- United Arab Emirates

- /

- Software

- /

- ADX:PHX

Middle Eastern Penny Stocks To Watch In September 2025

Reviewed by Simply Wall St

Most Gulf markets have shown resilience, buoyed by steady oil prices and expectations of a U.S. Federal Reserve rate cut, which has bolstered investor confidence across the region. For investors exploring beyond established giants, penny stocks—typically smaller or newer companies—continue to hold intrigue due to their potential for growth and affordability. Despite the term's vintage feel, these stocks can offer surprising value when backed by solid financial foundations; this article will explore several such opportunities in the Middle East market.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Maharah for Human Resources (SASE:1831) | SAR4.52 | SAR2.03B | ✅ 2 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.55 | SAR1.42B | ✅ 2 ⚠️ 1 View Analysis > |

| Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi (IBSE:MEGAP) | TRY4.84 | TRY1.33B | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.06 | AED2.12B | ✅ 5 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.30 | AED683.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.45 | AED398.48M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.00 | AED12.76B | ✅ 2 ⚠️ 3 View Analysis > |

| Al Dhafra Insurance Company P.S.C (ADX:DHAFRA) | AED4.86 | AED486M | ✅ 1 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.822 | AED502.42M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.555 | ₪189.94M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 80 stocks from our Middle Eastern Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Insurance House P.S.C (ADX:IH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Insurance House P.S.C. offers a range of non-life insurance solutions in the United Arab Emirates and has a market capitalization of AED64.34 million.

Operations: The company's revenue is derived from two main segments: Investment, generating AED1.46 million, and Underwriting, contributing AED341.89 million.

Market Cap: AED64.34M

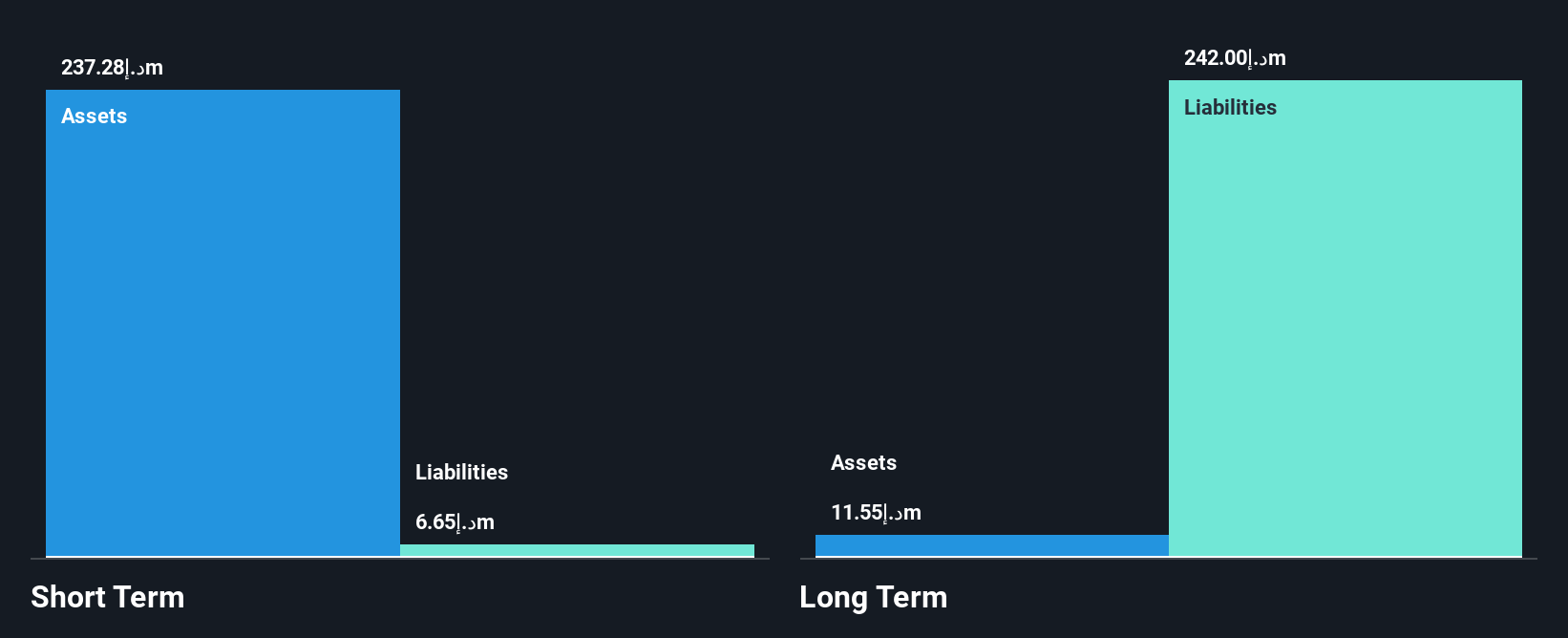

Insurance House P.S.C. has shown improvement in its financial performance, reporting a net income of AED 2.02 million for Q2 2025, compared to a net loss of AED 3 million in the same period last year. Despite being unprofitable overall with negative return on equity and high volatility, it remains debt-free and has sufficient short-term assets to cover liabilities. The company also boasts an experienced board with an average tenure of eight years and maintains a cash runway exceeding three years due to positive free cash flow. However, long-term liabilities slightly exceed short-term assets by AED 4.7 million.

- Unlock comprehensive insights into our analysis of Insurance House P.S.C stock in this financial health report.

- Assess Insurance House P.S.C's previous results with our detailed historical performance reports.

Phoenix Group (ADX:PHX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Phoenix Group Plc, along with its subsidiaries, offers crypto and cloud mining services across the United Arab Emirates, Oman, CIS, Canada, the United States, and other international markets with a market cap of AED8.83 billion.

Operations: The company generates revenue from its data processing segment, totaling $145.94 million.

Market Cap: AED8.83B

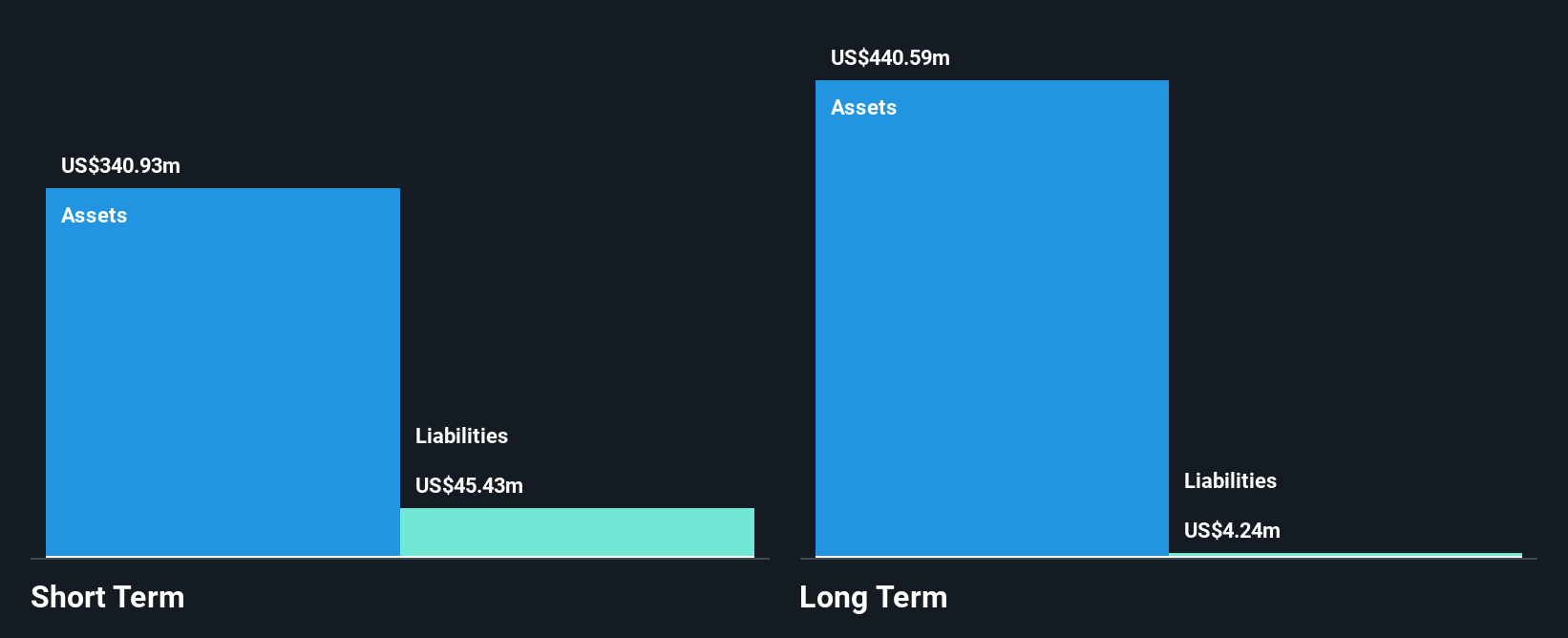

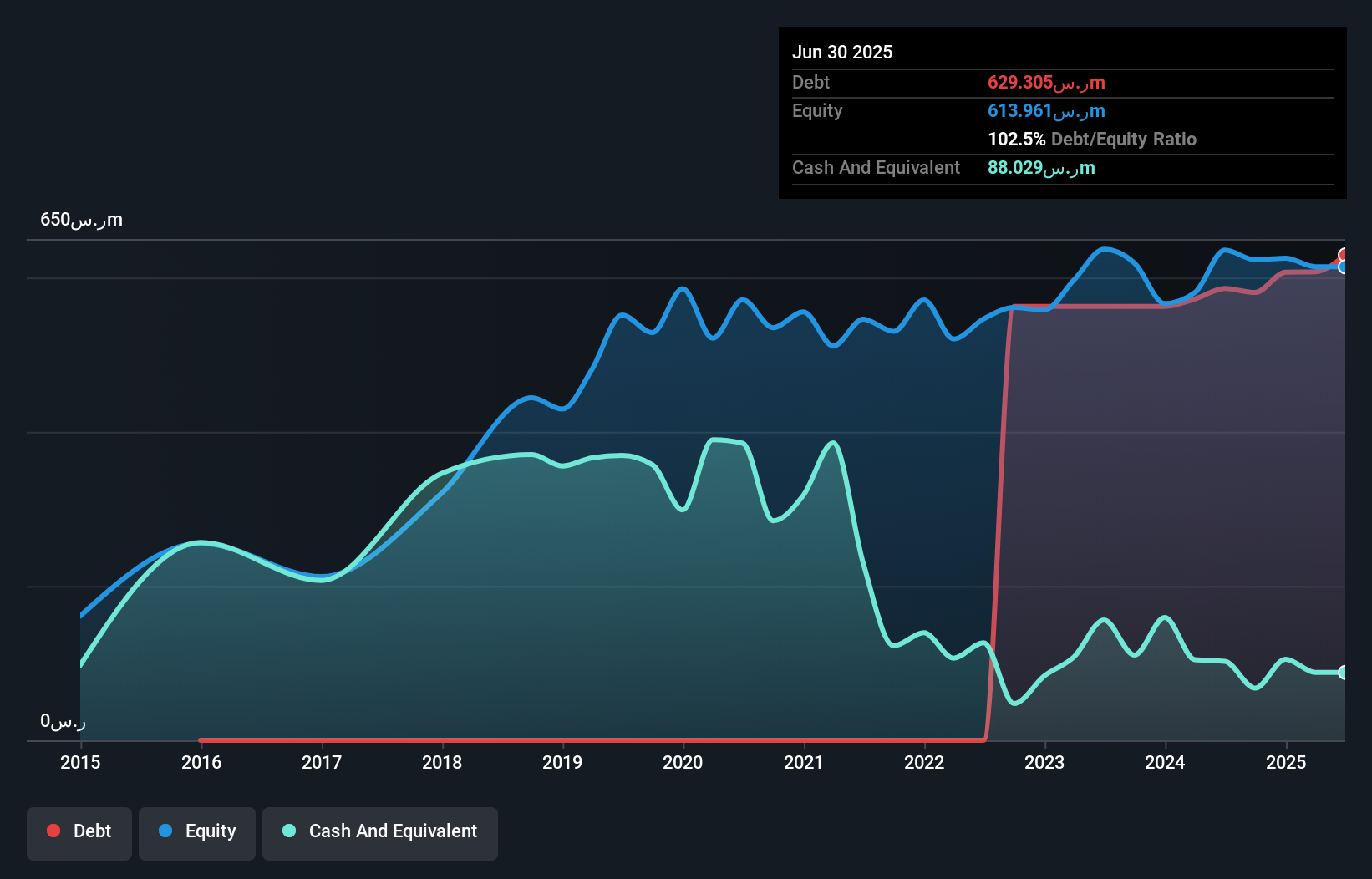

Phoenix Group Plc, despite generating US$61.92 million in revenue for the first half of 2025, remains unprofitable with a significant net loss of US$182.77 million. The company faces high share price volatility and declining sales compared to the previous year. However, its financial structure is relatively stable; short-term assets of $340.9M comfortably cover both short-term and long-term liabilities, while operating cash flow adequately covers debt obligations at 152%. The management team is experienced with an average tenure of 2.7 years, but the board's experience level remains unclear due to insufficient data.

- Click to explore a detailed breakdown of our findings in Phoenix Group's financial health report.

- Explore Phoenix Group's analyst forecasts in our growth report.

Maharah for Human Resources (SASE:1831)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Maharah for Human Resources Company offers manpower services to both public and private sectors in Saudi Arabia and the United Arab Emirates, with a market cap of SAR2.03 billion.

Operations: Revenue Segments: No Revenue Segments Reported.

Market Cap: SAR2.03B

Maharah for Human Resources, with a market cap of SAR2.03 billion, is navigating challenges and opportunities in the Middle East penny stock landscape. The company has a high debt level with a net debt to equity ratio of 88.2%, though its interest payments are well covered by EBIT at 4.6 times coverage. Short-term assets exceed both short and long-term liabilities, indicating financial stability despite declining earnings growth over the past year. Recent dividend affirmations highlight Maharah's commitment to shareholder returns, distributing SAR31.5 million as interim cash dividends for the first half of 2025, aligning with its distribution policy.

- Click here and access our complete financial health analysis report to understand the dynamics of Maharah for Human Resources.

- Gain insights into Maharah for Human Resources' future direction by reviewing our growth report.

Seize The Opportunity

- Gain an insight into the universe of 80 Middle Eastern Penny Stocks by clicking here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:PHX

Phoenix Group

Provides crypto and cloud mining services in the United Arab Emirates, Oman, CIS, Canada, the United States, and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives