- United Arab Emirates

- /

- Water Utilities

- /

- DFM:TABREED

Investors Still Waiting For A Pull Back In National Central Cooling Company PJSC (DFM:TABREED)

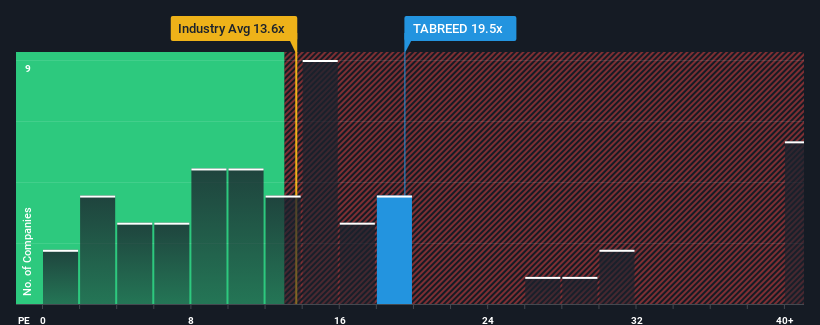

With a price-to-earnings (or "P/E") ratio of 19.5x National Central Cooling Company PJSC ( DFM:TABREED ) may be sending bearish signals at the moment, given that almost half of all companies in the United Arab Emirates have P/E ratios under 15x and even P/E's lower than 8x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, National Central Cooling Company PJSC's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for National Central Cooling Company PJSC

Want the full picture on analyst estimates for the company? Then our free report on National Central Cooling Company PJSC will help you uncover what's on the horizon.

Is There Enough Growth For National Central Cooling Company PJSC?

There's an inherent assumption that a company should outperform the market for P/E ratios like National Central Cooling Company PJSC's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's bottom line. Investors should note that there is an asterisk against this loss and that it was largely caused by the introduction of new corporate tax and accounting treatment related to intangibles in balance sheet. The impact of the change led to recognition of non-cash deferred tax liability which was a once off. Normalized earnings growth for the period came in at 14%.

Regardless, EPS has managed to lift by a handy 5.9% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 17% per year over the next three years. That's shaping up to be materially higher than the 5.8% per annum growth forecast for the broader market.

In light of this, it's understandable that National Central Cooling Company PJSC's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From National Central Cooling Company PJSC's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of National Central Cooling Company PJSC's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware National Central Cooling Company PJSC is showing 2 warning signs in our investment analysis, you should know about.

You might be able to find a better investment than National Central Cooling Company PJSC. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if National Central Cooling Company PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DFM:TABREED

National Central Cooling Company PJSC

Supplies chilled water in the United Arab Emirates and internationally.

Undervalued average dividend payer.

Market Insights

Community Narratives