Are Ottakringer Getränke's (VIE:OTS) Statutory Earnings A Good Reflection Of Its Earnings Potential?

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. That said, the current statutory profit is not always a good guide to a company's underlying profitability. Today we'll focus on whether this year's statutory profits are a good guide to understanding Ottakringer Getränke (VIE:OTS).

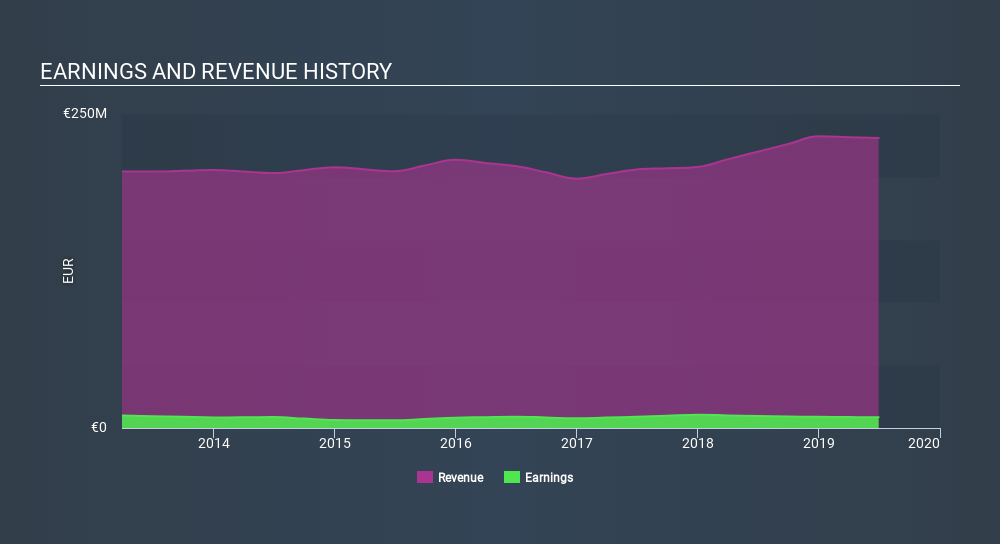

It's good to see that over the last twelve months Ottakringer Getränke made a profit of €8.50m on revenue of €230.8m. The chart below shows how it has grown revenue over the last three years, but that profit has declined.

View our latest analysis for Ottakringer Getränke

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. Today, we'll discuss Ottakringer Getränke's free cashflow relative to its earnings, and consider what that tells us about the company. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Ottakringer Getränke.

Zooming In On Ottakringer Getränke's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

For the year to June 2019, Ottakringer Getränke had an accrual ratio of 0.20. Therefore, we know that it's free cashflow was significantly lower than its statutory profit, which is hardly a good thing. Over the last year it actually had negative free cash flow of €17m, in contrast to the aforementioned profit of €8.50m. As it happens we don't have the data on what Ottakringer Getränke produced by way of free cashflow, the year before, which is a pity.

Our Take On Ottakringer Getränke's Profit Performance

Ottakringer Getränke didn't convert much of its profit to free cahs flow in the last year, which some investors may consider rather suboptimal. Because of this, we think that it may be that Ottakringer Getränke's statutory profits are better than its underlying earnings power. But at least holders can take some solace from the 5.9% per annum growth in EPS for the last three. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. Just as investors must consider earnings, it is also important to take into account the strength of a company's balance sheet. If you want to,you can see our take on Ottakringer Getränke's balance sheet by clicking here.

This note has only looked at a single factor that sheds light on the nature of Ottakringer Getränke's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About WBAG:OTS

Ottakringer Getränke

Ottakringer Getränke AG engages in the production and bottling of beer, mineral water, and other non-alcoholic beverages in Austria.

Weak fundamentals or lack of information.

Market Insights

Community Narratives