Leadership Changes Might Change The Case For Investing In ANZ Group Holdings (ASX:ANZ)

- ANZ Group Holdings has announced the upcoming retirements of two key executives, Gerard Florian, Group Executive Technology & Group Services, and Maile Carnegie, Group Executive Australia Retail, with experienced interim leaders appointed and global searches underway for permanent successors.

- Multiple high-level leadership transitions spanning technology, retail, and regional management highlight a significant period of operational change within ANZ’s top ranks.

- - We'll explore how interim management in crucial business areas could influence ANZ’s pursuit of efficiency and digital transformation.

Outshine the giants: these 21 early-stage AI stocks could fund your retirement.

ANZ Group Holdings Investment Narrative Recap

To be a shareholder in ANZ Group Holdings, you need to believe in the bank’s ability to scale operations and realize efficiencies from major digital programs, while successfully integrating recent acquisitions like Suncorp Bank. The recent wave of executive transitions, including interim leadership in technology and retail, is not expected to materially affect the crucial near-term catalyst of integrating Suncorp Bank, but does spotlight execution risk in large-scale technology and transformation initiatives.

The most relevant announcement to these leadership shifts is the retirement of Maile Carnegie and her replacement by Bruce Rush as acting Group Executive Australia Retail & Suncorp Bank, as this directly ties into Suncorp’s integration, a key catalyst for anticipated revenue and synergy improvements. With leadership changes underway, maintaining momentum behind the cost efficiency and digital strategies remains an immediate priority for ANZ as it aims to keep competitive in the tightening retail banking sector.

By contrast, a risk that investors should be especially aware of is how further delays or challenges in migrating customers to platforms like ANZ Plus could …

Read the full narrative on ANZ Group Holdings (it's free!)

Exploring Other Perspectives

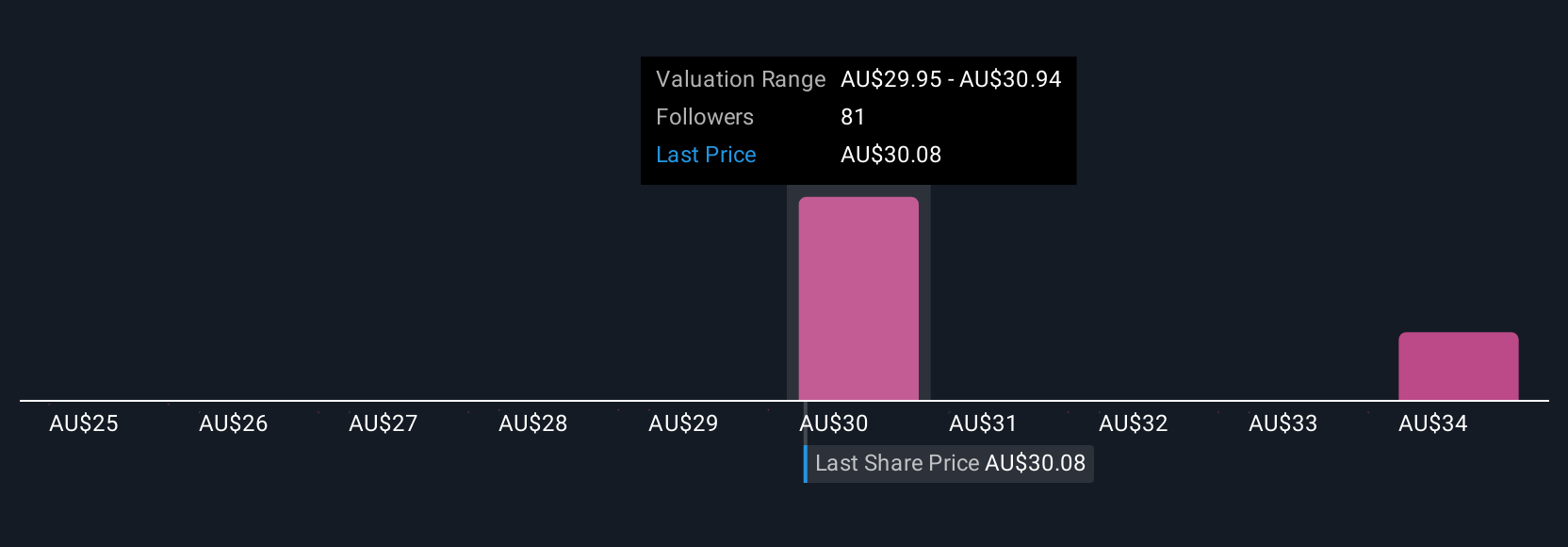

Seven members of the Simply Wall St Community estimate ANZ’s fair value between A$25 and A$34.90, highlighting a wide range of investor opinions. While integration of Suncorp Bank is seen as a key catalyst, many market participants remain focused on how execution risks could affect net margins and future performance.

Build Your Own ANZ Group Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ANZ Group Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free ANZ Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ANZ Group Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover 18 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ANZ

ANZ Group Holdings

Provides various banking and financial products and services to retail, individuals and business customers in Australia and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives