- United Arab Emirates

- /

- Healthcare Services

- /

- ADX:GMPC

We Wouldn't Be Too Quick To Buy Gulf Medical Projects Company (PJSC) (ADX:GMPC) Before It Goes Ex-Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Gulf Medical Projects Company (PJSC) (ADX:GMPC) is about to trade ex-dividend in the next 3 days. Ex-dividend means that investors that purchase the stock on or after the 16th of March will not receive this dividend, which will be paid on the 7th of April.

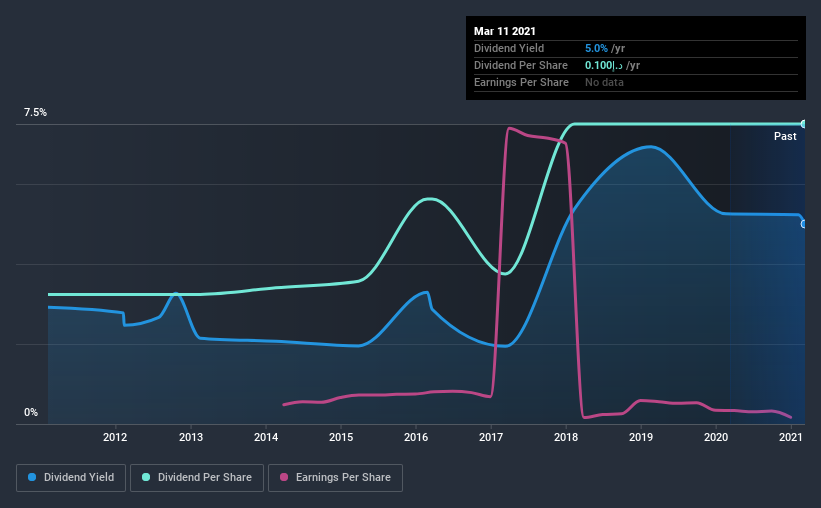

Gulf Medical Projects Company (PJSC)'s next dividend payment will be د.إ0.10 per share. Last year, in total, the company distributed د.إ0.10 to shareholders. Looking at the last 12 months of distributions, Gulf Medical Projects Company (PJSC) has a trailing yield of approximately 5.0% on its current stock price of AED2. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to investigate whether Gulf Medical Projects Company (PJSC) can afford its dividend, and if the dividend could grow.

See our latest analysis for Gulf Medical Projects Company (PJSC)

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. An unusually high payout ratio of 202% of its profit suggests something is happening other than the usual distribution of profits to shareholders. A useful secondary check can be to evaluate whether Gulf Medical Projects Company (PJSC) generated enough free cash flow to afford its dividend. It paid out 86% of its free cash flow as dividends, which is within usual limits but will limit the company's ability to lift the dividend if there's no growth.

It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and Gulf Medical Projects Company (PJSC) fortunately did generate enough cash to fund its dividend. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Readers will understand then, why we're concerned to see Gulf Medical Projects Company (PJSC)'s earnings per share have dropped 26% a year over the past five years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the last 10 years, Gulf Medical Projects Company (PJSC) has lifted its dividend by approximately 8.8% a year on average. The only way to pay higher dividends when earnings are shrinking is either to pay out a larger percentage of profits, spend cash from the balance sheet, or borrow the money. Gulf Medical Projects Company (PJSC) is already paying out 202% of its profits, and with shrinking earnings we think it's unlikely that this dividend will grow quickly in the future.

Final Takeaway

Should investors buy Gulf Medical Projects Company (PJSC) for the upcoming dividend? Earnings per share have been in decline, which is not encouraging. What's more, Gulf Medical Projects Company (PJSC) is paying out a majority of its earnings and over half its free cash flow. It's hard to say if the business has the financial resources and time to turn things around without cutting the dividend. It's not that we think Gulf Medical Projects Company (PJSC) is a bad company, but these characteristics don't generally lead to outstanding dividend performance.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with Gulf Medical Projects Company (PJSC). For instance, we've identified 3 warning signs for Gulf Medical Projects Company (PJSC) (1 is potentially serious) you should be aware of.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Gulf Medical Projects Company (PJSC), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ADX:GMPC

Gulf Medical Projects Company (PJSC)

Manages hospitals in the United Arab Emirates.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026