As European markets navigate a landscape of cautious optimism fueled by potential EU-U.S. trade agreements and steady interest rates from the European Central Bank, investors are keenly watching for opportunities in less-explored sectors. In this climate, identifying promising stocks often involves seeking companies that demonstrate resilience amidst economic uncertainties and have the potential to capitalize on evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Deceuninck (ENXTBR:DECB)

Simply Wall St Value Rating: ★★★★★★

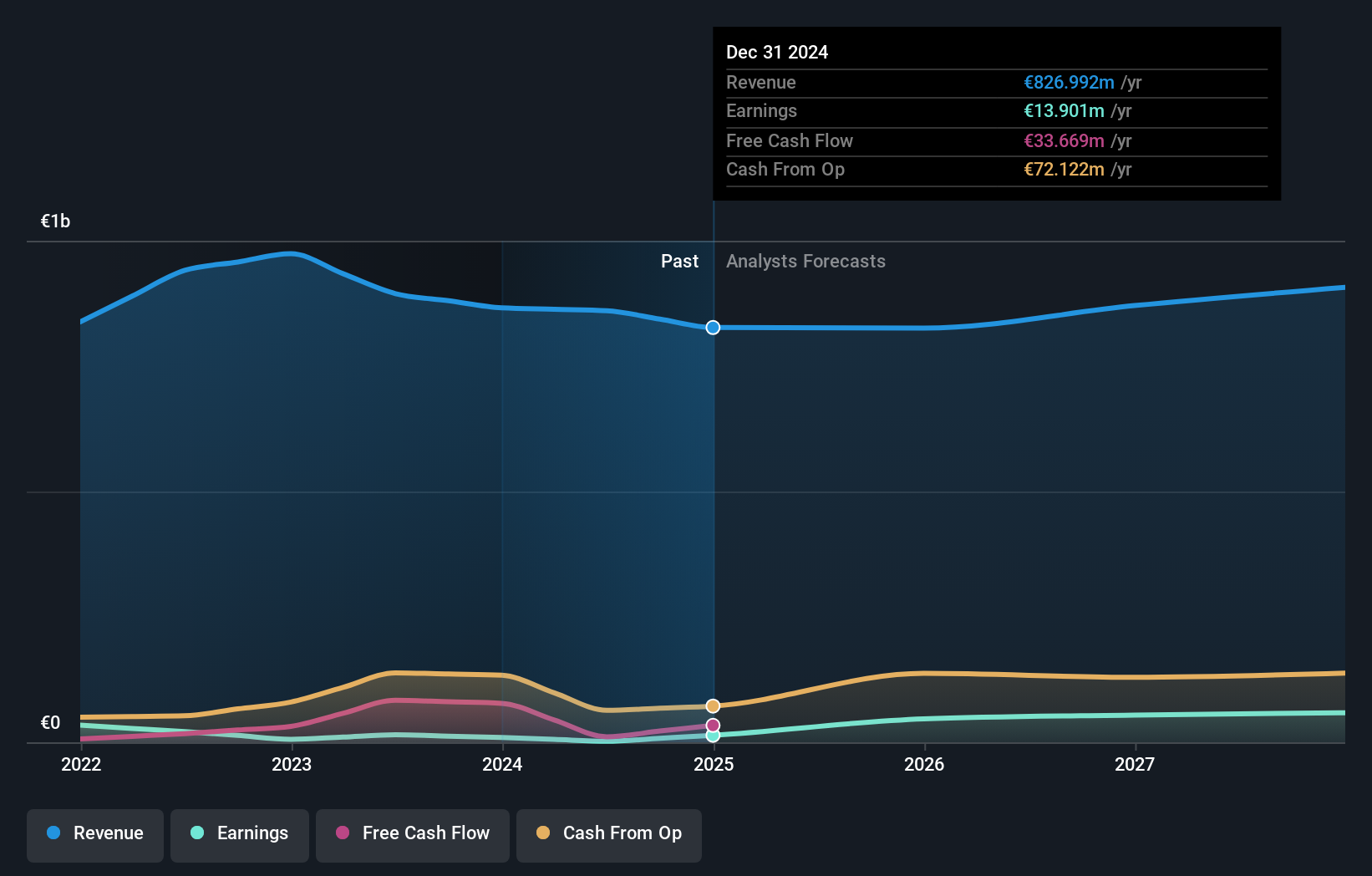

Overview: Deceuninck NV is involved in the design, manufacture, recycling, and distribution of multi-material window, door, and building solutions across Europe, North America, Turkey, and internationally with a market cap of €300.98 million.

Operations: Deceuninck generates revenue primarily from its Window and Door Systems segment, contributing €759.81 million, followed by Home Protection at €40.48 million and Outdoor Living at €26.70 million.

Deceuninck, a nimble player in the building industry, has shown impressive earnings growth of 46.6% over the past year, outpacing the sector's -3.7%. The company's debt to equity ratio has improved significantly from 70.4% to 26.3% over five years, indicating robust financial management. With interest payments well covered by EBIT at 9.8x and a net debt to equity ratio of 16.7%, Deceuninck stands on solid ground financially. Trading at nearly 26% below its estimated fair value and having declared an annual dividend of €0.056 per share recently, it presents an intriguing opportunity for investors seeking growth potential in Europe.

- Unlock comprehensive insights into our analysis of Deceuninck stock in this health report.

Understand Deceuninck's track record by examining our Past report.

Cloetta (OM:CLA B)

Simply Wall St Value Rating: ★★★★★☆

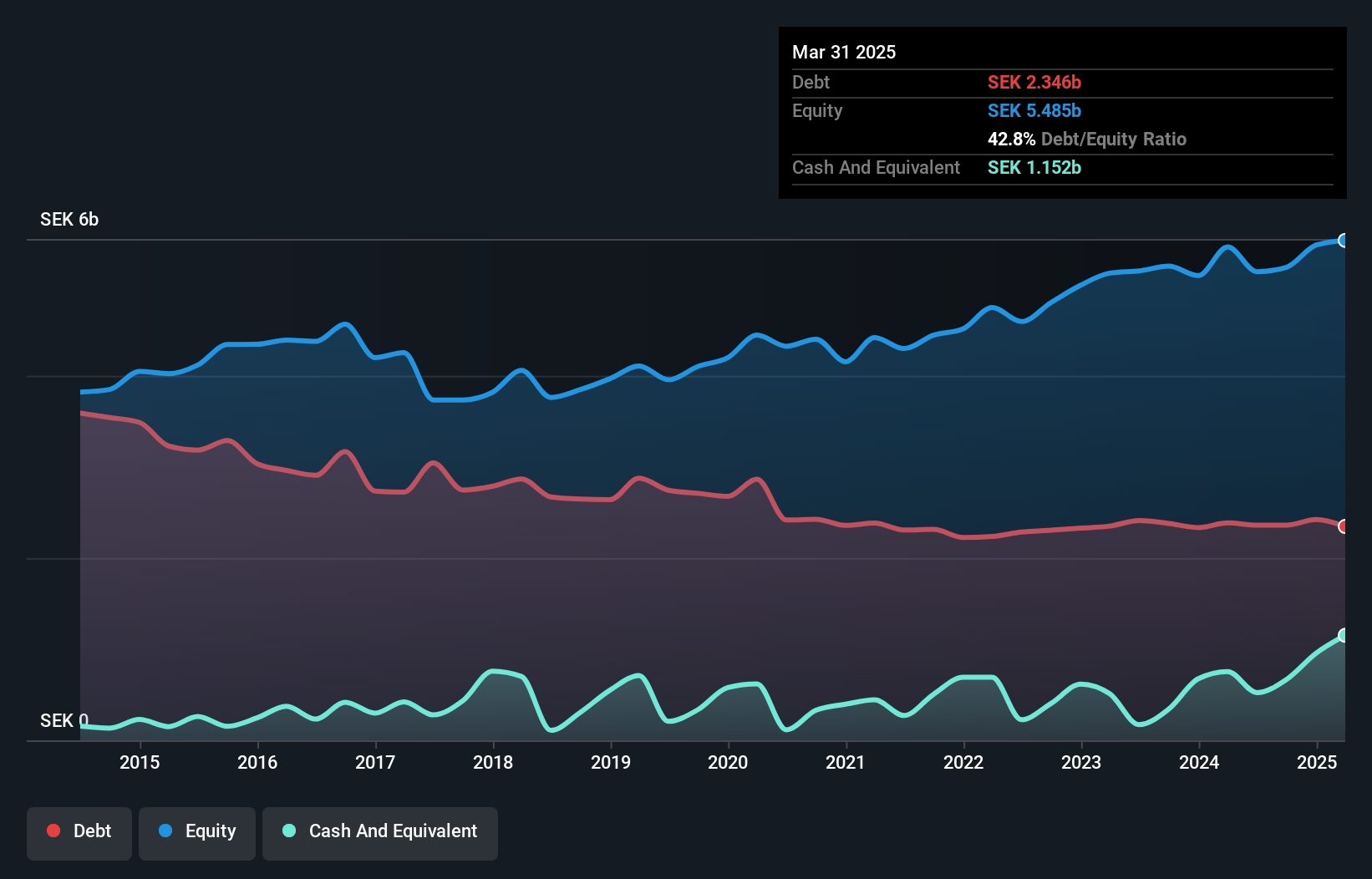

Overview: Cloetta AB (publ) is a confectionery company with a market capitalization of approximately SEK9.29 billion.

Operations: Cloetta AB generates revenue primarily from packaged branded goods, contributing SEK6.08 billion, and pick & mix products, adding SEK2.51 billion.

Cloetta, a notable player in the European confectionery market, has shown impressive financial strength. Recent earnings for Q2 2025 reported net income of SEK 116 million, up from SEK 82 million the previous year. The company's net debt to equity ratio stands at a satisfactory 30.4%, reflecting prudent financial management as it reduced from 55.9% over five years. Trading at a significant discount of 52% below estimated fair value, Cloetta offers potential upside for investors seeking value opportunities within the sector. Additionally, earnings have grown consistently by an average of 10% annually over five years, underscoring its robust growth trajectory.

Burgenland Holding (WBAG:BHD)

Simply Wall St Value Rating: ★★★★★★

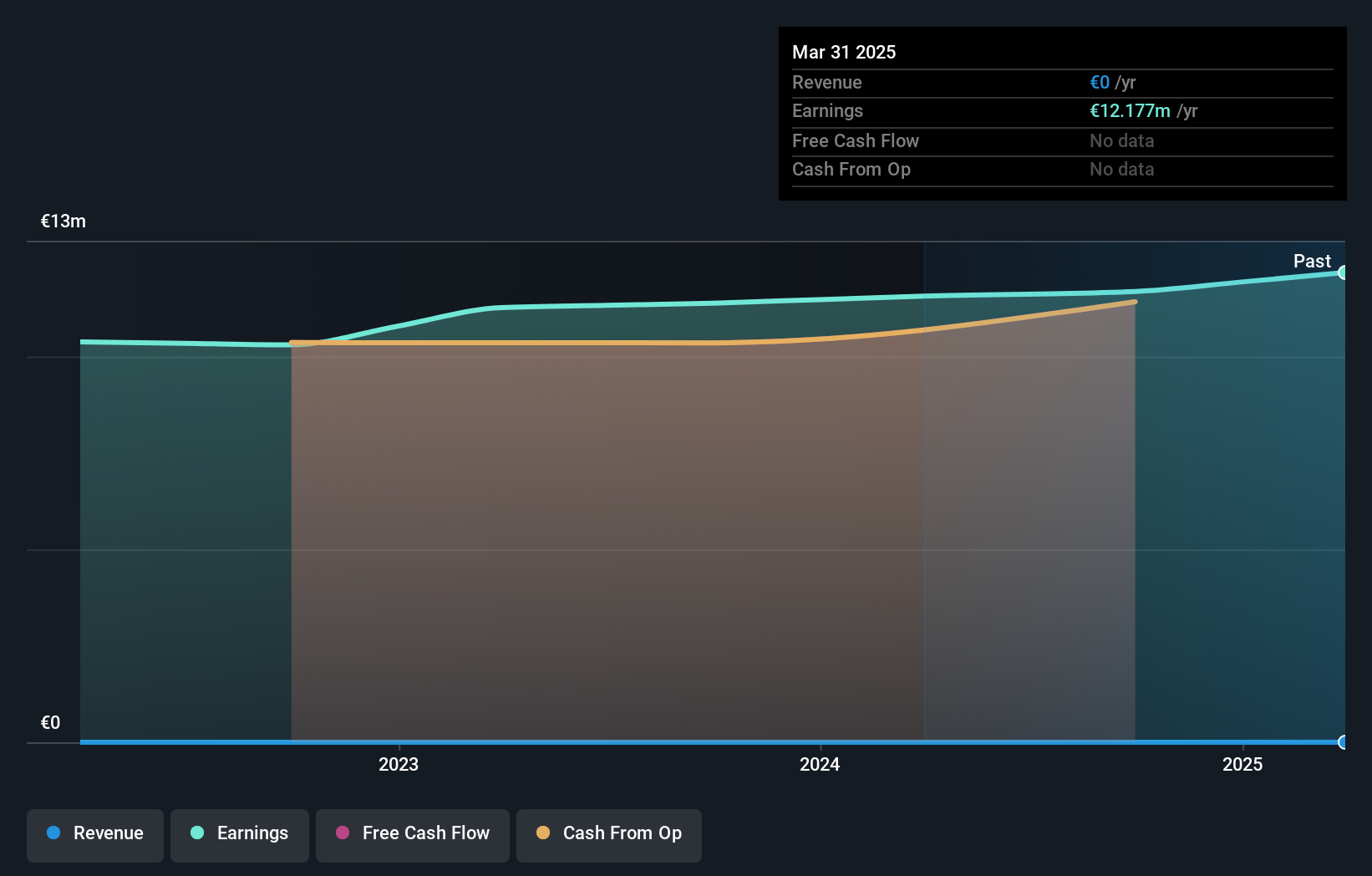

Overview: Burgenland Holding Aktiengesellschaft is involved in the generation and sale of electricity in Austria through its investment in Burgenland Energie AG, with a market capitalization of €219 million.

Operations: Burgenland Holding derives its revenue primarily from its investment in Burgenland Energie AG, focusing on electricity generation and sales within Austria. The company has a market capitalization of €219 million.

Burgenland Holding, a small player in the European market, showcases a unique financial profile with no debt, a significant improvement from its 1.5 debt-to-equity ratio five years ago. The company reported net income of €11.81 million for the half-year ending March 2025, up from €11.31 million previously. Despite earnings growth at 5.3% last year, it lagged behind the Integrated Utilities industry's 21%. However, trading at about 26% below its estimated fair value suggests potential upside for investors seeking undervalued opportunities with high-quality earnings and stable share prices in an illiquid market space.

Turning Ideas Into Actions

- Click here to access our complete index of 317 European Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:DECB

Deceuninck

Engages in the design, manufacture, recycling, and distribution of multi-material window, door, and building solutions in Europe, North America, Turkey, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives