- United Arab Emirates

- /

- Basic Materials

- /

- ADX:BILDCO

What You Can Learn From Abu Dhabi National Company for Building Materials PJSC's (ADX:BILDCO) P/S After Its 27% Share Price Crash

The Abu Dhabi National Company for Building Materials PJSC (ADX:BILDCO) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. The good news is that in the last year, the stock has shone bright like a diamond, gaining 253%.

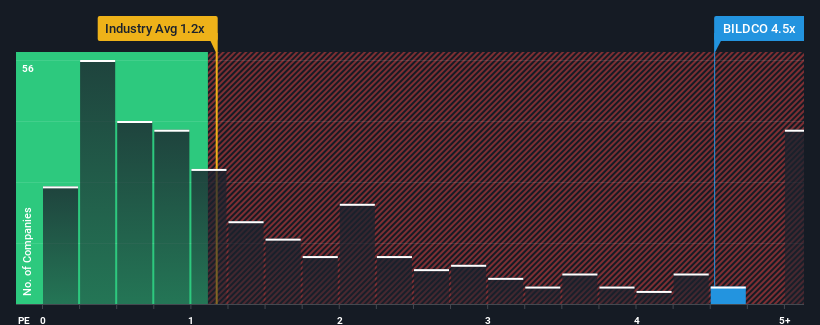

Even after such a large drop in price, you could still be forgiven for thinking Abu Dhabi National Company for Building Materials PJSC is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.5x, considering almost half the companies in the United Arab Emirates' Basic Materials industry have P/S ratios below 2.1x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Abu Dhabi National Company for Building Materials PJSC

What Does Abu Dhabi National Company for Building Materials PJSC's Recent Performance Look Like?

The revenue growth achieved at Abu Dhabi National Company for Building Materials PJSC over the last year would be more than acceptable for most companies. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Abu Dhabi National Company for Building Materials PJSC's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Abu Dhabi National Company for Building Materials PJSC's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 28% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 69% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 3.9%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we can see why Abu Dhabi National Company for Building Materials PJSC is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What We Can Learn From Abu Dhabi National Company for Building Materials PJSC's P/S?

Abu Dhabi National Company for Building Materials PJSC's shares may have suffered, but its P/S remains high. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Abu Dhabi National Company for Building Materials PJSC revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Abu Dhabi National Company for Building Materials PJSC (2 are a bit unpleasant) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:BILDCO

Abu Dhabi National Company for Building Materials PJSC

Through its subsidiaries, provides steel and cement products in the United Arab Emirates.

Mediocre balance sheet with weak fundamentals.

Market Insights

Community Narratives