Middle Eastern Market Movers: E7 Group PJSC And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

Most Gulf markets have recently experienced gains, driven by strong corporate earnings and rising oil prices. For investors interested in exploring beyond well-known stocks, penny stocks—typically representing smaller or newer companies—can present intriguing opportunities. Despite the term's somewhat outdated connotation, these stocks can still offer significant value and stability when backed by solid financials, as demonstrated by E7 Group PJSC and two other promising candidates discussed in this article.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.57 | SAR1.43B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.68 | ₪333.66M | ✅ 3 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.06 | AED2.12B | ✅ 5 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.39 | AED703.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.20 | AED333.8M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.28 | AED14.03B | ✅ 2 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.817 | AED3.47B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.837 | AED509.11M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.855 | ₪224.11M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 79 stocks from our Middle Eastern Penny Stocks screener.

We'll examine a selection from our screener results.

E7 Group PJSC (ADX:E7)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: E7 Group PJSC operates in the commercial printing, packaging, and distribution sectors in the United Arab Emirates with a market capitalization of AED2.12 billion.

Operations: The company generates revenue from its printing segment, which accounts for AED615.95 million, and distribution activities contributing AED77.67 million.

Market Cap: AED2.12B

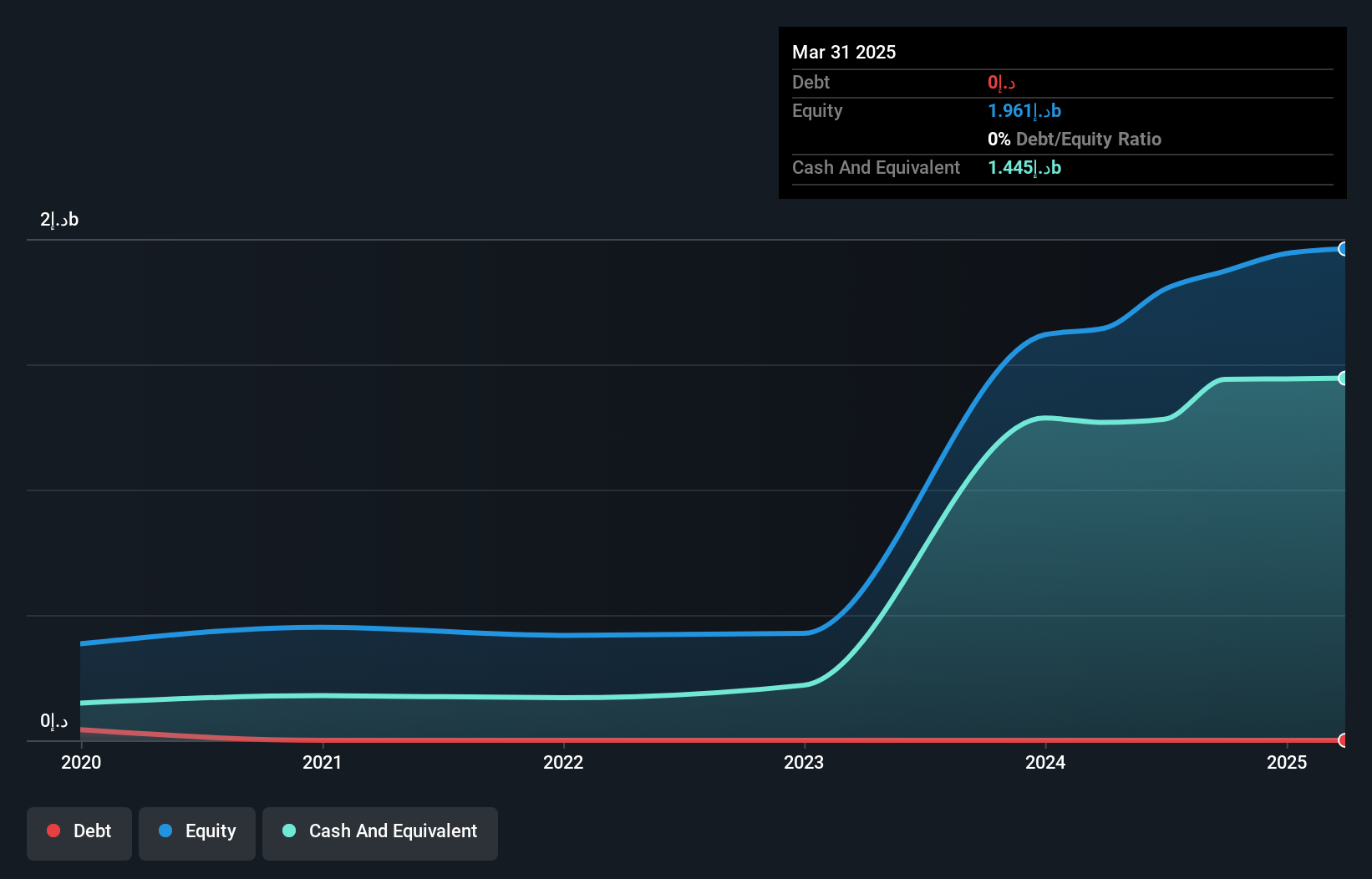

E7 Group PJSC, with a market cap of AED2.12 billion, operates in the commercial printing and packaging sectors in the UAE. Recently becoming profitable, E7's earnings have grown significantly over five years, though its return on equity remains low at 9.5%. Despite high share price volatility and non-cash earnings concerns, E7 is trading below fair value estimates by 16.9%, suggesting potential upside. The company is debt-free with strong asset coverage for liabilities. Recent strategic partnerships aim to expand its identity solutions segment globally, enhancing growth prospects through innovation and new market entry while leadership changes may impact strategic execution stability.

- Dive into the specifics of E7 Group PJSC here with our thorough balance sheet health report.

- Evaluate E7 Group PJSC's prospects by accessing our earnings growth report.

Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sharjah Cement and Industrial Development (PJSC) operates in the production and distribution of cement and related products, with a market cap of AED509.11 million.

Operations: The company's revenue primarily comes from its manufacturing segment, which generated AED706.16 million.

Market Cap: AED509.11M

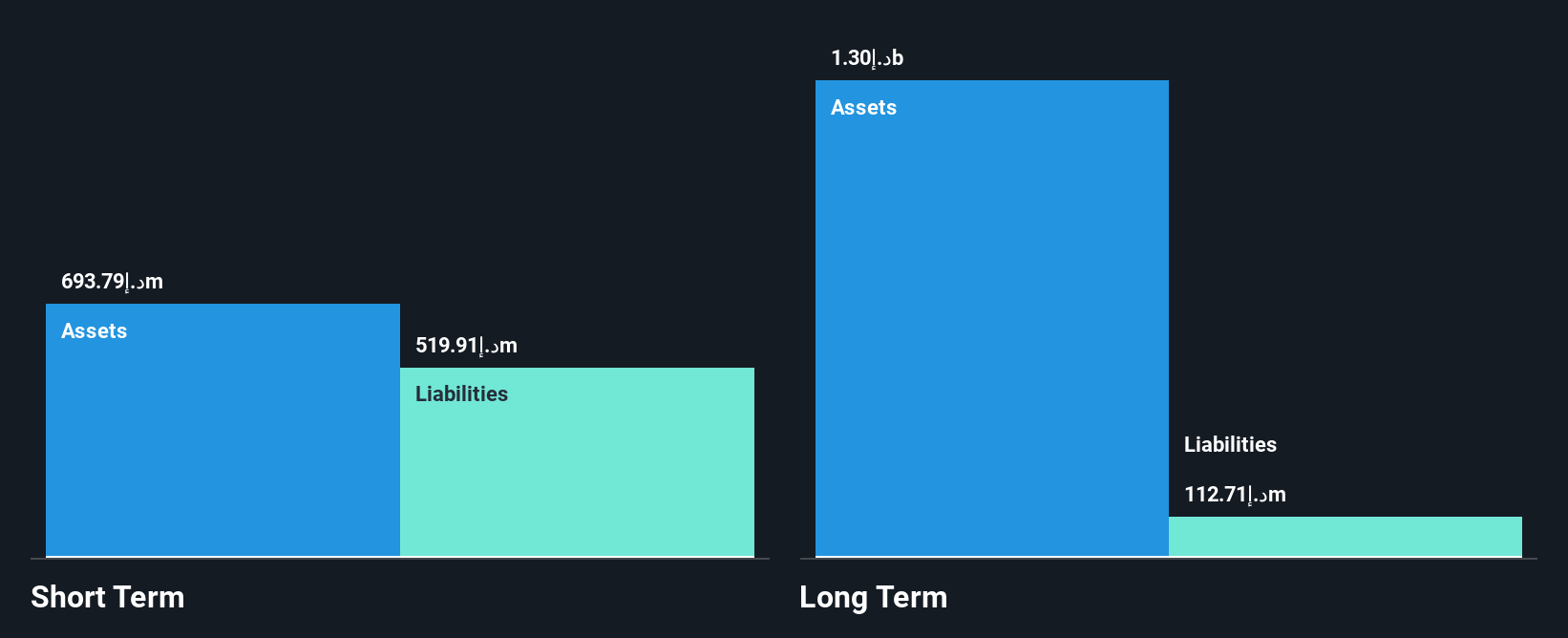

Sharjah Cement and Industrial Development (PJSC) shows a promising financial trajectory with significant earnings growth of 213.7% over the past year, outpacing industry averages. Despite its volatile share price, the company maintains a stable financial position with short-term assets covering both short and long-term liabilities. Its debt levels are satisfactory, supported by strong operating cash flow coverage. Recent earnings reports highlight improved net income and profit margins compared to last year, although return on equity remains low at 4.4%. The dividend yield of 5.97% is not well covered by free cash flows, indicating potential sustainability concerns.

- Click here to discover the nuances of Sharjah Cement and Industrial Development (PJSC) with our detailed analytical financial health report.

- Explore historical data to track Sharjah Cement and Industrial Development (PJSC)'s performance over time in our past results report.

Yesil Yapi Endüstrisi (IBSE:YYAPI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yesil Yapi Endüstrisi A.S. is a construction company operating in Turkey and internationally, with a market cap of TRY1.70 billion.

Operations: The company generates revenue of TRY29.76 million from its heavy construction segment.

Market Cap: TRY1.7B

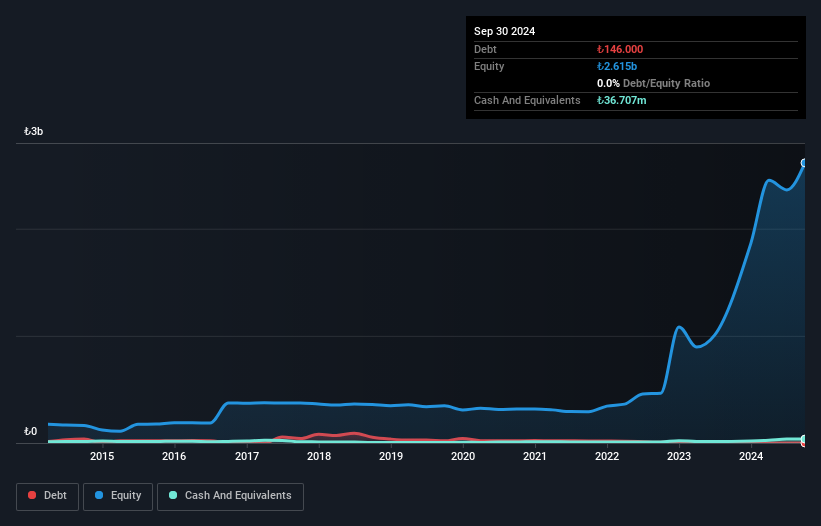

Yesil Yapi Endüstrisi A.S. demonstrates a complex financial profile with its TRY1.70 billion market cap and revenue of TRY29.76 million from heavy construction activities, though it remains pre-revenue by international standards. The company has shown impressive earnings growth of over 2,000% in the past year, significantly outpacing industry averages. It boasts a strong balance sheet with short-term assets exceeding both short and long-term liabilities and more cash than total debt, though its share price remains highly volatile. Despite low return on equity at 19.7%, the price-to-earnings ratio is attractively low at 2.2x compared to the broader market.

- Jump into the full analysis health report here for a deeper understanding of Yesil Yapi Endüstrisi.

- Learn about Yesil Yapi Endüstrisi's historical performance here.

Seize The Opportunity

- Take a closer look at our Middle Eastern Penny Stocks list of 79 companies by clicking here.

- Interested In Other Possibilities? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if E7 Group PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:E7

E7 Group PJSC

Engages in commercial printing, packaging, and distribution business in the United Arab Emirates.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives