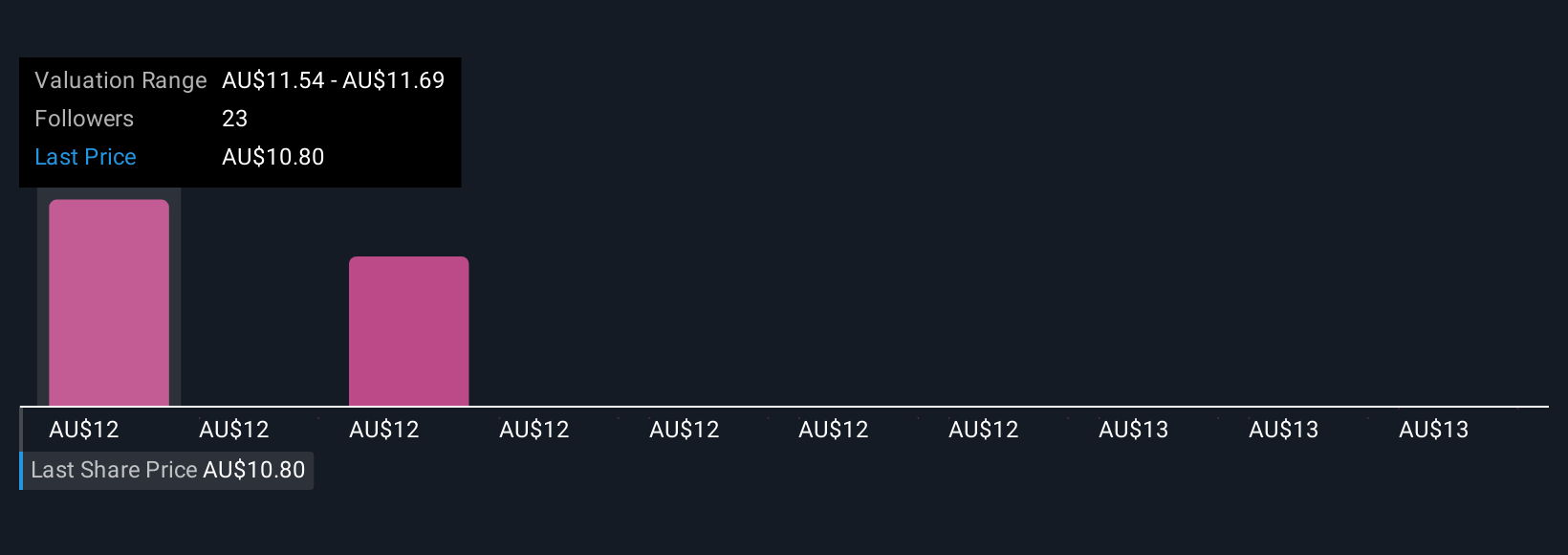

Simply Wall St Community members provided three fair value estimates for Bendigo and Adelaide Bank, ranging from A$10.94 to A$11.30 per share. With funding costs on the rise, market participants may weigh their views differently as the company pursues digital growth ambitions.

Explore 3 other fair value estimates on Bendigo and Adelaide Bank - why the stock might be worth 17% less than the current price!

Build Your Own Bendigo and Adelaide Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bendigo and Adelaide Bank research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bendigo and Adelaide Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bendigo and Adelaide Bank's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bendigo and Adelaide Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BEN

Bendigo and Adelaide Bank

Engages in the provision of banking and other financial services to retail customers and small to medium sized businesses in Australia.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives