- Israel

- /

- Diversified Financial

- /

- TASE:SHVA

Undiscovered Gems In Middle East Backed By Strong Fundamentals

Reviewed by Simply Wall St

In recent months, most Gulf markets have experienced a downturn due to weak oil prices and lackluster corporate earnings, with key indices like Saudi Arabia's benchmark and Dubai's main share index showing declines. Despite these challenges, opportunities still exist for discerning investors willing to explore stocks backed by strong fundamentals in the Middle East. Identifying such gems involves looking beyond immediate market sentiment to focus on companies with robust financial health and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.27% | -1.66% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 38.36% | 57.78% | ★★★★★☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Abu Dhabi Aviation (ADX:ADAVIATION)

Simply Wall St Value Rating: ★★★★★☆

Overview: Abu Dhabi Aviation Co. operates helicopters, and rotary and fixed wing aircraft for civil and military aviation sectors in the United Arab Emirates and internationally, with a market cap of AED5.92 billion.

Operations: The company's primary revenue streams are derived from Maintenance Repair and Overhaul (AED6.46 billion) and General Aviation (AED1.02 billion). Investments contribute a smaller portion to the overall revenue at AED27.38 million.

Abu Dhabi Aviation, a nimble player in the aviation sector, has shown impressive financial resilience. Over the past year, its earnings surged by 67%, outpacing the logistics industry's 12% growth. The company enjoys high-quality earnings and maintains a strong position with more cash than total debt, ensuring interest payments are comfortably covered. Despite limited historical data, it trades at a significant discount of nearly 99% below its estimated fair value. With positive free cash flow and profitability intact, Abu Dhabi Aviation seems poised for potential future growth within the Middle Eastern market landscape.

Dubai Insurance Company (P.S.C.) (DFM:DIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dubai Insurance Company (P.S.C.) offers a range of insurance products for individuals and corporates in the United Arab Emirates, with a market capitalization of AED1.35 billion.

Operations: Dubai Insurance generates revenue primarily through the sale of insurance products to both individuals and corporate clients in the UAE. The company's net profit margin is a key financial indicator, reflecting its profitability after accounting for all expenses.

Dubai Insurance Company (P.S.C.) showcases a promising profile with impressive earnings growth of 28.1% over the past year, outpacing the industry average. Their debt to equity ratio has increased from 0.2% to 6% in five years, yet they hold more cash than total debt, indicating financial robustness. The company reported a significant jump in net income for Q3 2025 at AED 46.22 million compared to AED 9.82 million last year, reflecting strong operational performance and high-quality earnings as evidenced by their EBIT covering interest payments by an impressive factor of 75 times.

Automatic Bank Services (TASE:SHVA)

Simply Wall St Value Rating: ★★★★★★

Overview: Automatic Bank Services Limited operates payment systems for international debit cards in Israel and has a market capitalization of ₪841.20 million.

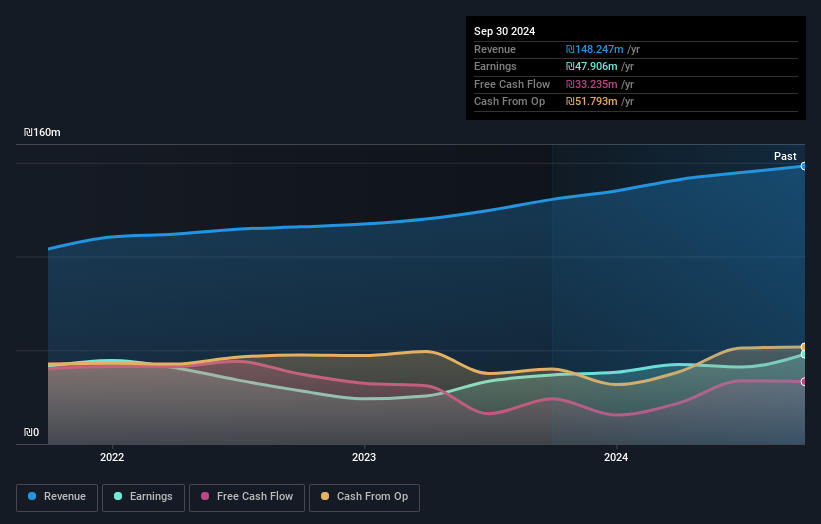

Operations: The company generates revenue primarily from its Clearing Segment, amounting to ₪153.65 million.

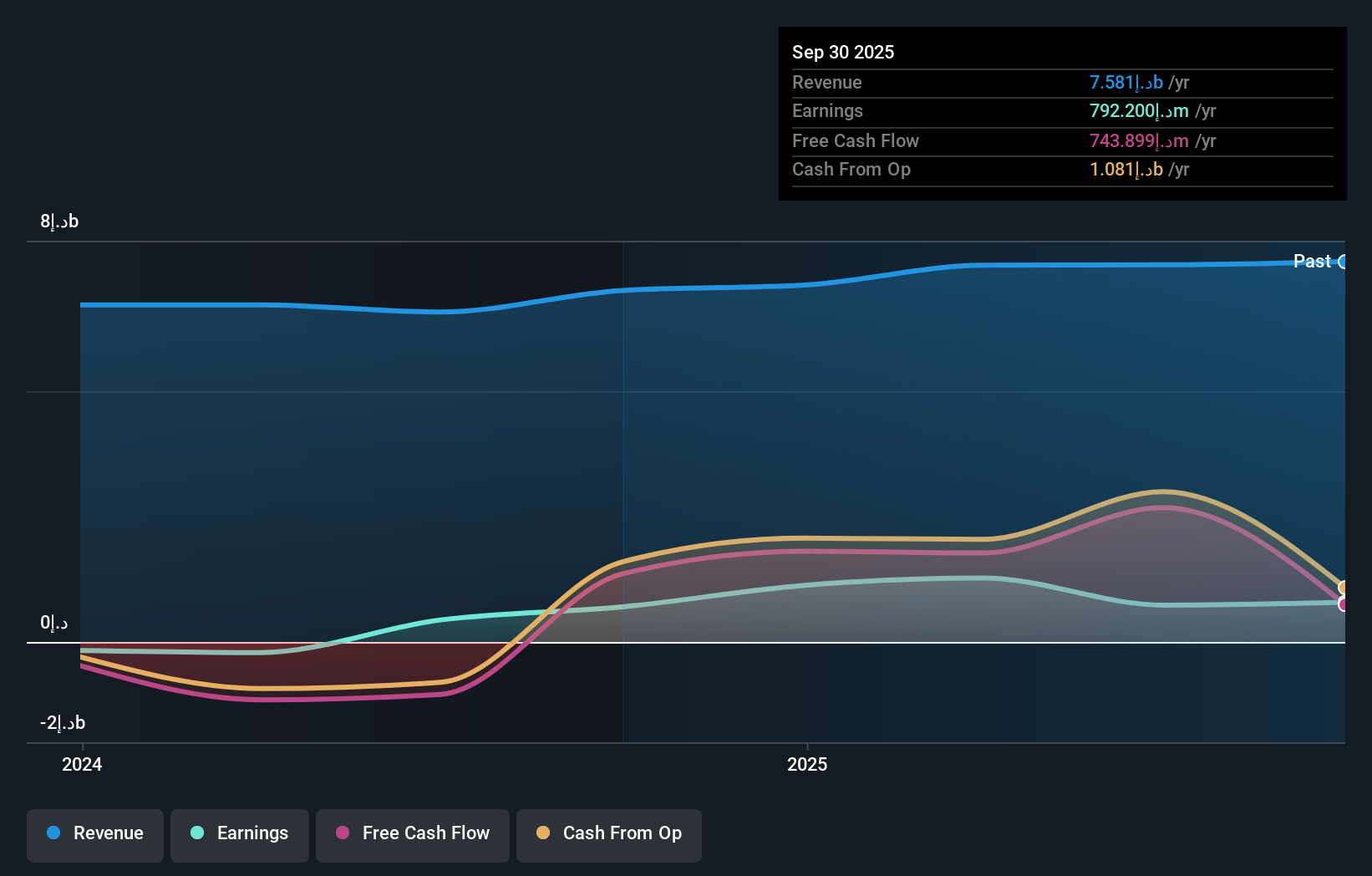

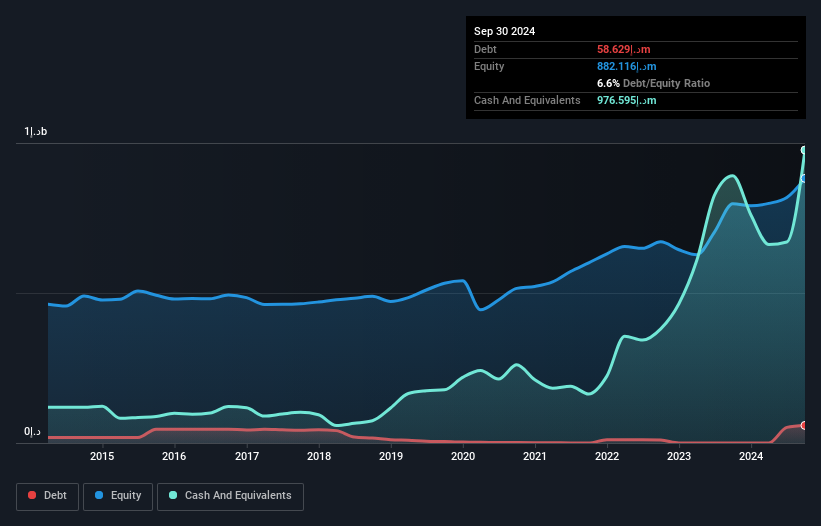

Automatic Bank Services, a relatively smaller player in the financial sector, has demonstrated steady earnings growth of 10.6% annually over the past five years. Despite not outpacing its industry peers recently, it remains profitable with no debt burden to worry about. The company reported a net income of ILS 13.44 million for Q2 2025, up from ILS 10.93 million the previous year, and basic earnings per share rose to ILS 0.34 from ILS 0.27. Notably added to the S&P Global BMI Index recently, Automatic Bank Services continues to show resilience and potential for future value creation in its market niche.

Turning Ideas Into Actions

- Investigate our full lineup of 195 Middle Eastern Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:SHVA

Automatic Bank Services

Operates payment systems for international debit cards in Israel.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives