- Austria

- /

- Electronic Equipment and Components

- /

- WBAG:KTCG

Further weakness as Kapsch TrafficCom (VIE:KTCG) drops 13% this week, taking five-year losses to 68%

Statistically speaking, long term investing is a profitable endeavour. But no-one is immune from buying too high. For example, after five long years the Kapsch TrafficCom AG (VIE:KTCG) share price is a whole 68% lower. That is extremely sub-optimal, to say the least. We also note that the stock has performed poorly over the last year, with the share price down 26%. Unfortunately the share price momentum is still quite negative, with prices down 16% in thirty days. But this could be related to poor market conditions -- stocks are down 13% in the same time.

After losing 13% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Given that Kapsch TrafficCom didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over half a decade Kapsch TrafficCom reduced its trailing twelve month revenue by 4.4% for each year. That's not what investors generally want to see. With neither profit nor revenue growth, the loss of 11% per year doesn't really surprise us. We don't think anyone is rushing to buy this stock. Ultimately, it may be worth watching - should revenue pick up, the share price might follow.

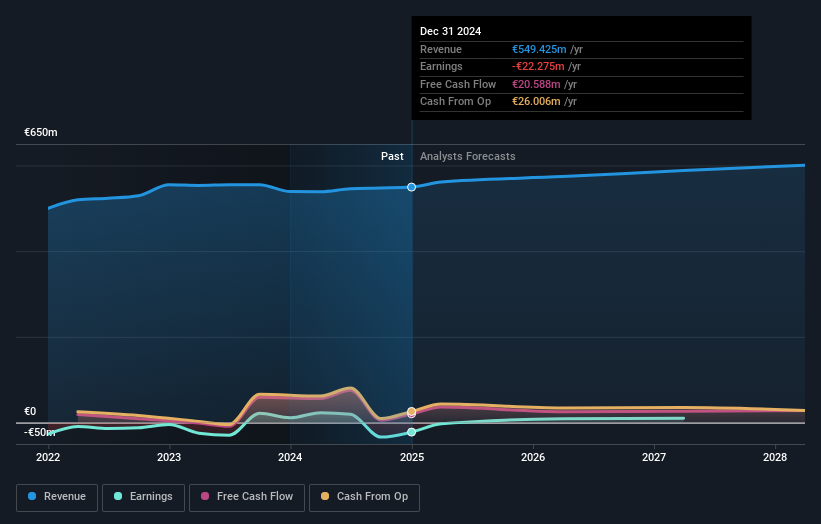

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Kapsch TrafficCom's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 6.6% in the last year, Kapsch TrafficCom shareholders lost 26%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Kapsch TrafficCom , and understanding them should be part of your investment process.

Of course Kapsch TrafficCom may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Austrian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Kapsch TrafficCom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WBAG:KTCG

Kapsch TrafficCom

Provides intelligent transportation systems technologies, solutions, and services in Austria, Europe, the Middle East, Africa, the Asia-Pacific, and the Americas.

Very undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives