- Israel

- /

- Food and Staples Retail

- /

- TASE:DIPL

Undiscovered Gems in the Middle East for June 2025

Reviewed by Simply Wall St

Amidst geopolitical tensions and recent declines in key Middle Eastern indices, investors are navigating a complex landscape with markets reacting strongly to regional developments. In such an environment, identifying stocks with solid fundamentals and resilience to external shocks can be crucial for uncovering potential opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Besler Gida Ve Kimya Sanayi ve Ticaret Anonim Sirketi | 40.12% | 43.54% | 38.87% | ★★★★★★ |

| Vakif Gayrimenkul Yatirim Ortakligi | 0.00% | 50.97% | 56.63% | ★★★★★★ |

| Amanat Holdings PJSC | 11.28% | 31.80% | 1.00% | ★★★★★☆ |

| Mackolik Internet Hizmetleri Ticaret | 0.14% | 25.61% | 36.34% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 6.88% | 51.77% | 67.59% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 17.80% | 49.41% | 66.89% | ★★★★★☆ |

| Segmen Kardesler Gida Üretim ve Ambalaj Sanayi Anonim Sirketi | 2.02% | -10.23% | 74.54% | ★★★★☆☆ |

| Kirac Galvaniz Telekominikasyon Metal Makine Insaat Elektrik Sanayi ve Ticaret Anonim Sirketi | 12.49% | -23.32% | 41.51% | ★★★★☆☆ |

| Dogan Burda Dergi Yayincilik Ve Pazarlama | 64.82% | 46.23% | -12.39% | ★★★★☆☆ |

| Izmir Firça Sanayi ve Ticaret Anonim Sirketi | 43.01% | 40.80% | -34.83% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

National Cement Company (Public Shareholding) (DFM:NCC)

Simply Wall St Value Rating: ★★★★★★

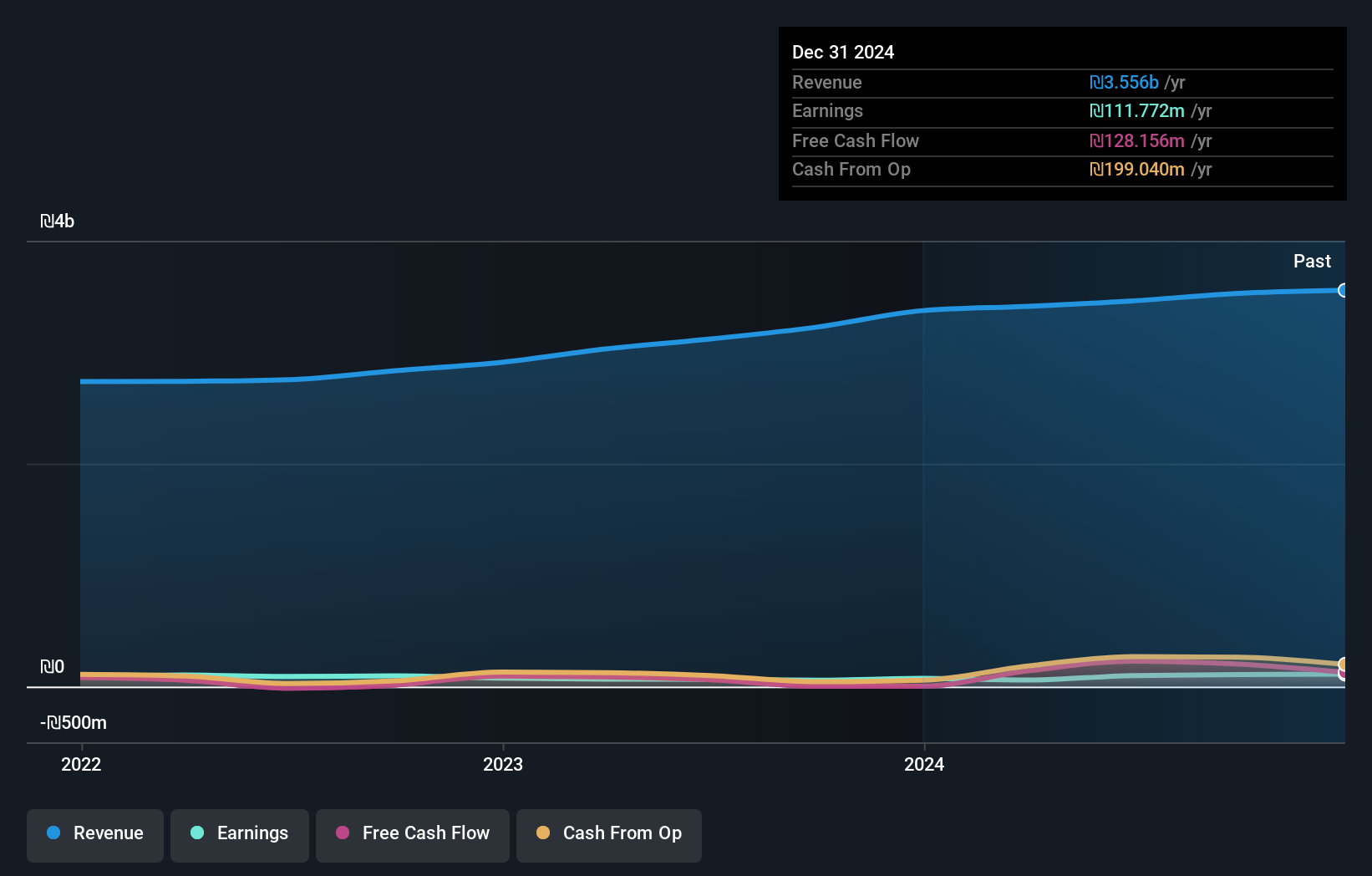

Overview: National Cement Company (Public Shareholding Co.) is involved in the production and distribution of cement and related products both within the United Arab Emirates and internationally, with a market capitalization of AED 1.29 billion.

Operations: NCC generates revenue primarily from its cement segment, which brought in AED 172.03 million. The company's financial performance can be gauged by its net profit margin, which is a key indicator of profitability trends over time.

National Cement Company, a small player in the Middle East's cement industry, shows promising financial health with no debt and high-quality earnings. Over the past year, its earnings grew by 15.3%, outpacing the Basic Materials industry's 12.7% growth rate. Despite a volatile share price recently, it trades at 70.4% below its estimated fair value, suggesting potential undervaluation. The company reported net income of AED 157.16 million for Q1 2025 compared to AED 129.5 million the previous year, reflecting strong profitability even as sales dipped slightly from AED 55.31 million to AED 51.6 million over the same period.

Mohammed Hadi Al-Rasheed (SASE:9601)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mohammed Hadi Al-Rasheed Company specializes in the production of silica sand for various industrial applications and has a market capitalization of SAR1.31 billion.

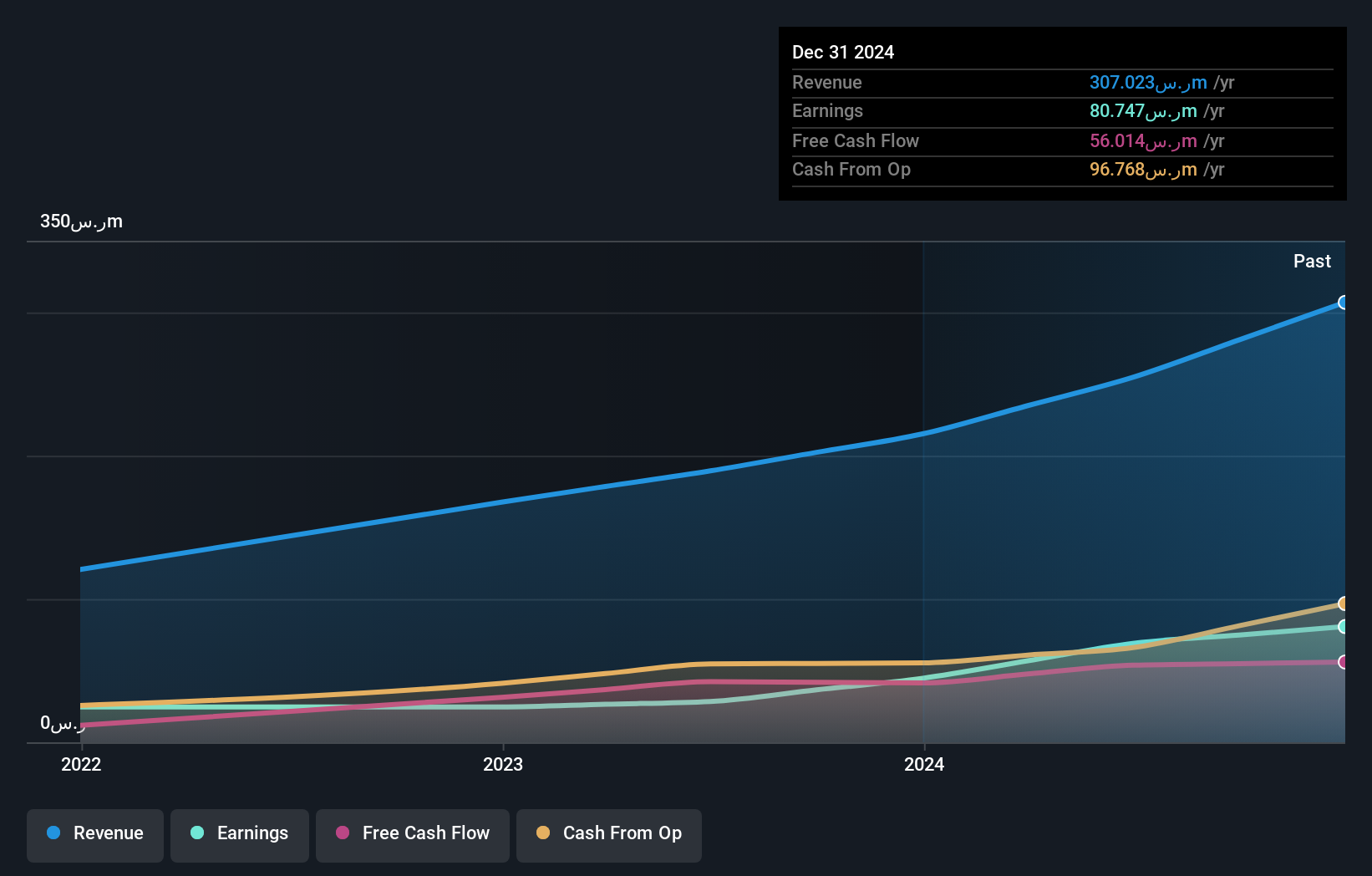

Operations: The company generates revenue primarily from sales of silica sand, amounting to SAR273.90 million, and contracting services contributing SAR33.12 million.

Mohammed Hadi Al-Rasheed, a relatively small player in the market, has demonstrated impressive financial resilience. Its recent earnings report showed net income of SAR 80.75 million, up from SAR 44.71 million the previous year, with basic earnings per share increasing to SAR 6.73 from SAR 3.73. The company's ability to cover interest payments is robust with an EBIT coverage of 92 times its interest obligations, indicating strong operational efficiency and financial health. Despite a volatile share price recently, it trades at a significant discount of about 56% below estimated fair value, suggesting potential upside for investors seeking value opportunities in the region's market landscape.

- Click to explore a detailed breakdown of our findings in Mohammed Hadi Al-Rasheed's health report.

Gain insights into Mohammed Hadi Al-Rasheed's past trends and performance with our Past report.

Diplomat Holdings (TASE:DIPL)

Simply Wall St Value Rating: ★★★★★★

Overview: Diplomat Holdings Ltd. is a sales and distribution company in the fast-moving consumer goods sector with a market cap of ₪1.13 billion.

Operations: Diplomat Holdings generates revenue primarily through its sales and distribution activities in the fast-moving consumer goods sector. The company's financial performance is characterized by a notable net profit margin trend, which reflects its ability to manage costs effectively while driving sales growth.

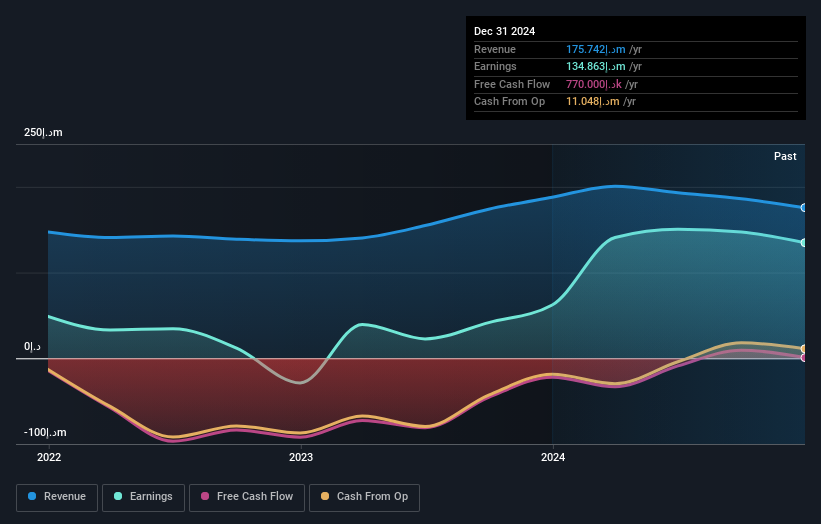

Diplomat Holdings, a nimble player in the Middle East market, showcases a robust financial stance with its debt to equity ratio dropping from 97.6% to 42.3% over five years and net debt to equity at a satisfactory 20.8%. Despite recent one-off gains of ₪34.9M impacting earnings, the company has seen impressive growth with earnings rising by 53%, outpacing industry averages. Trading at an attractive valuation—75% below fair value estimates—Diplomat's interest payments are well covered by EBIT at 7.1x coverage, indicating solid operational efficiency and potential for future profitability in the consumer retailing sector.

Summing It All Up

- Delve into our full catalog of 221 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:DIPL

Diplomat Holdings

Operates as a sales and distribution company in the fast-moving consumer goods sector.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives