- United Arab Emirates

- /

- Basic Materials

- /

- ADX:GCEM

Fewer Investors Than Expected Jumping On Gulf Cement Company P.S.C. (ADX:GCEM)

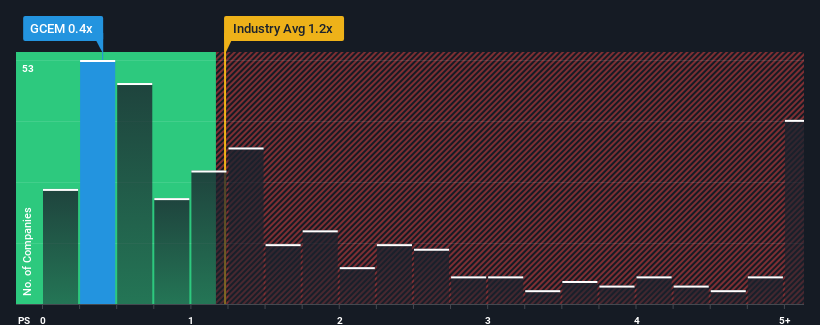

When close to half the companies operating in the Basic Materials industry in the United Arab Emirates have price-to-sales ratios (or "P/S") above 1.3x, you may consider Gulf Cement Company P.S.C. (ADX:GCEM) as an attractive investment with its 0.4x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Gulf Cement Company P.S.C

How Gulf Cement Company P.S.C Has Been Performing

Gulf Cement Company P.S.C has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. Those who are bullish on Gulf Cement Company P.S.C will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Gulf Cement Company P.S.C's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Gulf Cement Company P.S.C's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 27% gain to the company's top line. The latest three year period has also seen an excellent 42% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 2.0% shows it's a great look while it lasts.

In light of this, it's quite peculiar that Gulf Cement Company P.S.C's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

What Does Gulf Cement Company P.S.C's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Upon analysing the past data, we see it is unexpected that Gulf Cement Company P.S.C is currently trading at a lower P/S than the rest of the industry given that its revenue growth in the past three-year years is exceeding expectations in a challenging industry. We think potential risks might be placing significant pressure on the P/S ratio and share price. The most obvious risk is that its revenue trajectory may not keep outperforming under these tough industry conditions. While the chance of the share price dropping sharply is fairly remote, investors do seem to be anticipating future revenue instability.

Having said that, be aware Gulf Cement Company P.S.C is showing 2 warning signs in our investment analysis, and 1 of those is a bit concerning.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:GCEM

Gulf Cement Company P.S.C

Produces and markets various types of cement in the United Arab Emirates and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives