- Australia

- /

- Auto Components

- /

- ASX:ARB

Could ARB (ASX:ARB) Special Dividend Reveal New Priorities in Capital Allocation?

Reviewed by Simply Wall St

- ARB Corporation Limited announced its financial results for the year ended June 30, 2025, reporting revenue of A$739.03 million, net income of A$97.53 million, and declaring both a fully franked ordinary dividend of A$0.35 and a special dividend of A$0.50 per share, all confirmed in August 2025.

- The combination of revenue growth and a special dividend announcement offers insight into ARB’s approach to balancing shareholder returns with changes in earnings performance.

- We will explore how the special dividend payout shapes ARB’s investment narrative with regard to capital allocation and future growth prospects.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

ARB Investment Narrative Recap

ARB’s investment case centers on confidence in the global demand for premium 4x4 accessories, with both export growth and deep OEM partnerships seen as crucial tailwinds. The recent announcement of a special dividend, while signaling a continued focus on shareholder rewards, does not materially change the primary near-term catalyst, ongoing expansion in international markets, or lessen the top risk of margin pressure from persistent FX volatility, as ARB remains unhedged against currency fluctuations.

Of particular relevance is the special dividend of A$0.50 per share declared for FY25, which underscores ARB’s ability to generate strong cash flows despite a modest drop in net income. This payout may reinforce perceptions of balance sheet discipline, but does not directly address the execution risks associated with scaling operations overseas, which remain pivotal to future growth.

Yet, while dividends offer certainty in the short term, investors should be aware that a prolonged weak Australian dollar could still materially affect margins and profits if left unhedged...

Read the full narrative on ARB (it's free!)

ARB's outlook forecasts A$924.7 million in revenue and A$136.6 million in earnings by 2028. This is based on an 8.0% annual revenue growth rate and a A$39.1 million increase in earnings from the current A$97.5 million.

Uncover how ARB's forecasts yield a A$40.50 fair value, in line with its current price.

Exploring Other Perspectives

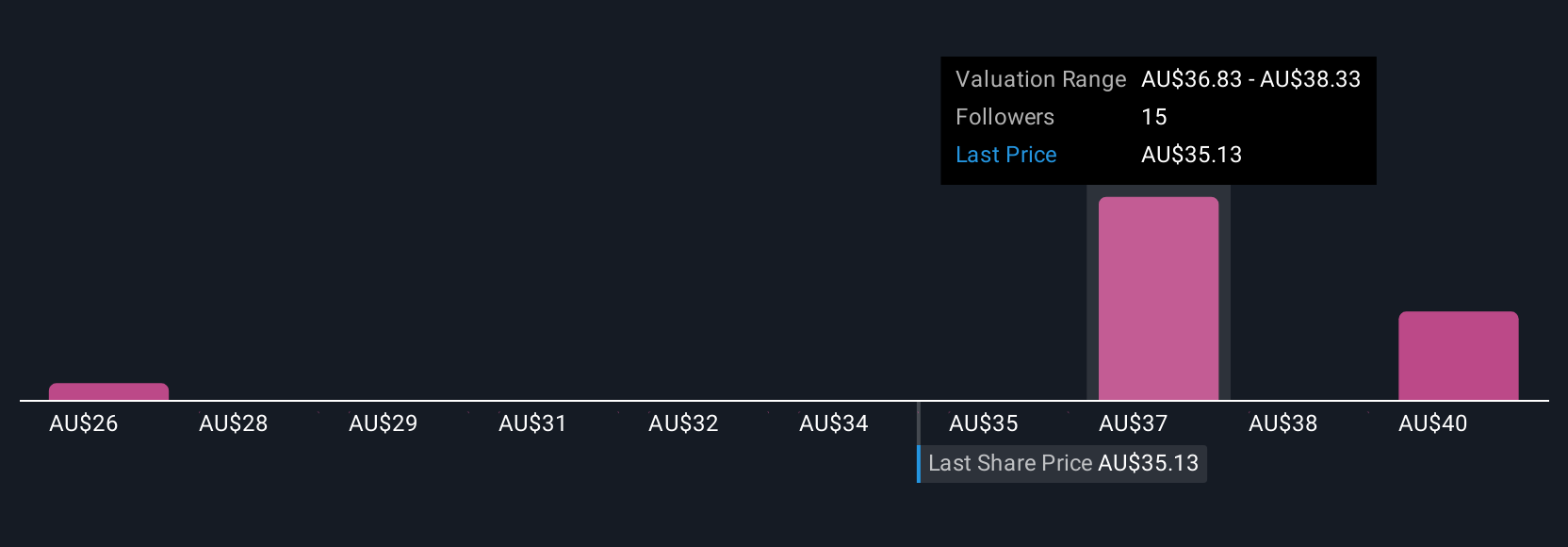

Five distinct fair value estimates from the Simply Wall St Community range from A$26.32 to A$40.91 per share. While opinions among market participants vary widely, the issue of FX risk in ARB’s global business highlights why different outlooks on near-term performance persist, explore how these views could shape your expectations.

Explore 5 other fair value estimates on ARB - why the stock might be worth 35% less than the current price!

Build Your Own ARB Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ARB research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free ARB research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ARB's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ARB

ARB

Engages in the design, manufacture, distribution, and sale of motor vehicle accessories and light metal engineering works.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives