PIERER Mobility (VIE:PMAG) Is Paying Out A Larger Dividend Than Last Year

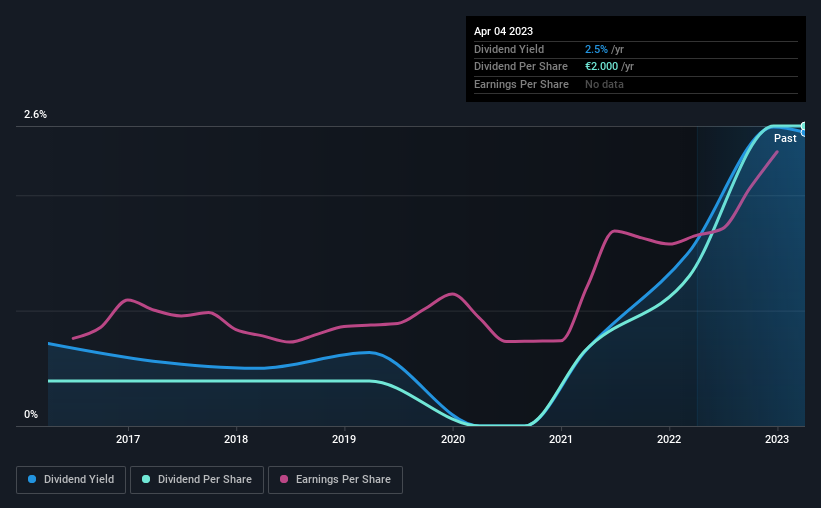

The board of PIERER Mobility AG (VIE:PMAG) has announced that it will be paying its dividend of €2.00 on the 2nd of May, an increased payment from last year's comparable dividend. This takes the annual payment to 2.5% of the current stock price, which unfortunately is below what the industry is paying.

Check out our latest analysis for PIERER Mobility

PIERER Mobility's Payment Has Solid Earnings Coverage

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Before making this announcement, PIERER Mobility was paying a whopping 200% as a dividend, but this only made up 40% of its overall earnings. A cash payout ratio this high could put the dividend under pressure and force the company to reduce it in the future if it were to run into tough times.

Over the next year, EPS could expand by 23.3% if recent trends continue. Assuming the dividend continues along recent trends, we think the payout ratio could be 41% by next year, which is in a pretty sustainable range.

PIERER Mobility's Dividend Has Lacked Consistency

It's comforting to see that PIERER Mobility has been paying a dividend for a number of years now, however it has been cut at least once in that time. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. Since 2016, the dividend has gone from €0.30 total annually to €2.00. This implies that the company grew its distributions at a yearly rate of about 31% over that duration. PIERER Mobility has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. PIERER Mobility has seen EPS rising for the last five years, at 23% per annum. Earnings have been growing rapidly, and with a low payout ratio we think that the company could turn out to be a great dividend stock.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. While PIERER Mobility is earning enough to cover the payments, the cash flows are lacking. We don't think PIERER Mobility is a great stock to add to your portfolio if income is your focus.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. See if management have their own wealth at stake, by checking insider shareholdings in PIERER Mobility stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WBAG:PKTM

PIERER Mobility

Operates as a motorcycle manufacturer in Europe, North America, Mexico, and internationally.

Low risk with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026