- United Arab Emirates

- /

- Insurance

- /

- ADX:EIC

Many Still Looking Away From Emirates Insurance Company P.J.S.C. (ADX:EIC)

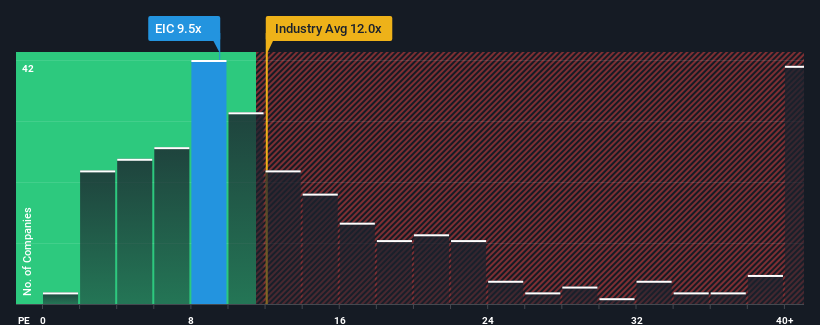

When close to half the companies in the United Arab Emirates have price-to-earnings ratios (or "P/E's") above 15x, you may consider Emirates Insurance Company P.J.S.C. (ADX:EIC) as an attractive investment with its 9.5x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, Emirates Insurance Company P.J.S.C has been doing very well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Emirates Insurance Company P.J.S.C

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Emirates Insurance Company P.J.S.C would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 126%. As a result, it also grew EPS by 17% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

This is in contrast to the rest of the market, which is expected to grow by 2.2% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Emirates Insurance Company P.J.S.C's P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Emirates Insurance Company P.J.S.C's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Emirates Insurance Company P.J.S.C revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Plus, you should also learn about these 2 warning signs we've spotted with Emirates Insurance Company P.J.S.C (including 1 which makes us a bit uncomfortable).

If you're unsure about the strength of Emirates Insurance Company P.J.S.C's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Emirates Insurance Company P.J.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:EIC

Emirates Insurance Company P.J.S.C

Engages in writing general insurance and reinsurance in the United Arab Emirates, the United States, and Europe.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives