- United Arab Emirates

- /

- Basic Materials

- /

- ADX:BILDCO

Abu Dhabi National Company for Building Materials PJSC (ADX:BILDCO) Soars 29% But It's A Story Of Risk Vs Reward

Abu Dhabi National Company for Building Materials PJSC (ADX:BILDCO) shares have continued their recent momentum with a 29% gain in the last month alone. The annual gain comes to 122% following the latest surge, making investors sit up and take notice.

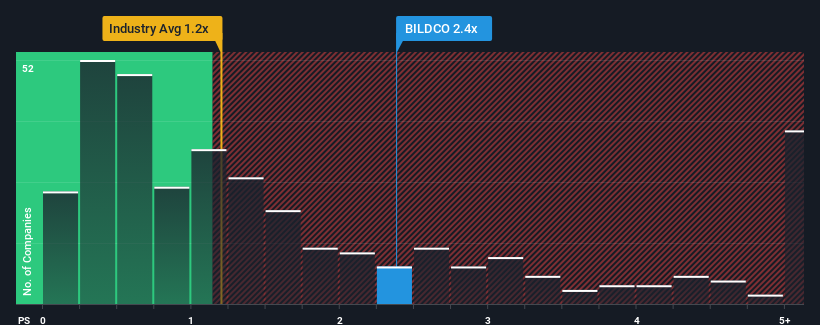

Although its price has surged higher, there still wouldn't be many who think Abu Dhabi National Company for Building Materials PJSC's price-to-sales (or "P/S") ratio of 2.4x is worth a mention when the median P/S in the United Arab Emirates' Basic Materials industry is similar at about 2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Abu Dhabi National Company for Building Materials PJSC

What Does Abu Dhabi National Company for Building Materials PJSC's P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Abu Dhabi National Company for Building Materials PJSC has been doing very well. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Abu Dhabi National Company for Building Materials PJSC will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Abu Dhabi National Company for Building Materials PJSC will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Abu Dhabi National Company for Building Materials PJSC?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Abu Dhabi National Company for Building Materials PJSC's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 66%. Revenue has also lifted 12% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 3.2% shows it's a great look while it lasts.

In light of this, it's peculiar that Abu Dhabi National Company for Building Materials PJSC's P/S sits in line with the majority of other companies. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Final Word

Its shares have lifted substantially and now Abu Dhabi National Company for Building Materials PJSC's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As mentioned previously, Abu Dhabi National Company for Building Materials PJSC currently trades on a P/S on par with the wider industry, but this is lower than expected considering its recent three-year revenue growth is beating forecasts for a struggling industry. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. The fact that the company's relative performance has not provided a kick to the share price suggests that some investors are anticipating revenue instability.

Plus, you should also learn about these 2 warning signs we've spotted with Abu Dhabi National Company for Building Materials PJSC (including 1 which can't be ignored).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:BILDCO

Abu Dhabi National Company for Building Materials PJSC

Through its subsidiaries, provides steel and cement products in the United Arab Emirates.

Mediocre balance sheet with minimal risk.

Market Insights

Community Narratives