- Saudi Arabia

- /

- Construction

- /

- SASE:2320

Middle Eastern Dividend Stocks To Consider In November 2025

Reviewed by Simply Wall St

As Middle Eastern markets navigate the impact of global monetary policy shifts, particularly from the U.S. Federal Reserve, regional indices like those in Dubai and Abu Dhabi have seen consecutive declines. In this context, dividend stocks can offer a measure of stability and income potential for investors seeking to balance market volatility with reliable returns.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.36% | ★★★★★☆ |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 3.40% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.35% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.75% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.53% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.42% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.25% | ★★★★★☆ |

| Computer Direct Group (TASE:CMDR) | 7.74% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.80% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.01% | ★★★★★☆ |

Click here to see the full list of 64 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Emirates Insurance Company P.J.S.C (ADX:EIC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Emirates Insurance Company P.J.S.C. operates in the general insurance and reinsurance sectors across the United Arab Emirates, the United States, and Europe, with a market cap of AED1.10 billion.

Operations: Emirates Insurance Company P.J.S.C. generates revenue through its operations in general insurance and reinsurance across various regions including the UAE, the US, and Europe.

Dividend Yield: 6.8%

Emirates Insurance Company P.J.S.C. offers a high dividend yield of 6.85%, placing it in the top 25% of dividend payers in the UAE market. Despite past volatility, dividends are currently well-covered by earnings and cash flows, with payout ratios at 54.7% and 45.6%, respectively. Recent earnings growth supports sustainability, as net income rose to AED 39.3 million for Q3 2025 from AED 29.24 million a year ago, indicating potential stability for future payouts.

- Get an in-depth perspective on Emirates Insurance Company P.J.S.C's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Emirates Insurance Company P.J.S.C is trading beyond its estimated value.

Fourth Milling (SASE:2286)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fourth Milling Company operates in the Kingdom of Saudi Arabia, producing flour, feed, bran, and wheat derivatives with a market cap of SAR20.30 billion.

Operations: Fourth Milling Company's revenue is derived from its Food Processing segment, which generated SAR646.51 million.

Dividend Yield: 5.9%

Fourth Milling's dividends are well-covered by earnings and cash flows, with payout ratios of 65.6% and 72.7%, respectively. The dividend yield of 5.85% ranks in the top quartile of Saudi Arabian payers. Recent earnings growth is promising, with Q3 net income rising to SAR 52.12 million from SAR 47.06 million year-on-year, supporting dividend sustainability despite its nascent history in payouts and ongoing expansion efforts in Al-Kharj.

- Click to explore a detailed breakdown of our findings in Fourth Milling's dividend report.

- The analysis detailed in our Fourth Milling valuation report hints at an deflated share price compared to its estimated value.

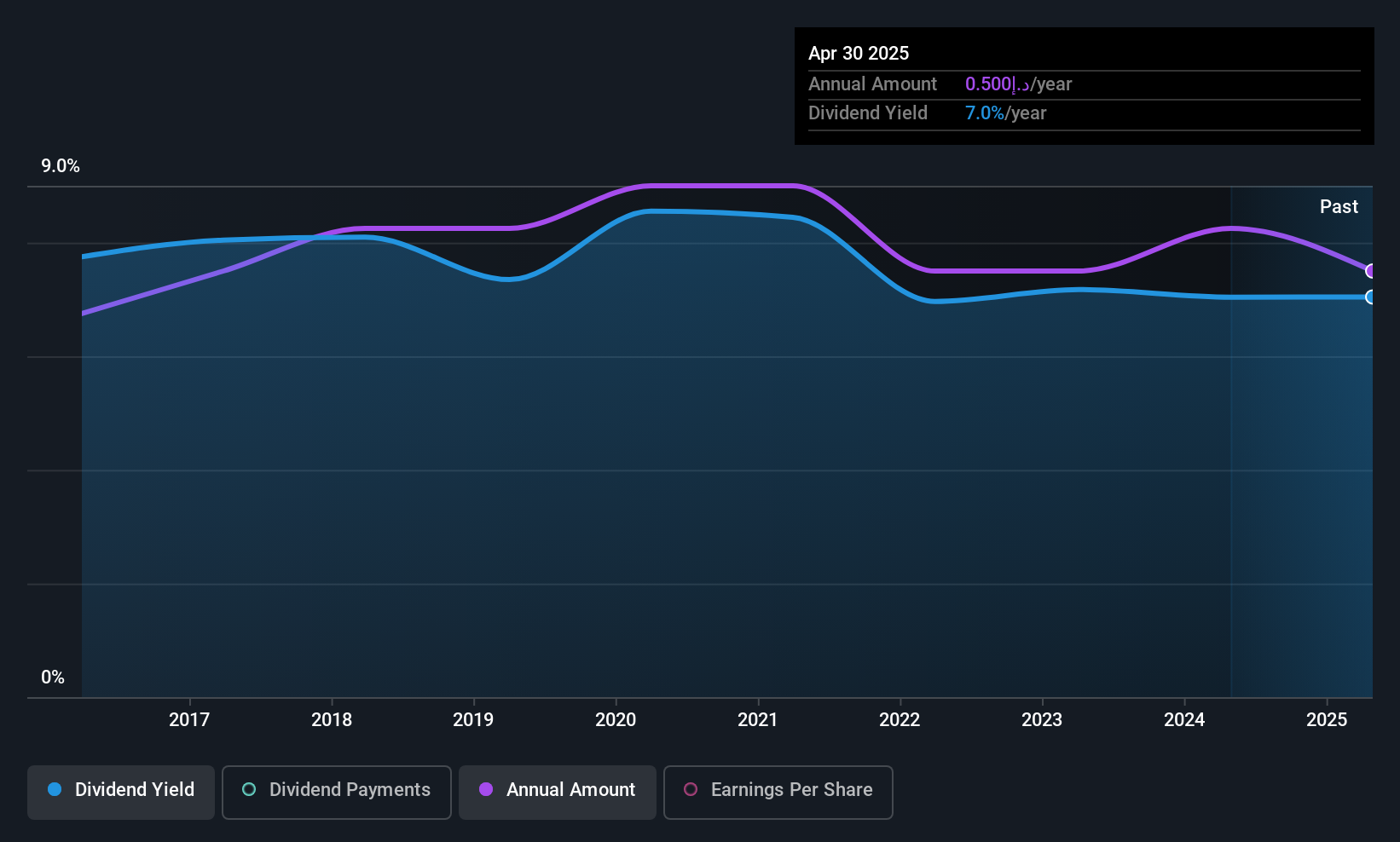

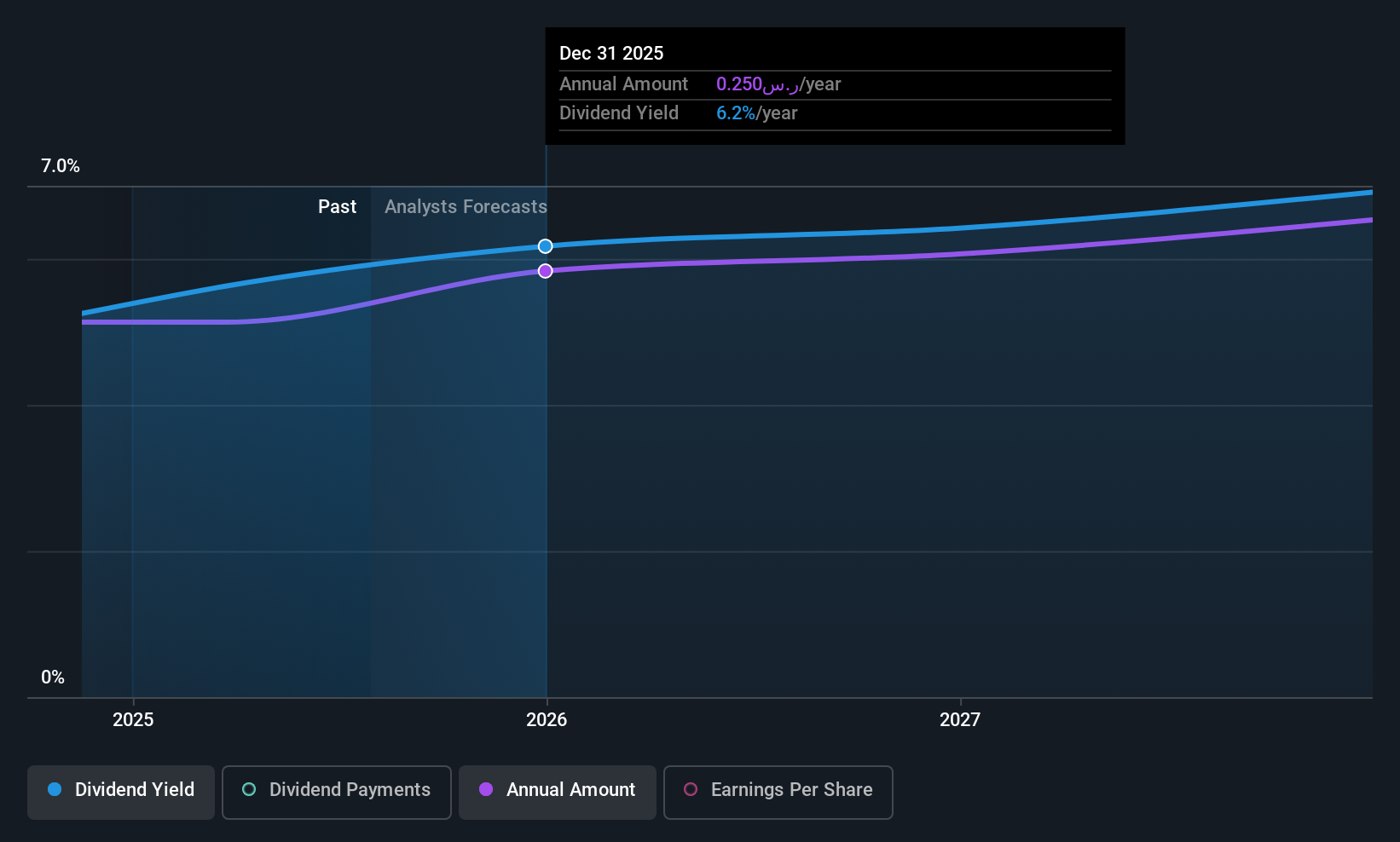

Al-Babtain Power and Telecommunications (SASE:2320)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Al-Babtain Power and Telecommunications Company, along with its subsidiaries, manufactures lighting poles, power transmission towers, accessories, and communication towers across the United Arab Emirates, Saudi Arabia, and Egypt with a market cap of SAR4.23 billion.

Operations: Al-Babtain Power and Telecommunications Company generates revenue through the production of lighting poles, power transmission towers, accessories, and communication towers across its operations in the UAE, Saudi Arabia, and Egypt.

Dividend Yield: 3%

Al-Babtain Power and Telecommunications offers a solid dividend profile, with payouts covered by both earnings (16.1% payout ratio) and cash flows (24.5% cash payout ratio), despite an unstable dividend history. Its recent Q3 2025 earnings showed significant growth in net income to SAR 127.31 million from SAR 43.85 million year-on-year, supporting its ability to maintain dividends amidst high debt levels. The company trades at a favorable P/E of 10.6x compared to the market average of 18.8x, though its current yield of 3.03% is below the top quartile in Saudi Arabia's market.

- Dive into the specifics of Al-Babtain Power and Telecommunications here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Al-Babtain Power and Telecommunications is trading behind its estimated value.

Key Takeaways

- Unlock our comprehensive list of 64 Top Middle Eastern Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2320

Al-Babtain Power and Telecommunications

Produces lighting poles, power transmission towers, accessories, and communication towers in the United Arab Emirates, Saudi Arabia, and Egyptian Arabic Republic.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives