- United Arab Emirates

- /

- Real Estate

- /

- ADX:ANAN

Wahat Al Zaweya Holding PJSC (ADX:WAZ) Shareholders Have Enjoyed A 19% Share Price Gain

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But you can significantly boost your returns by picking above-average stocks. To wit, the Wahat Al Zaweya Holding PJSC (ADX:WAZ) share price is 19% higher than it was a year ago, much better than the market return of around 3.5% (not including dividends) in the same period. So that should have shareholders smiling. We'll need to follow Wahat Al Zaweya Holding PJSC for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

View our latest analysis for Wahat Al Zaweya Holding PJSC

Wahat Al Zaweya Holding PJSC wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Wahat Al Zaweya Holding PJSC actually shrunk its revenue over the last year, with a reduction of 100%. The stock is up 19% in that time, a fine performance given the revenue drop. To us that means that there isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

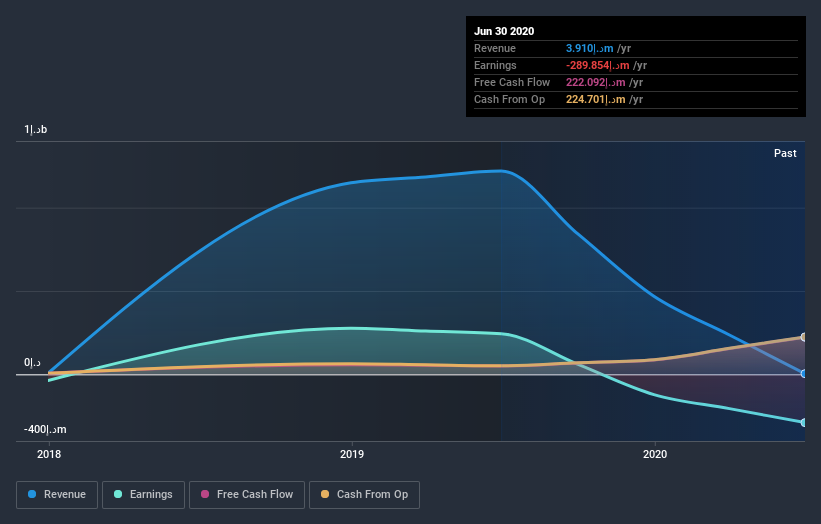

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that Wahat Al Zaweya Holding PJSC shareholders have gained 19% over the last year, including dividends. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Wahat Al Zaweya Holding PJSC (1 doesn't sit too well with us) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AE exchanges.

If you’re looking to trade Wahat Al Zaweya Holding PJSC, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wahat Al Zaweya Holding PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ADX:ANAN

Wahat Al Zaweya Holding PJSC

Engages in developing, investing, and managing real estate properties in the United Arab Emirates.

Minimal risk with weak fundamentals.

Market Insights

Community Narratives