- United Arab Emirates

- /

- Specialty Stores

- /

- ADX:ADNOCDIST

Abu Dhabi National Oil Company for Distribution PJSC (ADX:ADNOCDIST) May Have Run Too Fast Too Soon With Recent 90% Price Plummet

Abu Dhabi National Oil Company for Distribution PJSC (ADX:ADNOCDIST) shareholders that were waiting for something to happen have been dealt a blow with a 90% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 90% loss during that time.

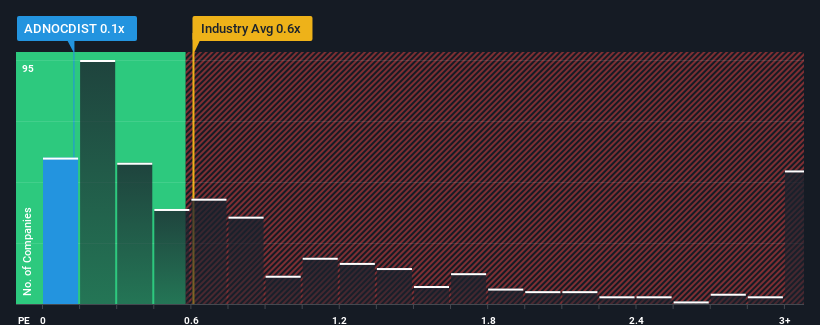

In spite of the heavy fall in price, there still wouldn't be many who think Abu Dhabi National Oil Company for Distribution PJSC's price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S in the United Arab Emirates' Specialty Retail industry is similar at about 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Abu Dhabi National Oil Company for Distribution PJSC

How Abu Dhabi National Oil Company for Distribution PJSC Has Been Performing

With revenue growth that's inferior to most other companies of late, Abu Dhabi National Oil Company for Distribution PJSC has been relatively sluggish. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Abu Dhabi National Oil Company for Distribution PJSC's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Abu Dhabi National Oil Company for Distribution PJSC's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 8.8% gain to the company's revenues. The latest three year period has also seen an excellent 92% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 4.9% per year as estimated by the nine analysts watching the company. That's shaping up to be materially lower than the 11% per year growth forecast for the broader industry.

In light of this, it's curious that Abu Dhabi National Oil Company for Distribution PJSC's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Bottom Line On Abu Dhabi National Oil Company for Distribution PJSC's P/S

Following Abu Dhabi National Oil Company for Distribution PJSC's share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

When you consider that Abu Dhabi National Oil Company for Distribution PJSC's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Abu Dhabi National Oil Company for Distribution PJSC that you need to be mindful of.

If these risks are making you reconsider your opinion on Abu Dhabi National Oil Company for Distribution PJSC, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:ADNOCDIST

Abu Dhabi National Oil Company for Distribution PJSC

Abu Dhabi National Oil Company for Distribution PJSC, together with its subsidiaries, markets petroleum products, natural gas, and ancillary products in the United Arab Emirates.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives