How Erste Group’s Upgraded 2025 Outlook Has Changed Its Investment Story (WBAG:EBS)

Reviewed by Sasha Jovanovic

- In October 2025, Erste Group Bank AG reported its third quarter and nine-month earnings, including €901 million in quarterly net income, and subsequently raised its 2025 outlook for net interest income to growth higher than 2%.

- This upgrade signals increased management confidence in future performance after posting improved net income and earnings per share despite a decrease in net interest income compared to the prior year.

- We'll explore how the upgraded 2025 outlook for net interest income shapes Erste Group Bank's investment narrative going forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Erste Group Bank Investment Narrative Recap

To be a shareholder in Erste Group Bank today, you need to believe in its ability to drive sustainable revenue growth and manage risk through expansion in Central and Eastern Europe, even as rising sector-specific taxes and macro volatility remain key concerns. The recent upgrade to the 2025 net interest income outlook boosts confidence around near-term profit resilience, but it does not fully resolve the most pressing risks related to large-scale integration in the Polish market and the permanence of windfall taxes.

Of all recent company announcements, the latest quarterly earnings stand out: despite a year-on-year decline in net interest income, Erste's net income and earnings per share saw measured improvement. This focus on maintaining overall profitability, in spite of headwinds, connects directly to the upgraded net interest income outlook, a key short-term catalyst, especially as the group pursues further operational efficiencies amidst ongoing digital transformation.

Yet, while optimism grows, investors should not ignore the potential long-term impact if newly introduced banking taxes across CEE markets do become a...

Read the full narrative on Erste Group Bank (it's free!)

Erste Group Bank's narrative projects €14.9 billion revenue and €3.9 billion earnings by 2028. This requires 11.1% yearly revenue growth and a €0.9 billion earnings increase from €3.0 billion today.

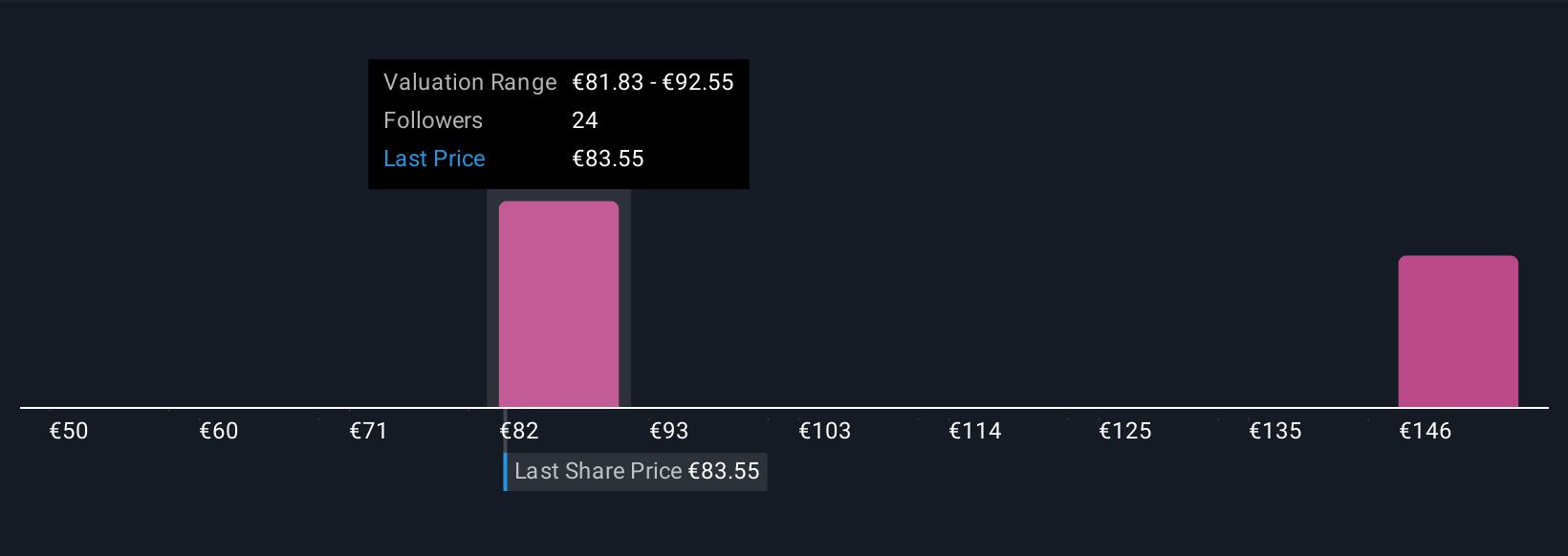

Uncover how Erste Group Bank's forecasts yield a €88.66 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Five recent fair value estimates from the Simply Wall St Community range widely from €49.67 to €166.11 per share. As you weigh these diverse opinions, keep in mind that rising sector-specific taxes could challenge future profitability and influence shareholder returns more broadly.

Explore 5 other fair value estimates on Erste Group Bank - why the stock might be worth as much as 78% more than the current price!

Build Your Own Erste Group Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Erste Group Bank research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Erste Group Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Erste Group Bank's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Erste Group Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:EBS

Erste Group Bank

Provides a range of banking and other financial services to retail, corporate, and public sector customers.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives