European Growth Companies With High Insider Ownership In December 2025

Reviewed by Simply Wall St

As European markets show resilience with the STOXX Europe 600 Index climbing 2.35% and major single-country indexes also advancing, investors are closely monitoring inflation trends that suggest eurozone inflation could remain near the ECB's target. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business, potentially aligning well with market optimism and stability in key economic indicators.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 96.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 109.1% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.8% |

| CD Projekt (WSE:CDR) | 29.7% | 50.2% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

We'll examine a selection from our screener results.

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★★

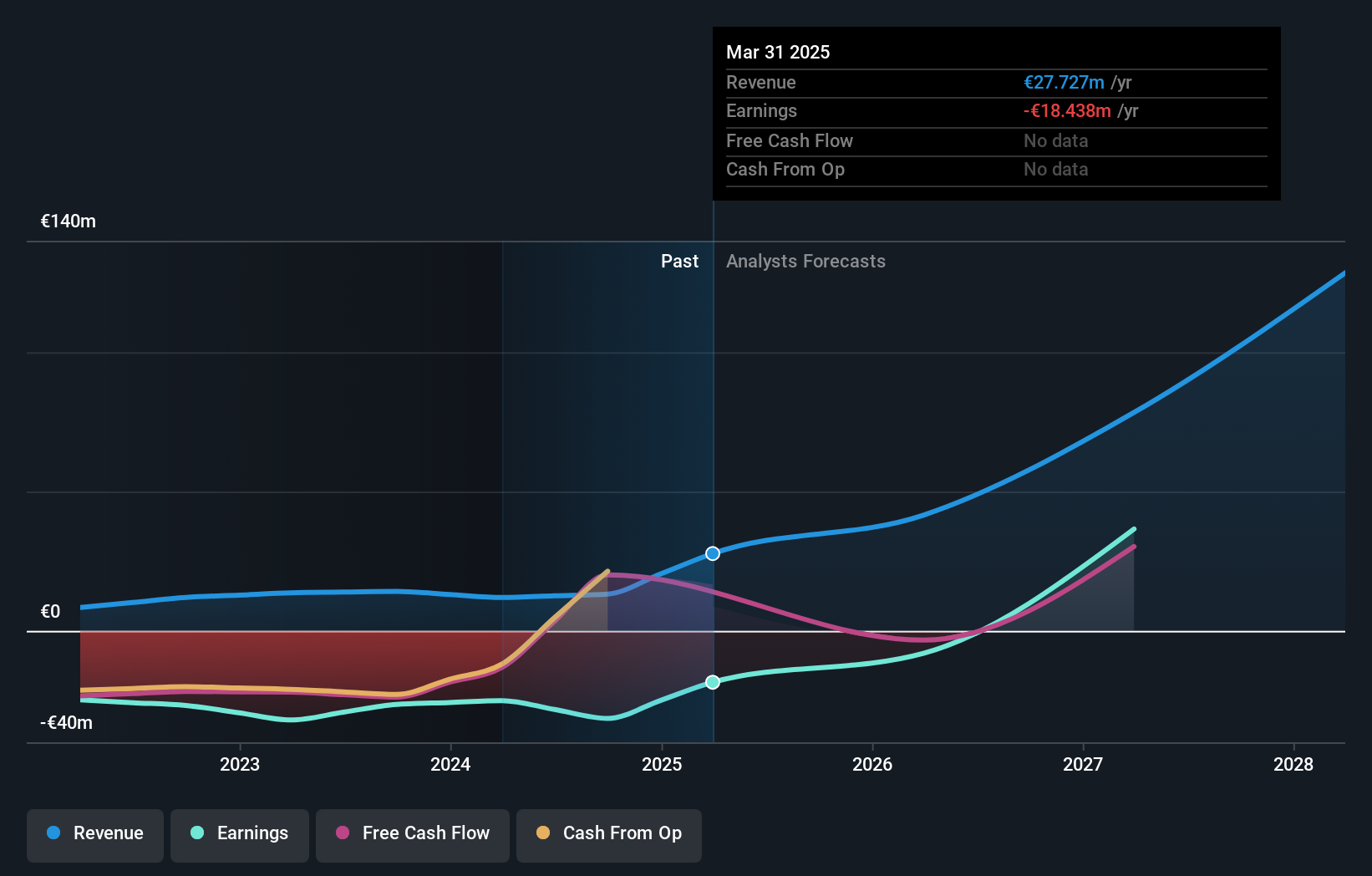

Overview: MedinCell S.A. is a pharmaceutical company in France that focuses on developing long-acting injectables across various therapeutic areas, with a market cap of €931.92 million.

Operations: The company's revenue segment includes conducting research and development on biodegradable polymer-based processes, generating €27.73 million.

Insider Ownership: 12.5%

MedinCell, a European growth company, is forecast to see revenue grow at 35.2% annually, significantly outpacing the French market's 5.4%. Despite recent share price volatility and negative equity, it's trading well below estimated fair value. The company's inclusion in the MSCI World Small Cap Index highlights its business model strength and growth potential. Recent FDA approval of UZEDY® for bipolar I disorder underscores MedinCell's innovative drug delivery technology and strategic partnerships with Teva Pharmaceuticals.

- Click to explore a detailed breakdown of our findings in MedinCell's earnings growth report.

- Upon reviewing our latest valuation report, MedinCell's share price might be too optimistic.

Smart Eye (OM:SEYE)

Simply Wall St Growth Rating: ★★★★★☆

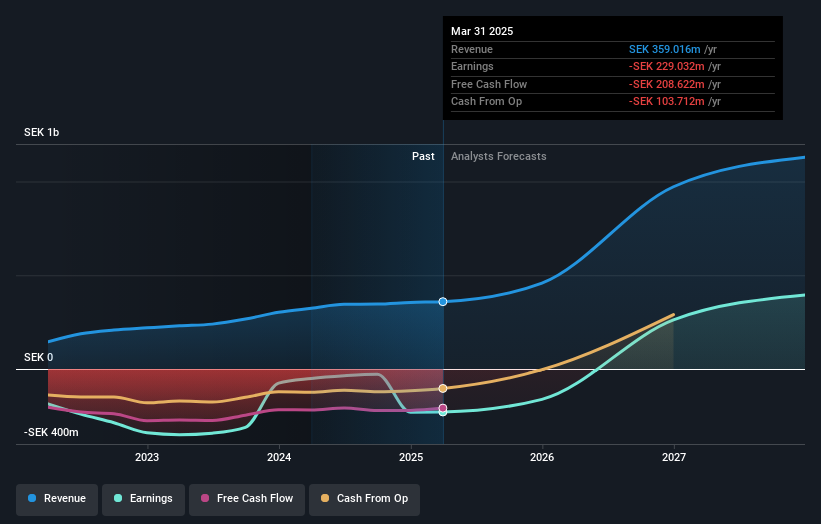

Overview: Smart Eye AB (publ) develops AI technology solutions to understand and predict human behavior across various regions, with a market cap of SEK2.75 billion.

Operations: The company's revenue is derived from Behavioral Research, which contributes SEK252.90 million, and Automotive Solutions, accounting for SEK128.65 million.

Insider Ownership: 15%

Smart Eye, a European company with significant growth potential, is expected to achieve 47.4% annual revenue growth, surpassing the Swedish market average. Despite trading at 64.6% below estimated fair value and having less than a year of cash runway, its recent collaboration with Sony Semiconductor Solutions enhances its competitive edge in automotive safety technology. The company's forecasted profitability within three years and strategic partnerships underscore its robust position in the evolving automotive sector.

- Get an in-depth perspective on Smart Eye's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Smart Eye is priced lower than what may be justified by its financials.

Semperit Holding (WBAG:SEM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Semperit Aktiengesellschaft Holding is a company that develops, produces, and sells rubber products for the medical and industrial sectors globally, with a market cap of €266.63 million.

Operations: The company's revenue is primarily derived from its Semperit Engineered Applications segment, contributing €362.01 million, and the Semperit Industrial Applications segment, which adds €291.58 million.

Insider Ownership: 10.1%

Semperit Holding, with significant insider ownership, reported a positive turnaround in its third-quarter earnings, achieving a net income of €2.76 million compared to a loss the previous year. Despite being dropped from the S&P Global BMI Index and facing challenges with unsustainable dividends, it is expected to become profitable within three years. Analysts anticipate revenue growth at 7.7% annually, outpacing the Austrian market average and projecting a potential stock price increase of 29.8%.

- Take a closer look at Semperit Holding's potential here in our earnings growth report.

- Our valuation report unveils the possibility Semperit Holding's shares may be trading at a discount.

Next Steps

- Discover the full array of 205 Fast Growing European Companies With High Insider Ownership right here.

- Looking For Alternative Opportunities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MEDCL

MedinCell

A pharmaceutical company, develops long acting injectables in various therapeutic areas in France.

Exceptional growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026