- Saudi Arabia

- /

- Banks

- /

- SASE:1030

3 Dividend Stocks With Up To 5.4% Yield For Your Consideration

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year, with U.S. equities facing inflation fears and political uncertainty, investors are seeking stability in dividend stocks that offer reliable income streams amidst market volatility. In such an environment, focusing on dividend stocks with yields of up to 5.4% can provide a cushion against market fluctuations while potentially enhancing portfolio returns through consistent payouts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.36% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.61% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.59% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.12% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.74% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.89% | ★★★★★★ |

Click here to see the full list of 2007 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

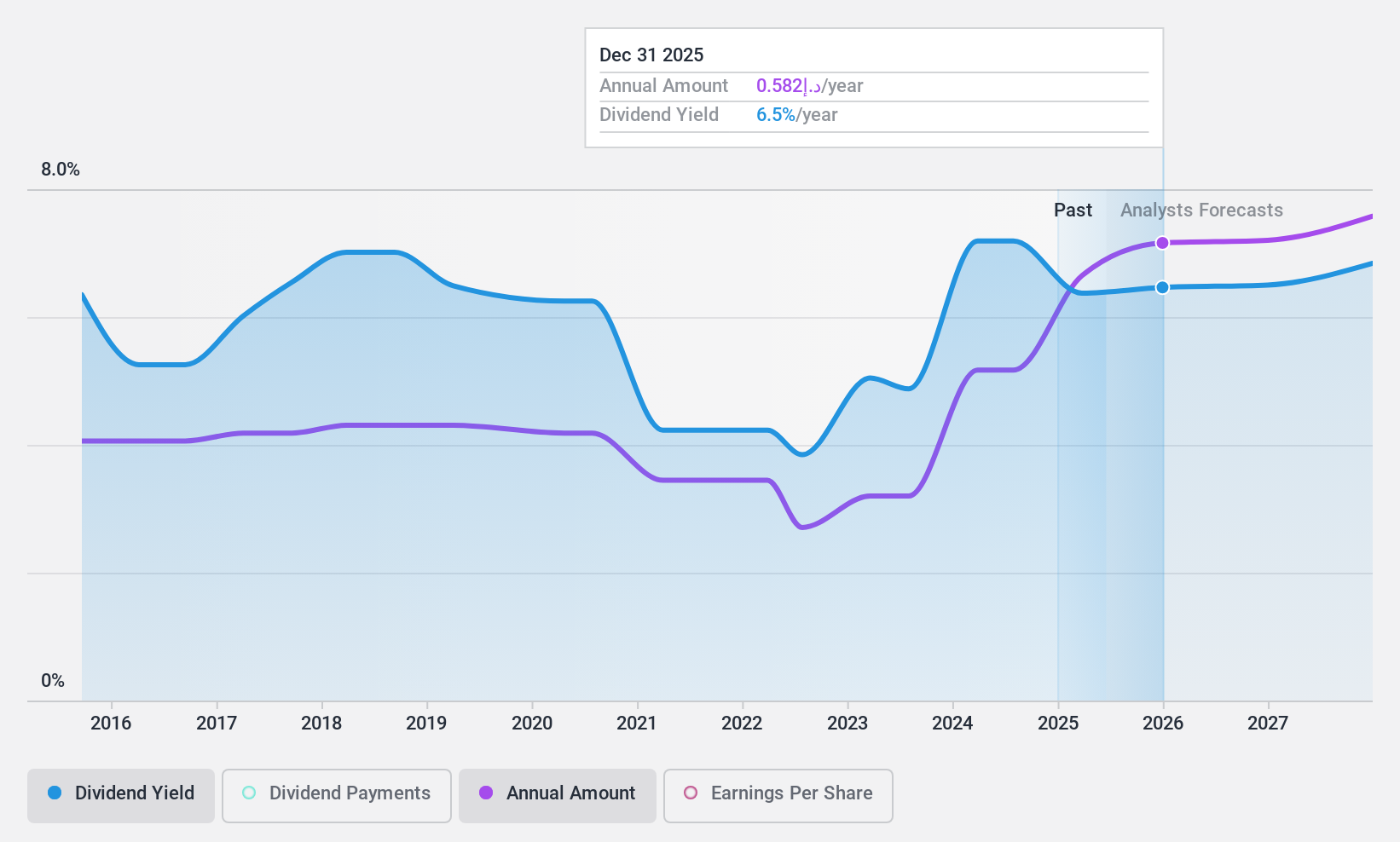

Emirates Integrated Telecommunications Company PJSC (DFM:DU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Emirates Integrated Telecommunications Company PJSC operates as a provider of carrier, data hub, internet exchange facilities, and satellite services primarily in the United Arab Emirates, with a market capitalization of AED33.91 billion.

Operations: Emirates Integrated Telecommunications Company PJSC generates revenue from its main segments: Fixed services at AED3.91 billion, Mobile services at AED7.32 billion, and Wholesale operations at AED1.83 billion.

Dividend Yield: 5.5%

Emirates Integrated Telecommunications Company PJSC has shown strong earnings growth, with a 47.6% increase in the past year, supporting its dividend payments. While the dividend is covered by both earnings and cash flows with payout ratios of 80.8% and 69.6% respectively, it remains relatively low compared to top market payers and has been historically volatile over the past decade. Recent strategic alliances and technological advancements may enhance operational efficiency and support future dividend sustainability.

- Unlock comprehensive insights into our analysis of Emirates Integrated Telecommunications Company PJSC stock in this dividend report.

- Our valuation report here indicates Emirates Integrated Telecommunications Company PJSC may be undervalued.

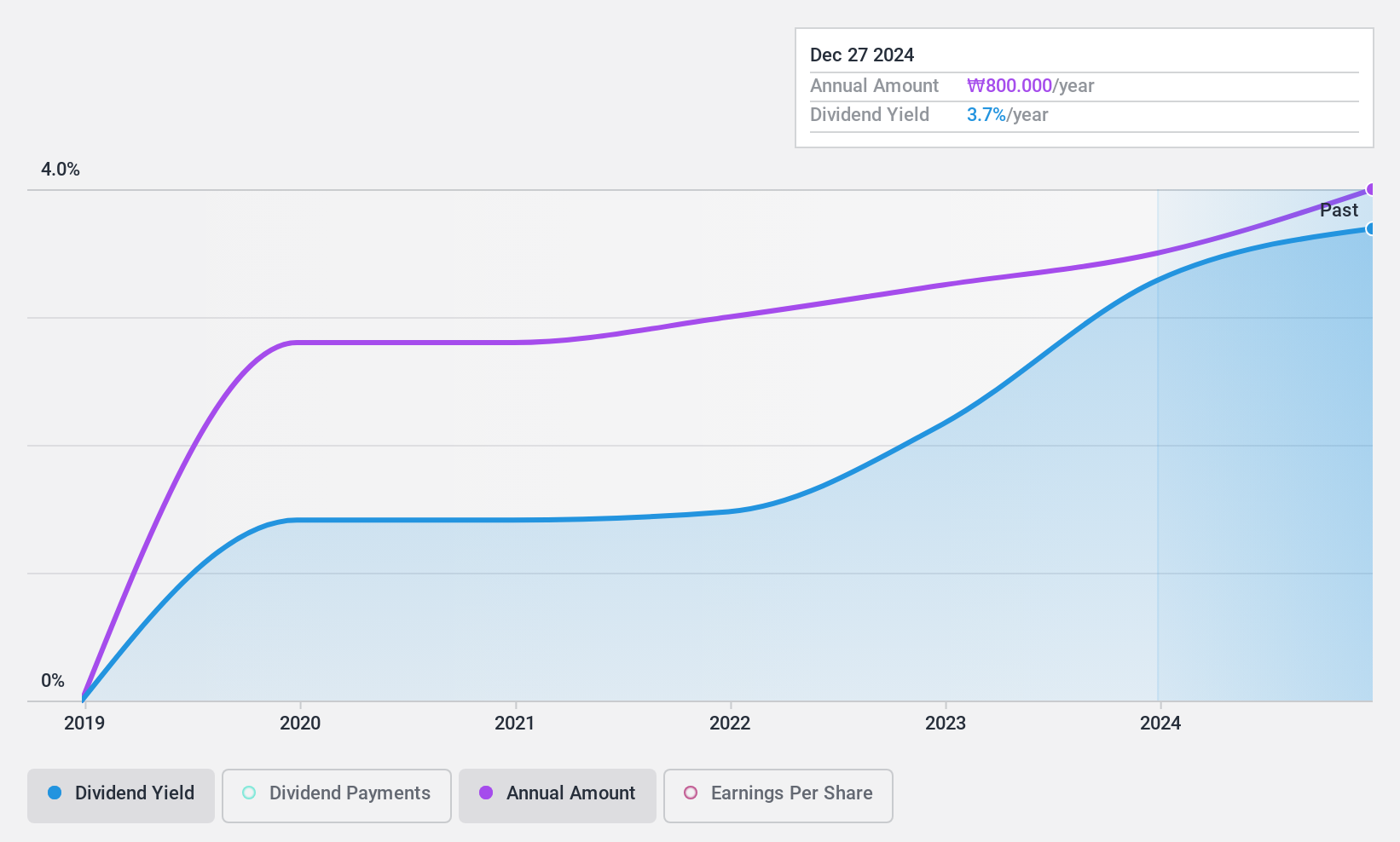

CUCKOO Homesys (KOSE:A284740)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CUCKOO Homesys Co., Ltd. is involved in the manufacture, sale, and rental of household appliances with a market cap of ₩449.57 billion.

Operations: CUCKOO Homesys Co., Ltd.'s revenue segments include ₩1.09 trillion from rentals and ₩55.88 million from IT services, with a negative contribution of ₩88.31 million from coordination activities.

Dividend Yield: 4%

CUCKOO Homesys' dividends are well-supported by earnings and cash flows, with low payout ratios of 14% and 33.3%, respectively. Earnings have surged by 59%, enhancing dividend reliability despite the company's brief five-year dividend history. Recent Q3 results show significant profit growth, with net income rising to KRW 20.91 billion from KRW 12.22 billion year-on-year, supporting its position as a top-tier dividend payer in the Korean market at a competitive yield of 3.99%.

- Click here and access our complete dividend analysis report to understand the dynamics of CUCKOO Homesys.

- According our valuation report, there's an indication that CUCKOO Homesys' share price might be on the cheaper side.

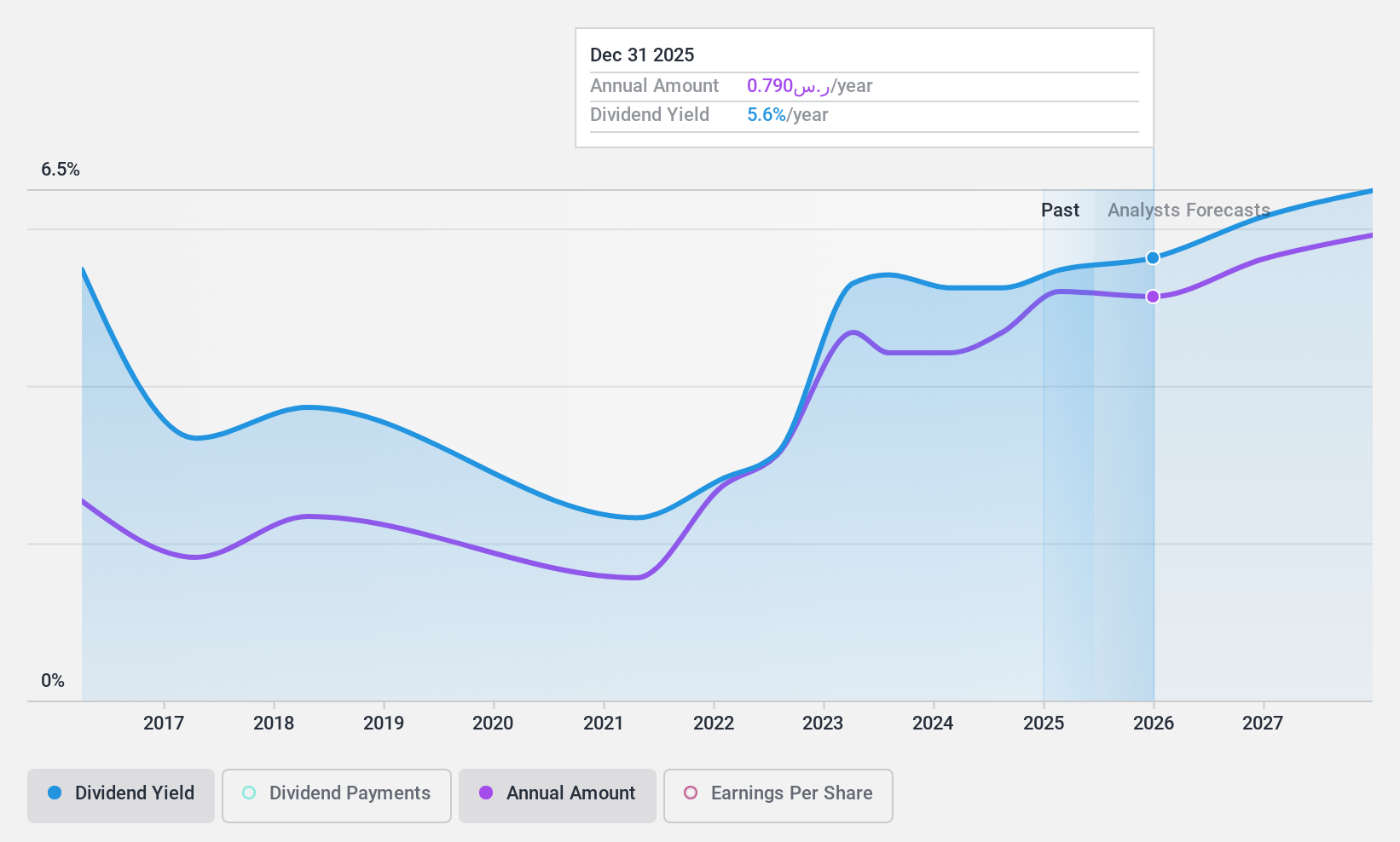

Saudi Investment Bank (SASE:1030)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Saudi Investment Bank offers commercial and retail banking services to individuals, small to medium-sized businesses, and corporate and institutional customers in the Kingdom of Saudi Arabia, with a market cap of SAR17.78 billion.

Operations: The Saudi Investment Bank's revenue is primarily derived from its Corporate Banking segment at SAR1.34 billion, followed by Treasury and Investments at SAR1.27 billion, Retail Banking at SAR1.23 billion, and Asset Management and Brokerage contributing SAR217.32 million.

Dividend Yield: 5.1%

Saudi Investment Bank's dividends, though in the top 25% of the Saudi market at 5.06%, have been unreliable and volatile over the past decade. Despite this, a reasonable payout ratio of 52% indicates dividends are covered by earnings. Recent Q3 results show net income increased to SAR 517.84 million from SAR 461.64 million, supporting potential future stability. The bank's recent $750 million fixed-income offering may enhance financial flexibility for dividend sustainability efforts.

- Navigate through the intricacies of Saudi Investment Bank with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Saudi Investment Bank is priced higher than what may be justified by its financials.

Make It Happen

- Get an in-depth perspective on all 2007 Top Dividend Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:1030

Saudi Investment Bank

Provides commercial and retail banking services to individuals, small to medium-sized businesses, and corporate and institutional customers in the Kingdom of Saudi Arabia.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives