As the European markets navigate a complex landscape of steady interest rates and mixed performances across major indices, investors are keenly observing opportunities that may arise from these fluctuations. In this context, identifying promising stocks often involves looking beyond immediate market trends to uncover companies with strong fundamentals and potential for growth amidst economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Alantra Partners | NA | -6.09% | -33.39% | ★★★★★★ |

| Dekpol | 64.28% | 9.75% | 13.77% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Novabase S.G.P.S (DB:NVQ)

Simply Wall St Value Rating: ★★★★★☆

Overview: Novabase S.G.P.S., S.A. is an IT consulting and services provider operating through its subsidiaries in Portugal, Europe, Africa, the Middle East, and internationally, with a market cap of €332.10 million.

Operations: The company's primary revenue stream is from its Next-Gen segment, generating €130.27 million, while the Value Portfolio contributes €1.29 million.

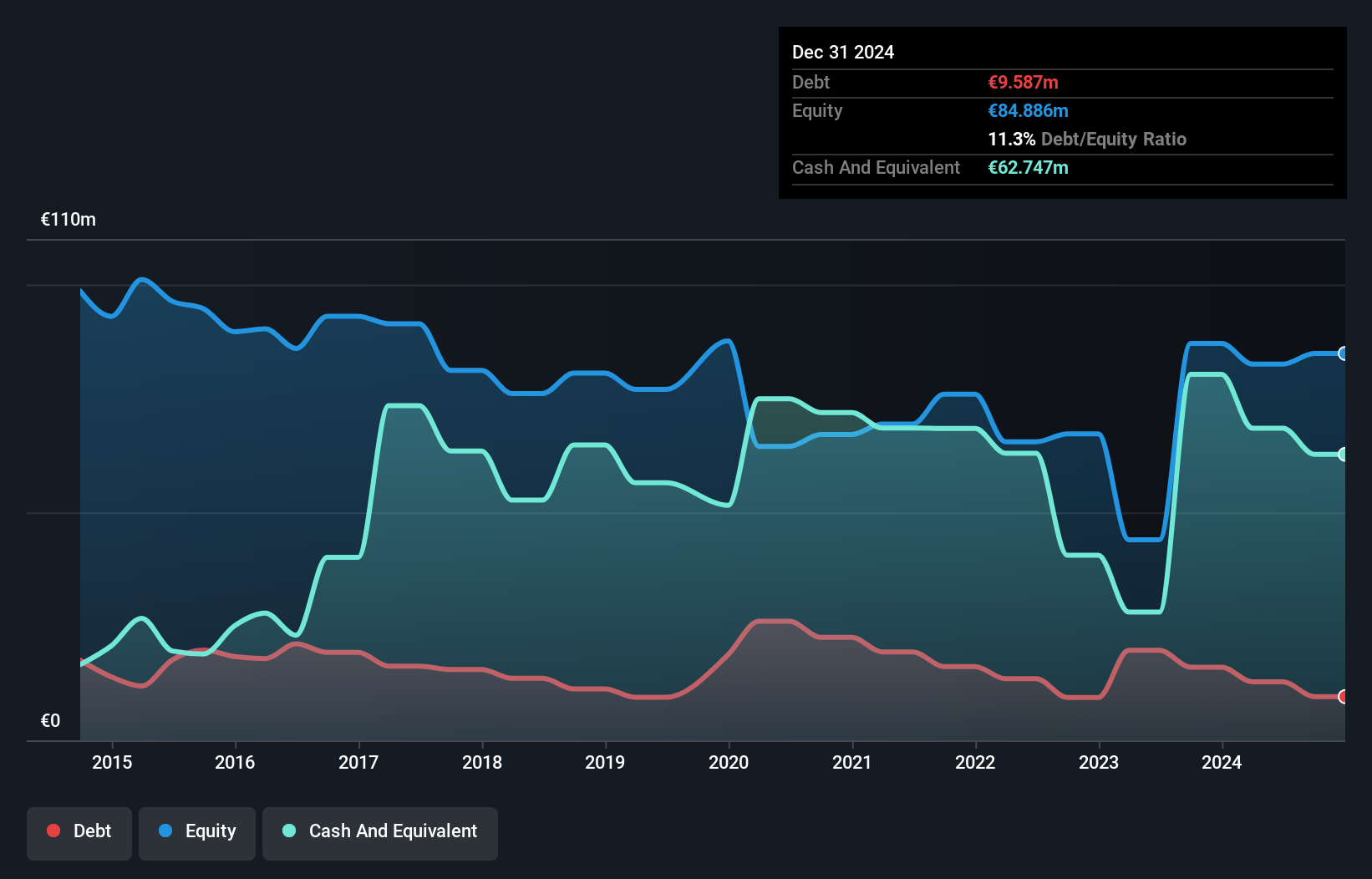

Novabase, a smaller European tech player, shows promise with its impressive earnings growth of 118% over the past year, significantly outpacing the IT sector's -19%. The company trades at a notable 28% below its estimated fair value, suggesting potential undervaluation. Over five years, Novabase has reduced its debt to equity ratio from 40.5% to 13.4%, indicating improved financial stability. However, despite these strengths and profitability ensuring no cash runway concerns, the presence of high non-cash earnings raises questions about quality. Future prospects seem promising if it continues leveraging these strengths effectively in the market.

Burgenland Holding (WBAG:BHD)

Simply Wall St Value Rating: ★★★★★★

Overview: Burgenland Holding Aktiengesellschaft, with a market cap of €222 million, is involved in the generation and sale of electricity in Austria through its investment in Burgenland Energie AG.

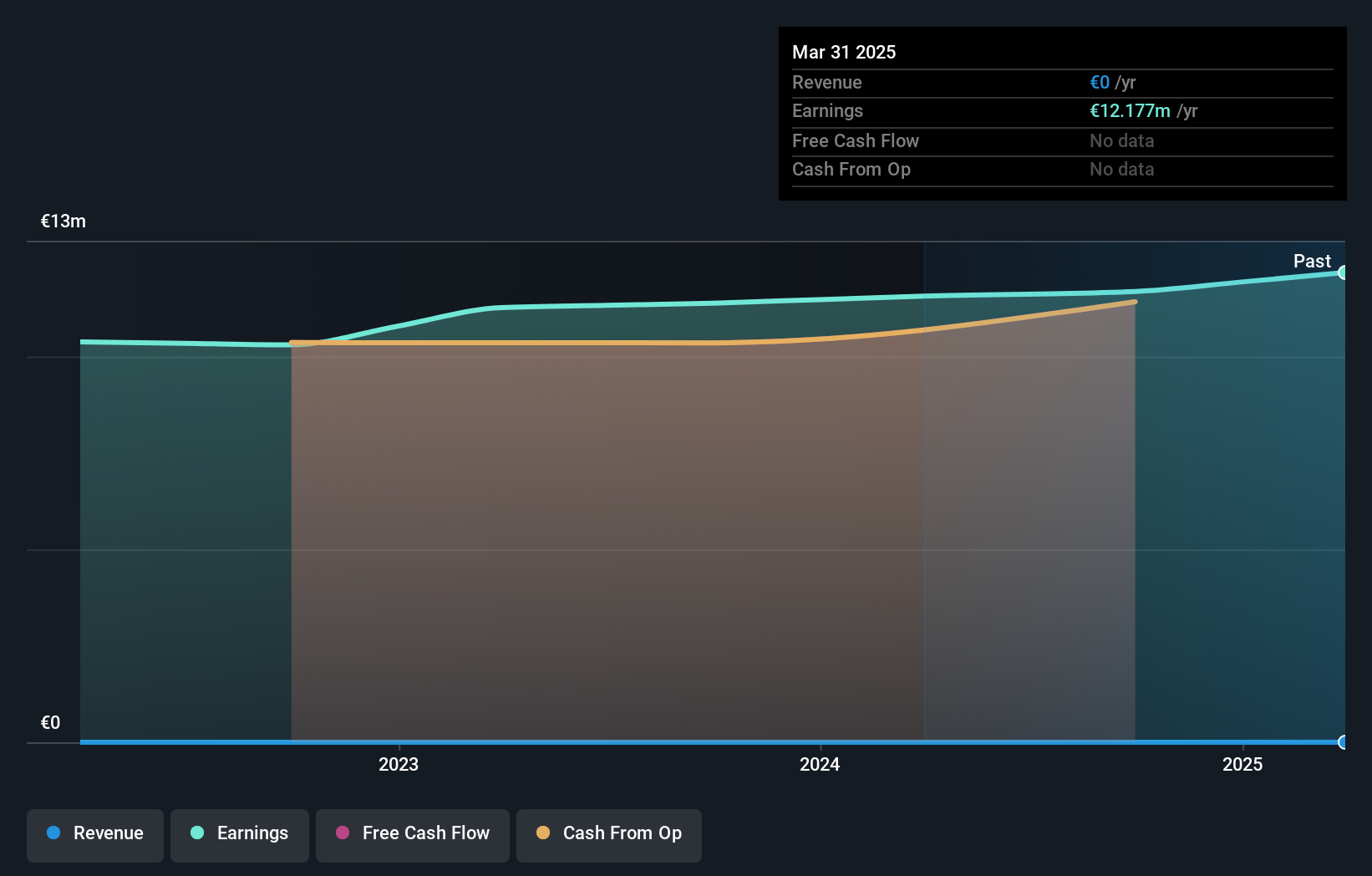

Operations: Burgenland Holding Aktiengesellschaft derives its revenue primarily from its stake in Burgenland Energie AG, focusing on electricity generation and sales. The company's net profit margin is a key financial indicator to consider when evaluating its profitability.

Burgenland Holding, a compact player in the European market, has shown steady earnings growth of 3.6% annually over the past five years. Despite a modest 5.3% earnings increase last year, trailing behind the Integrated Utilities industry's 14.2%, it remains attractive by trading at 29% below its estimated fair value. The company boasts high-quality past earnings and operates without debt, contrasting with its previous debt-to-equity ratio of 1.5%. Though revenue is under US$1 million (€0), Burgenland's financial health and valuation suggest potential for investors seeking undervalued opportunities in Europe’s utility sector.

Synektik Spólka Akcyjna (WSE:SNT)

Simply Wall St Value Rating: ★★★★★★

Overview: Synektik Spólka Akcyjna offers products, services, and IT solutions for surgery, diagnostic imaging, and nuclear medicine applications in Poland with a market cap of PLN2.29 billion.

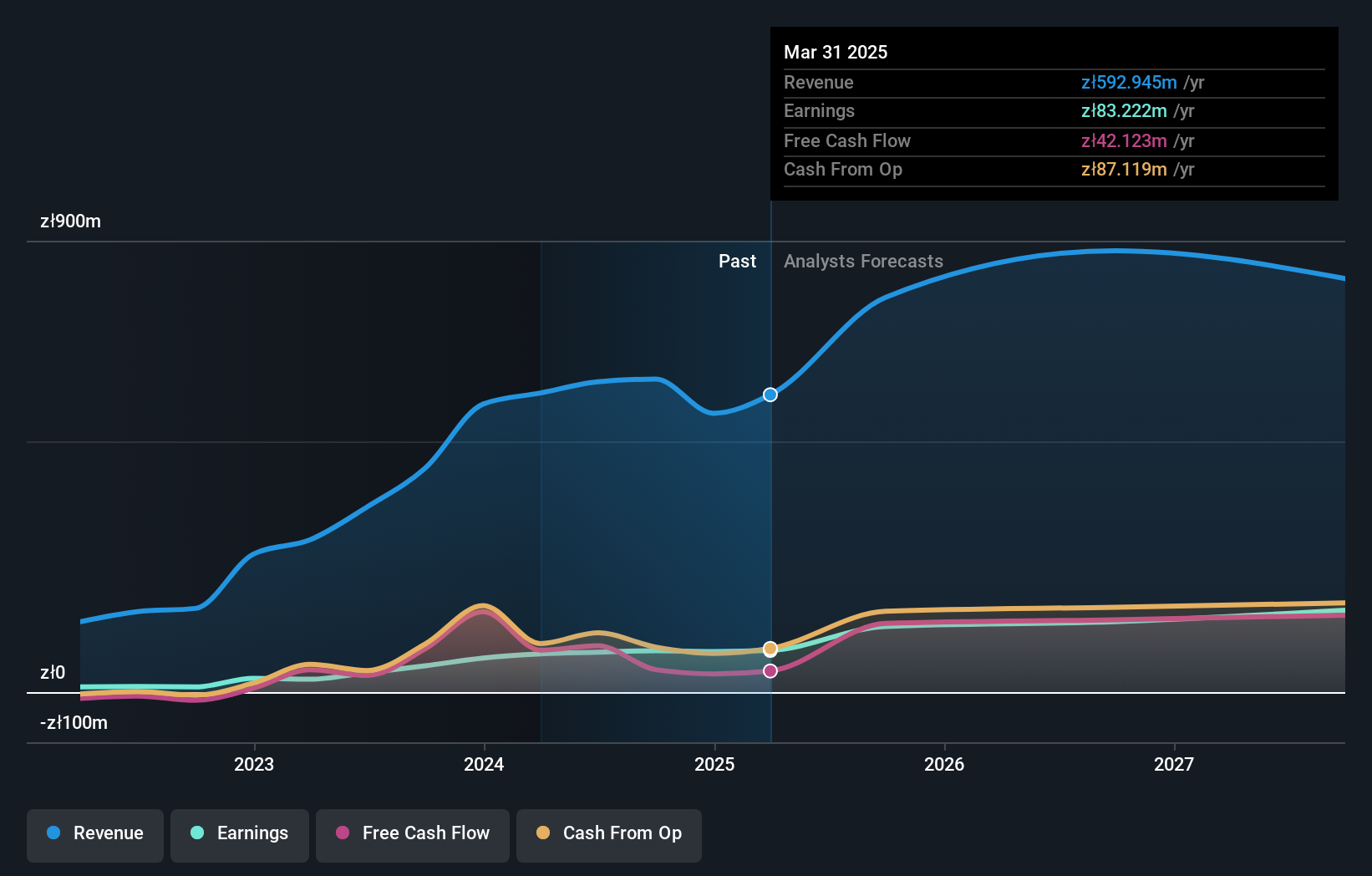

Operations: Synektik Spólka Akcyjna generates revenue primarily from its Diagnostic and IT Equipment segment, which accounts for PLN57.92 billion, and the Production of Radio Pharmaceuticals segment, contributing PLN4.67 billion.

Synektik Spólka Akcyjna, a small player in the healthcare sector, has shown promising financial health with its debt to equity ratio decreasing from 14.5% to 3% over five years. The company is trading at 12.5% below its estimated fair value and boasts high-quality earnings, including non-cash components. Recent results highlight a revenue increase to PLN 154 million for Q3 compared to PLN 124 million last year, while net income rose to PLN 24 million from PLN 17 million. Earnings per share also improved significantly, suggesting potential for continued growth in profitability and market valuation.

Seize The Opportunity

- Click through to start exploring the rest of the 321 European Undiscovered Gems With Strong Fundamentals now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novabase S.G.P.S might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:NVQ

Novabase S.G.P.S

Through its subsidiaries, provides IT consulting and services in Portugal, rest of Europe, Africa, the Middle East, and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives