- Israel

- /

- Diversified Financial

- /

- TASE:PEN

3 Middle Eastern Dividend Stocks With Up To 8.6% Yield

Reviewed by Simply Wall St

Amid concerns over a potential U.S. economic slowdown, most Gulf markets have seen declines, reflecting investor caution across the region. In such uncertain times, dividend stocks can offer a stable income stream and act as a buffer against market volatility, making them an attractive option for investors seeking reliable returns in the Middle East.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Peninsula Group (TASE:PEN) | 6.59% | ★★★★★★ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.72% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.05% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 9.01% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.41% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.77% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 5.71% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.85% | ★★★★★☆ |

| Nuh Çimento Sanayi (IBSE:NUHCM) | 3.10% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 6.34% | ★★★★★☆ |

Click here to see the full list of 63 stocks from our Top Middle Eastern Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

National General Insurance (P.J.S.C.) (DFM:NGI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: National General Insurance Co. (P.J.S.C.) operates in the United Arab Emirates, providing a range of life and general insurance as well as reinsurance products, with a market capitalization of AED857.74 million.

Operations: National General Insurance Co. (P.J.S.C.) generates revenue through its insurance segment, which accounts for AED857.38 million, and its investments segment, contributing AED120.97 million.

Dividend Yield: 8.7%

National General Insurance (P.J.S.C.) offers a compelling dividend yield of 8.65%, placing it in the top 25% of payers in the AE market. However, its dividends are not well covered by cash flows, with a high cash payout ratio of 277.4%. Despite recent earnings growth to AED 127.5 million, dividend reliability remains an issue due to historical volatility and illiquidity in shares. The P/E ratio is favorable at 6.7x against the market's 13x.

- Delve into the full analysis dividend report here for a deeper understanding of National General Insurance (P.J.S.C.).

- The analysis detailed in our National General Insurance (P.J.S.C.) valuation report hints at an inflated share price compared to its estimated value.

Ulusoy Un Sanayi ve Ticaret (IBSE:ULUUN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ulusoy Un Sanayi ve Ticaret A.S. is a Turkish company that specializes in the production and sale of wheat flour, with a market capitalization of TRY4.55 billion.

Operations: Ulusoy Un Sanayi ve Ticaret A.S. generates its revenue primarily from the production and sale of wheat flour in Turkey.

Dividend Yield: 4.6%

Ulusoy Un Sanayi ve Ticaret offers a dividend yield of 4.6%, ranking in the top 25% within the Turkish market. With a payout ratio of 40.4% and a cash payout ratio of just 8.9%, dividends are well covered by both earnings and cash flows, though they have been unreliable over two years with no growth in payments. Despite trading at a significant discount to estimated fair value, recent earnings showed reduced sales and net loss improvements from TRY 937.27 million to TRY 161.08 million year-over-year.

- Click to explore a detailed breakdown of our findings in Ulusoy Un Sanayi ve Ticaret's dividend report.

- Upon reviewing our latest valuation report, Ulusoy Un Sanayi ve Ticaret's share price might be too pessimistic.

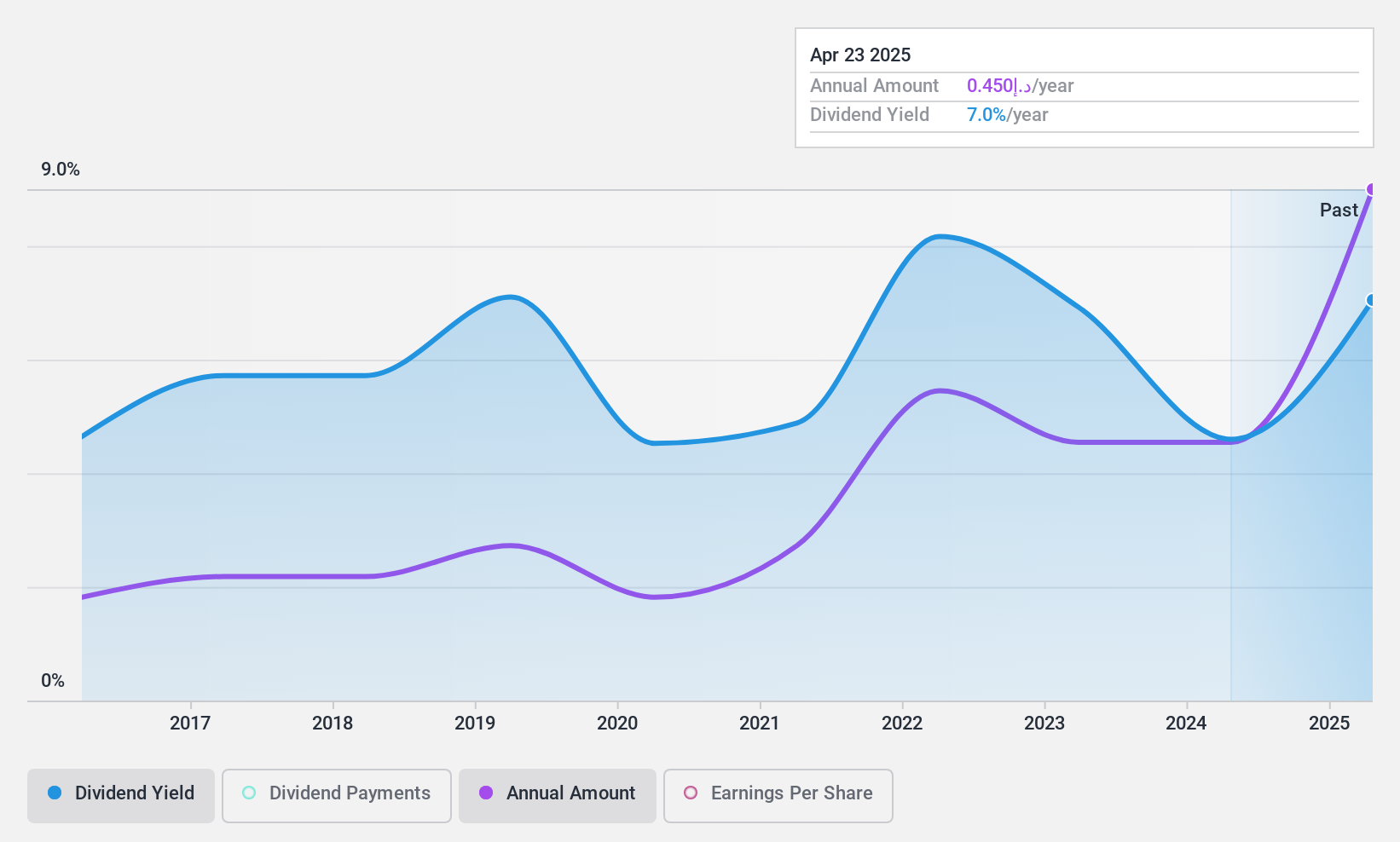

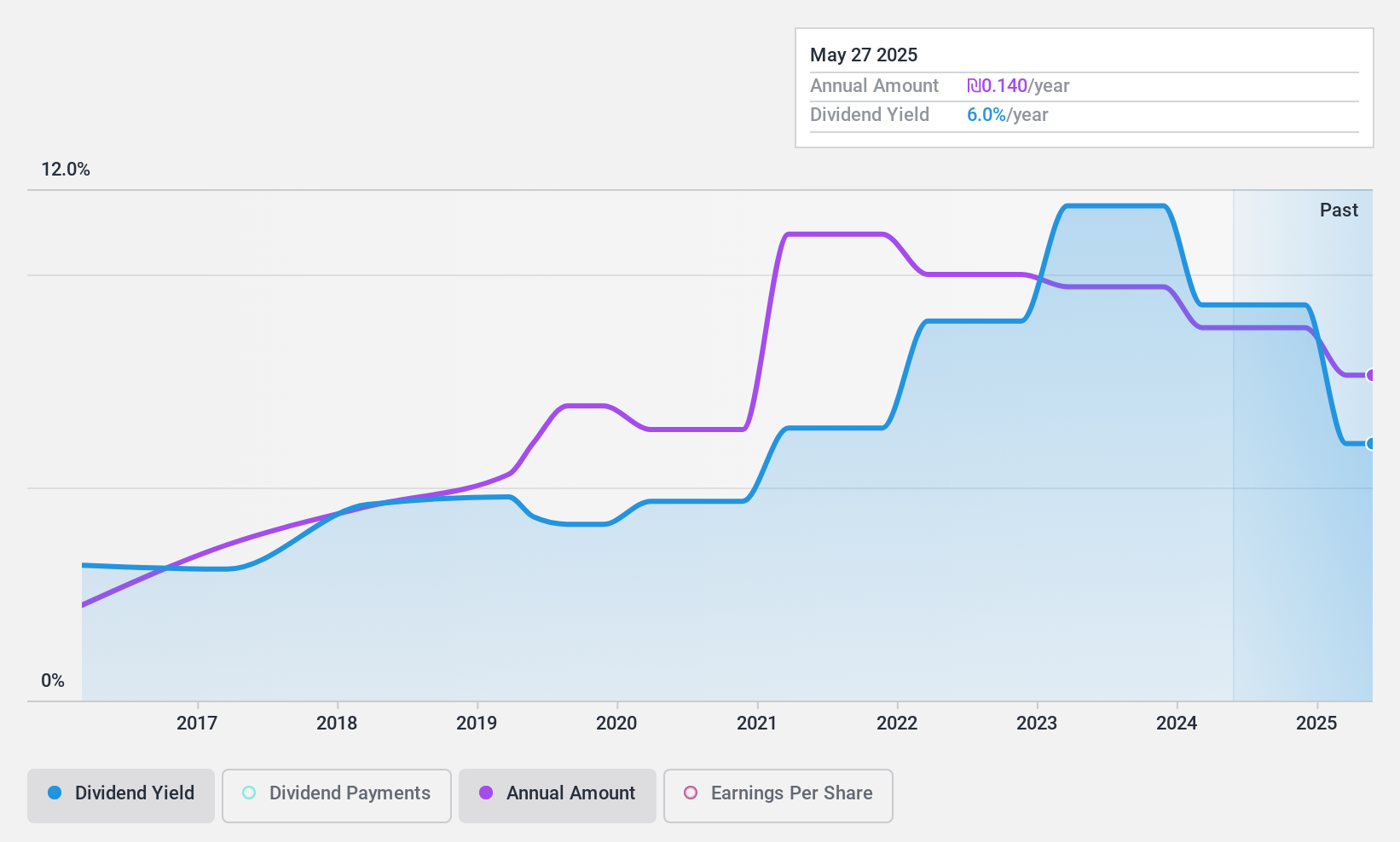

Peninsula Group (TASE:PEN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Peninsula Group Ltd, with a market cap of ₪541.57 million, provides credit solutions in Israel.

Operations: Peninsula Group Ltd's revenue from Financial Services - Commercial amounts to ₪99.59 million.

Dividend Yield: 6.6%

Peninsula Group offers a competitive dividend yield of 6.59%, placing it in the top 25% of IL market payers. Its dividends are well-supported by earnings and cash flows, with payout ratios of 61.2% and 22.5%, respectively, despite high debt levels. Over the past decade, dividends have been stable and growing, indicating reliability for investors seeking consistent income streams. The company is trading slightly below its estimated fair value as it prepares to release fiscal year 2024 results today.

- Click here to discover the nuances of Peninsula Group with our detailed analytical dividend report.

- Our expertly prepared valuation report Peninsula Group implies its share price may be too high.

Next Steps

- Dive into all 63 of the Top Middle Eastern Dividend Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:PEN

Established dividend payer with proven track record.

Market Insights

Community Narratives