- United Arab Emirates

- /

- Real Estate

- /

- DFM:EMAARDEV

Emaar Development PJSC (DFM:EMAARDEV) Soars 30% But It's A Story Of Risk Vs Reward

Emaar Development PJSC (DFM:EMAARDEV) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 62% in the last year.

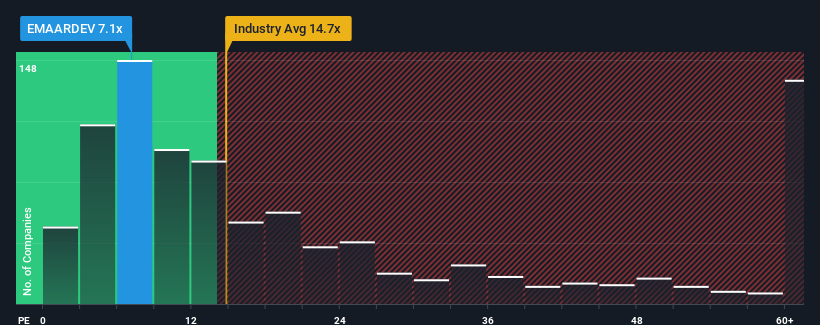

Even after such a large jump in price, Emaar Development PJSC's price-to-earnings (or "P/E") ratio of 7.1x might still make it look like a buy right now compared to the market in the United Arab Emirates, where around half of the companies have P/E ratios above 13x and even P/E's above 21x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's superior to most other companies of late, Emaar Development PJSC has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Emaar Development PJSC

What Are Growth Metrics Telling Us About The Low P/E?

Emaar Development PJSC's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 15% last year. Pleasingly, EPS has also lifted 135% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 22% per annum over the next three years. With the market only predicted to deliver 7.7% each year, the company is positioned for a stronger earnings result.

With this information, we find it odd that Emaar Development PJSC is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Emaar Development PJSC's P/E?

Emaar Development PJSC's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Emaar Development PJSC's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Before you take the next step, you should know about the 1 warning sign for Emaar Development PJSC that we have uncovered.

You might be able to find a better investment than Emaar Development PJSC. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Emaar Development PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DFM:EMAARDEV

Emaar Development PJSC

Develops and sells residential and commercial build-to-sell properties in the United Arab Emirates.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026