- United Arab Emirates

- /

- Basic Materials

- /

- ADX:APEX

Middle Eastern Penny Stocks To Watch In August 2025

Reviewed by Simply Wall St

As the Middle Eastern markets navigate mixed performances, with UAE bourses showing varied results ahead of a significant speech by Federal Reserve Chair Jerome Powell, investors are keenly observing potential opportunities. Penny stocks, while an old term, continue to offer intriguing prospects for those interested in smaller or emerging companies. These stocks can provide growth potential at lower price points, especially when backed by robust financial health and solid fundamentals.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Maharah for Human Resources (SASE:1831) | SAR4.79 | SAR2.18B | ✅ 2 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.70 | SAR1.49B | ✅ 2 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.54 | AED3.08B | ✅ 2 ⚠️ 3 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY3.12 | TRY3.36B | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.74 | AED776.25M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.97 | AED392.7M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.88 | AED12.2B | ✅ 3 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.845 | AED3.62B | ✅ 1 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.92 | AED553.51M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.98 | ₪221.47M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 80 stocks from our Middle Eastern Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Apex Investment PSC (ADX:APEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Apex Investment PSC engages in the manufacturing, distribution, and sale of clinkers and cement products both in the United Arab Emirates and internationally, with a market cap of AED15.88 billion.

Operations: Apex Investment PSC generates revenue primarily from its Catering segment with AED589.52 million, followed by Manufacturing at AED226.07 million, and Facility Management Services contributing AED107.27 million.

Market Cap: AED15.88B

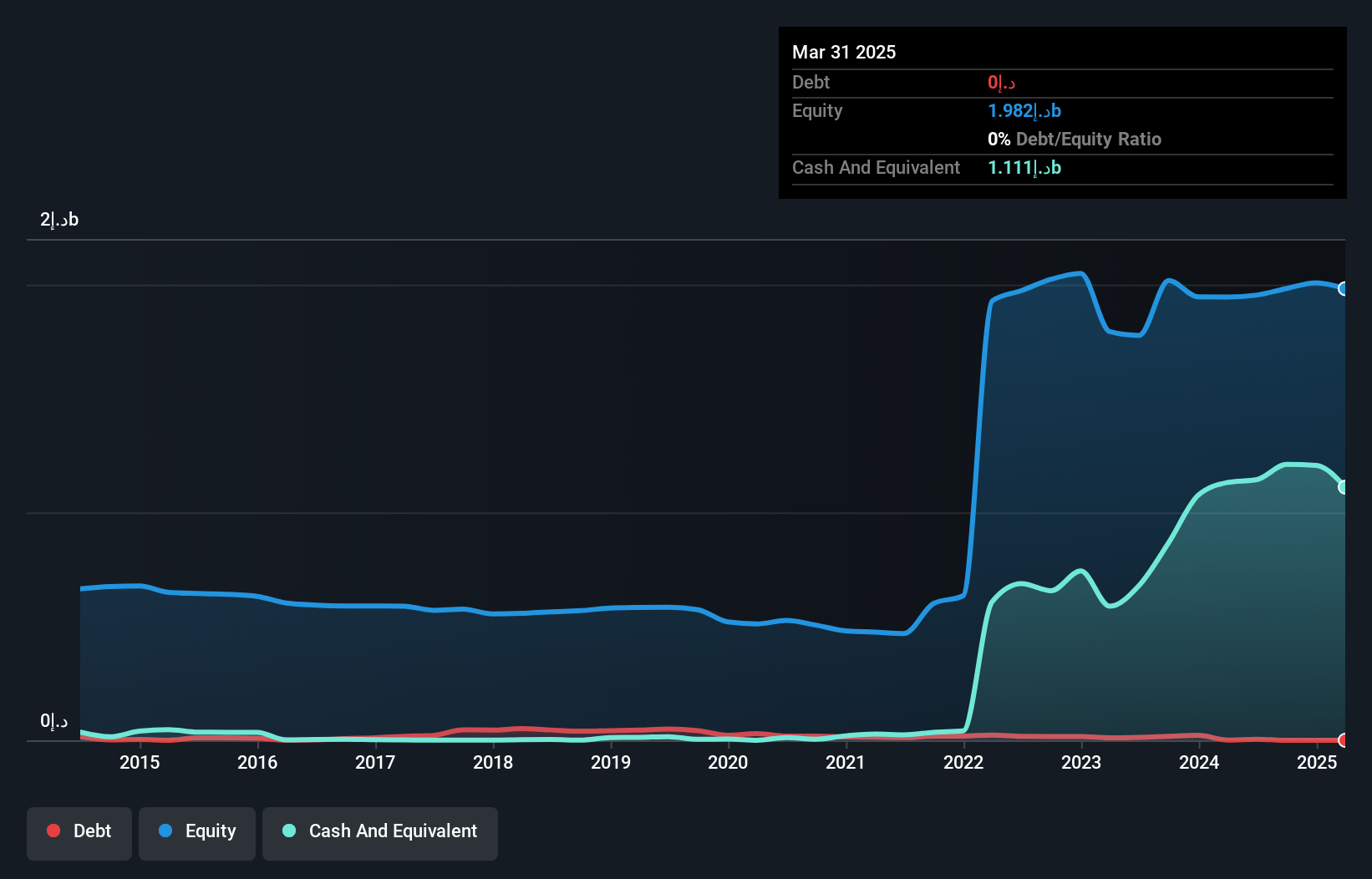

Apex Investment PSC, with a market cap of AED15.88 billion, operates in the manufacturing and distribution of cement products. Despite being debt-free and having strong short-term asset coverage over liabilities, the company faces challenges such as declining profit margins and negative earnings growth over the past year. Recent financial results show a decrease in sales but a significant increase in net income due to one-off gains impacting earnings quality. While Apex has achieved profitability over five years with stable volatility, its low return on equity and reliance on non-recurring income highlight potential risks for investors considering penny stocks in this region.

- Click to explore a detailed breakdown of our findings in Apex Investment PSC's financial health report.

- Learn about Apex Investment PSC's historical performance here.

Al Seer Marine Supplies and Equipment Company PJSC (ADX:ASM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Al Seer Marine Supplies and Equipment Company PJSC operates in the management, maintenance, crewing, and operation of yachts in the United Arab Emirates with a market cap of AED3.78 billion.

Operations: The company's revenue is primarily derived from its yachting segment, which accounts for AED930.12 million, followed by commercial shipping at AED384.50 million and IDT at AED83.99 million.

Market Cap: AED3.78B

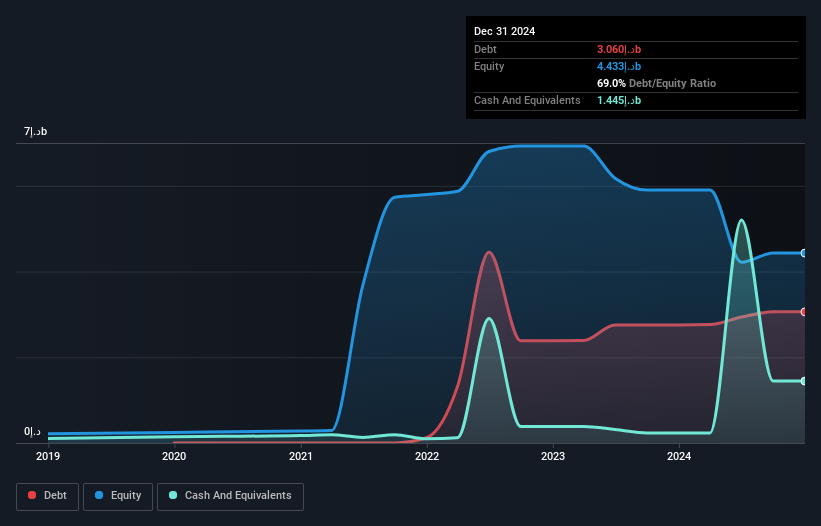

Al Seer Marine Supplies and Equipment Company PJSC, with a market cap of AED3.78 billion, operates in the yachting and commercial shipping sectors. Despite being unprofitable with increasing losses over five years, the company has secured significant financing facilities from Abu Dhabi Commercial Bank to support its asset-backed growth strategy. Recent earnings show improved sales at AED697.52 million for six months ending June 2025, though net losses persist at AED295.6 million. The strategic joint venture ASBI Shipping FZCO aims to strengthen LPG logistics through long-term charters and secured financing, reflecting confidence in its commercial viability amidst market volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of Al Seer Marine Supplies and Equipment Company PJSC.

- Gain insights into Al Seer Marine Supplies and Equipment Company PJSC's historical outcomes by reviewing our past performance report.

Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi (IBSE:ARSAN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi, along with its subsidiaries, produces and sells cotton and synthetic yarn both in Turkey and internationally, with a market cap of TRY5.14 billion.

Operations: The company generates revenue of TRY109.02 million from its operations in Turkey.

Market Cap: TRY5.14B

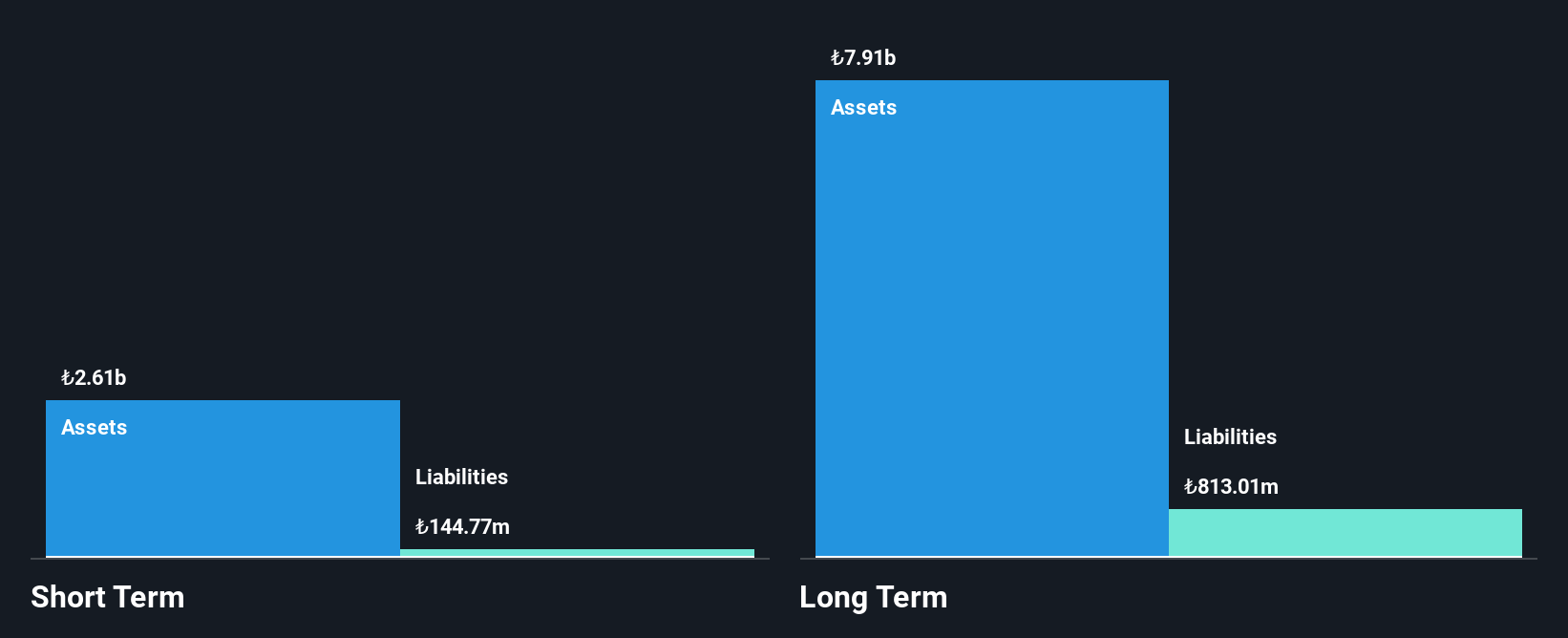

Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi, with a market cap of TRY5.14 billion, demonstrates robust financial health in the penny stock arena. The company has achieved earnings growth of 15.1% over the past year, surpassing industry averages despite being below its five-year average growth rate of 49% annually. Its short-term assets significantly exceed both short-term and long-term liabilities, indicating strong liquidity. Furthermore, Arsan's debt is well covered by operating cash flow and has reduced substantially over time to a low debt-to-equity ratio of 0.5%. However, its return on equity remains relatively low at 9.7%.

- Take a closer look at Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi's potential here in our financial health report.

- Examine Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi's past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Unlock more gems! Our Middle Eastern Penny Stocks screener has unearthed 77 more companies for you to explore.Click here to unveil our expertly curated list of 80 Middle Eastern Penny Stocks.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:APEX

Apex Investment PSC

Manufactures, distributes, and sells clinkers and cement products in the United Arab Emirates and internationally.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion