3 European Stocks Estimated To Be Undervalued In October 2025

Reviewed by Simply Wall St

In October 2025, the European stock market is experiencing a notable upswing, with the pan-European STOXX Europe 600 Index reaching record levels driven by a rally in technology stocks and expectations for lower U.S. borrowing costs. Amid this positive sentiment, investors are keenly looking for opportunities to identify undervalued stocks that could offer potential value as they navigate through an environment of contained inflation and slightly rising unemployment rates in the eurozone. In such a climate, identifying undervalued stocks involves assessing companies with strong fundamentals that may not yet be fully recognized by the market, presenting potential opportunities for growth as broader economic conditions improve.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xplora Technologies (OB:XPLRA) | NOK43.50 | NOK85.09 | 48.9% |

| Vimi Fasteners (BIT:VIM) | €1.19 | €2.32 | 48.8% |

| SBO (WBAG:SBO) | €27.35 | €53.33 | 48.7% |

| Robit Oyj (HLSE:ROBIT) | €1.14 | €2.19 | 48.1% |

| Micro Systemation (OM:MSAB B) | SEK63.40 | SEK122.68 | 48.3% |

| Lingotes Especiales (BME:LGT) | €5.70 | €11.11 | 48.7% |

| Industrie Chimiche Forestali (BIT:ICF) | €6.40 | €12.59 | 49.1% |

| E-Globe (BIT:EGB) | €0.65 | €1.26 | 48.5% |

| Atea (OB:ATEA) | NOK142.20 | NOK280.38 | 49.3% |

| Allegro.eu (WSE:ALE) | PLN33.615 | PLN66.29 | 49.3% |

Underneath we present a selection of stocks filtered out by our screen.

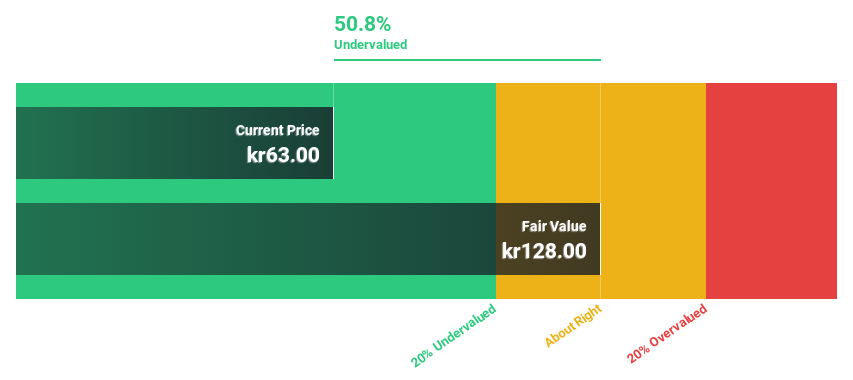

Hanza (OM:HANZA)

Overview: Hanza AB (publ) offers manufacturing solutions and has a market cap of SEK4.85 billion.

Operations: The company's revenue segments include Main Markets at SEK3.11 billion, Other Markets at SEK2.16 billion, and Business Development and Services contributing SEK32 million.

Estimated Discount To Fair Value: 34.5%

Hanza's recent earnings report shows significant growth, with net income rising to SEK 52 million in Q2 2025 from SEK 6 million a year ago. Despite substantial insider selling, the company is trading at SEK105.6, well below its estimated fair value of SEK161.32, and is considered highly undervalued based on discounted cash flows. While revenue growth is slower than ideal at 12.6% per year, earnings are expected to grow significantly above market rates at 34.6% annually over the next three years.

- Upon reviewing our latest growth report, Hanza's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Hanza's balance sheet by reading our health report here.

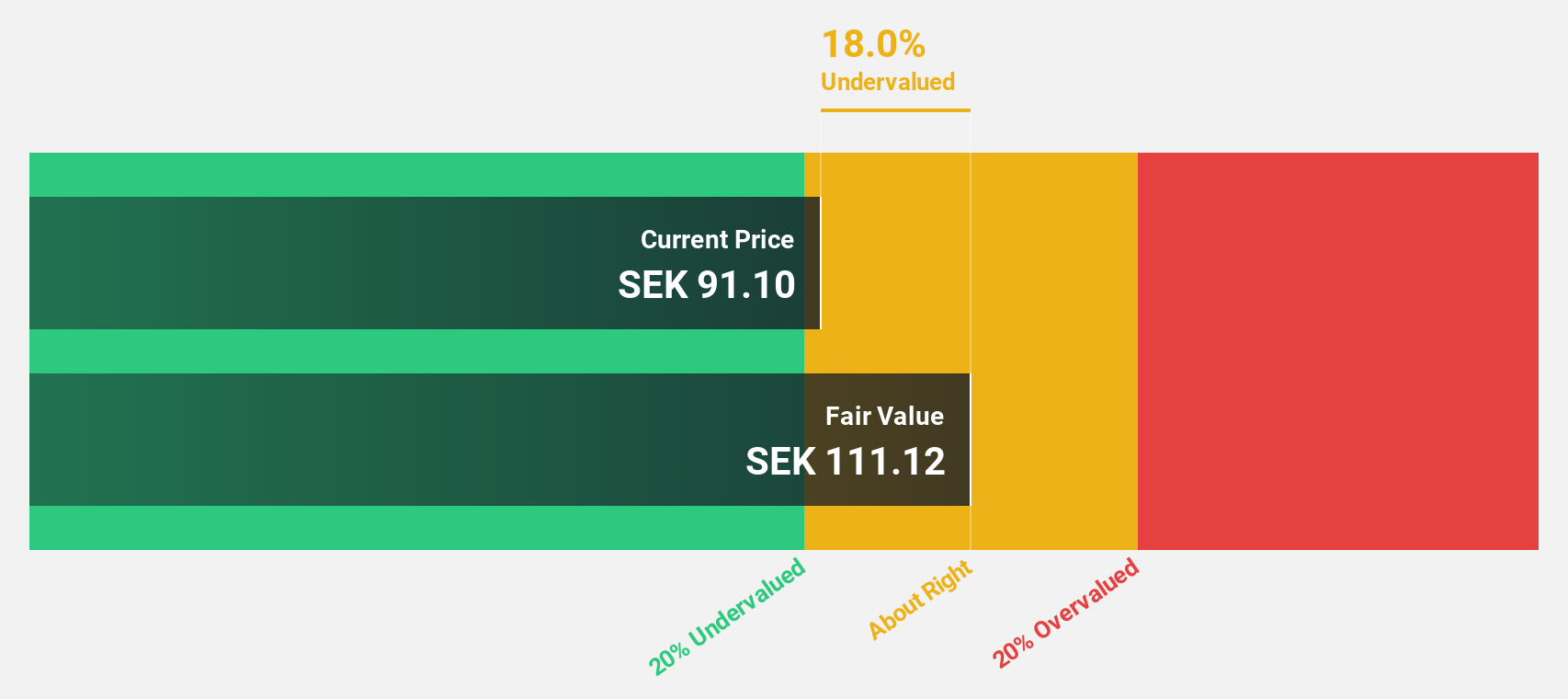

KB Components (OM:KBC)

Overview: KB Components AB (publ) is a company that designs, develops, manufactures, and sells polymer components for various sectors including light and heavy vehicles, medical, furniture, lighting, chrome plating, and industrial applications both in Sweden and internationally; it has a market cap of SEK2.38 billion.

Operations: The company's revenue segments are distributed as follows: SEK120.74 million from Asia, SEK1.18 billion from Europe, and SEK1.59 billion from North America.

Estimated Discount To Fair Value: 46.4%

KB Components is trading at SEK42.5, significantly below its estimated fair value of SEK79.31, indicating it is undervalued based on discounted cash flows. The company reported strong earnings growth for Q2 2025, with net income increasing to SEK44.57 million from SEK28.63 million a year ago, driven by revenue growth outpacing the Swedish market average. Despite a high level of debt and slower revenue growth forecasted at 6.4% annually, earnings are expected to grow significantly over the next three years at 21.54% per year under new CEO Magnus Andersson's leadership.

- Our expertly prepared growth report on KB Components implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in KB Components' balance sheet health report.

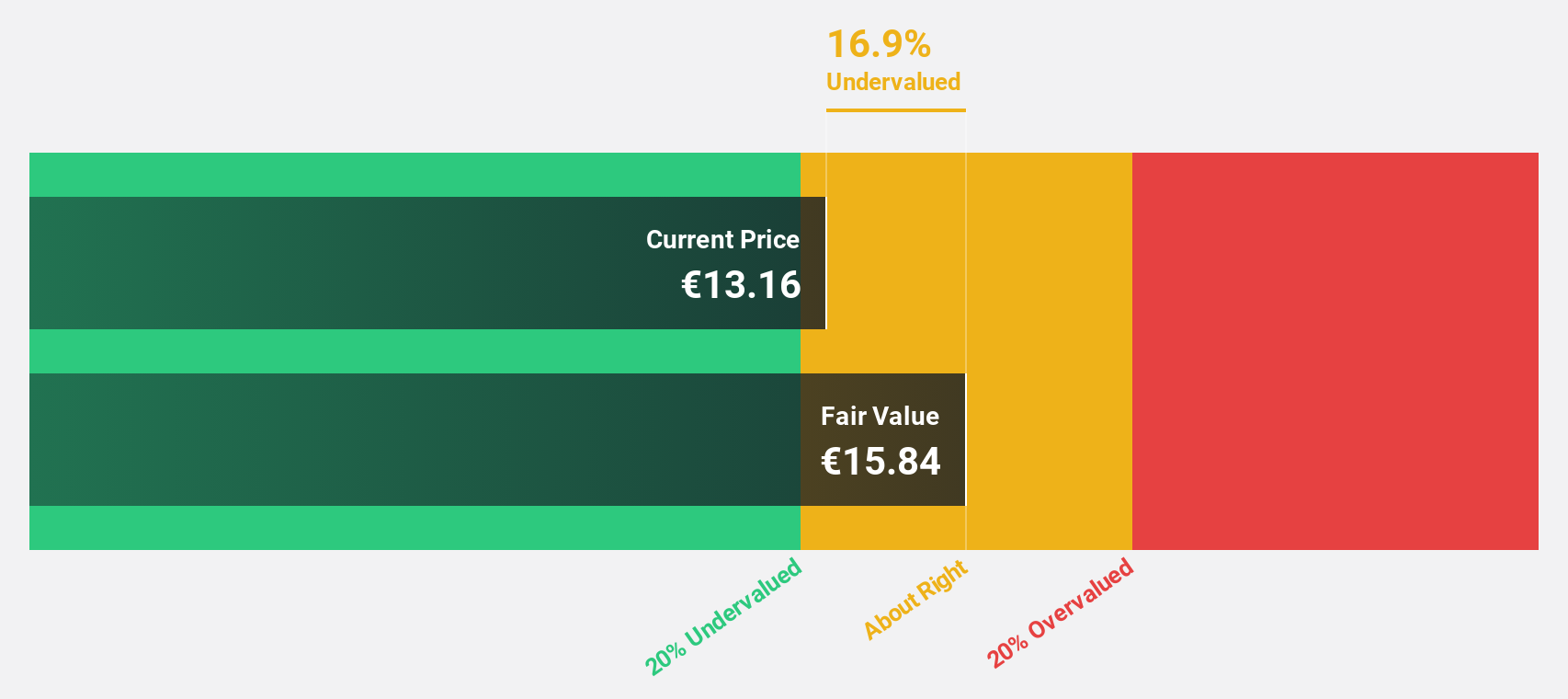

Semperit Holding (WBAG:SEM)

Overview: Semperit Aktiengesellschaft Holding is a global company that develops, produces, and sells rubber products for the medical and industrial sectors, with a market cap of €269.10 million.

Operations: The company's revenue primarily comes from its Semperit Engineered Applications segment, generating €364.57 million, and the Semperit Industrial Applications segment, contributing €287.20 million.

Estimated Discount To Fair Value: 15.2%

Semperit Holding is trading at €13.08, below its estimated fair value of €15.43, reflecting an undervaluation based on cash flows. Despite recent financial challenges, including a net loss of €4 million for Q2 2025 and being dropped from the S&P Global BMI Index, analysts expect the stock price to rise by 28.1%. The company is forecasted to achieve profitability within three years, with revenue growth outpacing the Austrian market average at 7.6% annually.

- The analysis detailed in our Semperit Holding growth report hints at robust future financial performance.

- Take a closer look at Semperit Holding's balance sheet health here in our report.

Summing It All Up

- Gain an insight into the universe of 208 Undervalued European Stocks Based On Cash Flows by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if KB Components might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:KBC

KB Components

Designs, develops, manufactures, and sells polymer components for light vehicles, heavy vehicles, medical, furniture, industrial, lighting, chrome plating, and industrial window applications in Sweden and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion