- Australia

- /

- Auto Components

- /

- ASX:AOV

GUD Holdings' (ASX:GUD) Upcoming Dividend Will Be Larger Than Last Year's

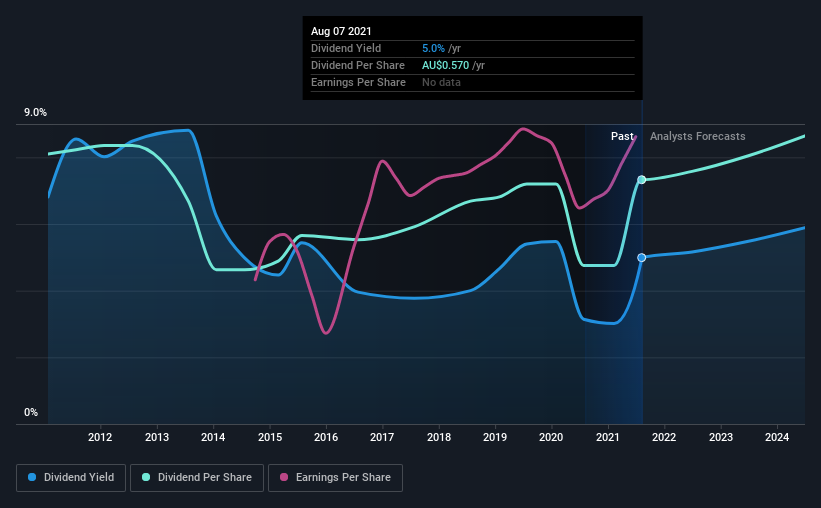

GUD Holdings Limited's (ASX:GUD) dividend will be increasing to AU$0.32 on 3rd of September. This will take the annual payment from 5.0% to 5.0% of the stock price, which is above what most companies in the industry pay.

Check out our latest analysis for GUD Holdings

GUD Holdings' Earnings Easily Cover the Distributions

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Prior to this announcement, GUD Holdings was paying out 85% of earnings and more than 75% of free cash flows. This indicates that the company is more focused on returning cash to shareholders than growing the business, but it is still in a reasonable range to continue with.

Over the next year, EPS is forecast to expand by 14.2%. If the dividend continues growing along recent trends, we estimate the payout ratio could reach 77%, which is on the higher side, but certainly still feasible.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The first annual payment during the last 10 years was AU$0.63 in 2011, and the most recent fiscal year payment was AU$0.57. Dividend payments have shrunk at a rate of less than 1% per annum over this time frame. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

GUD Holdings' Dividend Might Lack Growth

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. GUD Holdings has seen EPS rising for the last five years, at 10% per annum. The payout ratio is very much on the higher end, which could mean that the growth rate will slow down in the future, and that could flow through to the dividend as well.

Our Thoughts On GUD Holdings' Dividend

In summary, while it's always good to see the dividend being raised, we don't think GUD Holdings' payments are rock solid. While we generally think the level of distributions are a bit high, we wouldn't rule it out as becoming a good dividend payer in the future as its earnings are growing healthily. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 3 warning signs for GUD Holdings that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you decide to trade GUD Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:AOV

Amotiv

Manufactures, imports, distributes, and sells automotive products in Australia, New Zealand, Thailand, rest of Asia, the United States, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives