- Turkey

- /

- Residential REITs

- /

- IBSE:SNGYO

Undiscovered Gems In The Middle East For August 2025

Reviewed by Simply Wall St

As the Middle East markets navigate mixed corporate earnings and the anticipation of U.S. inflation data, investors are keenly observing how these factors influence small-cap stocks across the region. In this dynamic environment, identifying promising stocks involves looking for companies with strong fundamentals that can withstand economic fluctuations and capitalize on growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 1.05% | 36.24% | 62.23% | ★★★★★★ |

| Najran Cement | 14.20% | -2.87% | -22.60% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 15.77% | 4.39% | 8.74% | ★★★★★☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Dana Gas PJSC (ADX:DANA)

Simply Wall St Value Rating: ★★★★★★

Overview: Dana Gas PJSC operates in the exploration, production, and sale of natural gas and petroleum-related products across the UAE, Iraq, and Egypt with a market capitalization of AED5.34 billion.

Operations: Dana Gas generates revenue primarily through the exploration, production, and sale of natural gas and petroleum-related products in the UAE, Iraq, and Egypt. The company has a market capitalization of AED5.34 billion.

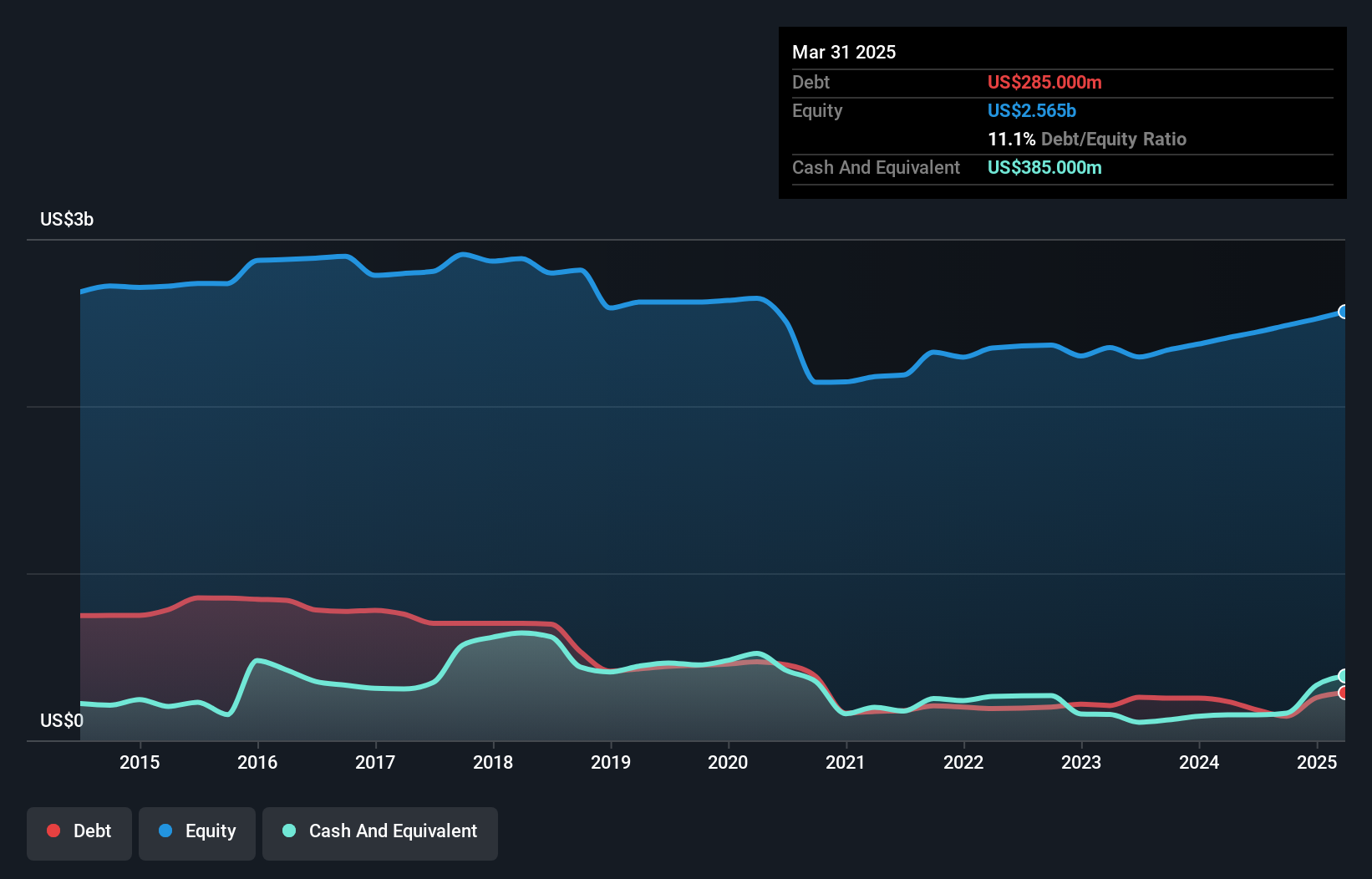

With a market presence that seems undervalued, Dana Gas PJSC is trading at 51.3% below its estimated fair value. The company has shown resilience with earnings growth of 2%, outpacing the Oil and Gas industry, which saw a -4.3% change. Net debt to equity ratio stands at a satisfactory 1.6%, reflecting prudent financial management over the past five years as it reduced from 18.1% to 9.1%. Recent developments in Egypt, including successful appraisal wells like Begonia-2, indicate potential for increased production and reserves, aligning with its $100 million investment strategy aimed at boosting domestic gas output.

- Navigate through the intricacies of Dana Gas PJSC with our comprehensive health report here.

Gain insights into Dana Gas PJSC's past trends and performance with our Past report.

Ray Sigorta Anonim Sirketi (IBSE:RAYSG)

Simply Wall St Value Rating: ★★★★★★

Overview: Ray Sigorta Anonim Sirketi operates in the non-life insurance sector in Turkey, with a market capitalization of TRY44.07 billion.

Operations: Ray Sigorta Anonim Sirketi generates revenue primarily from its accident insurance segment, amounting to TRY13.38 billion, and fire insurance, contributing TRY1.81 billion. The company's financial performance is significantly influenced by these segments within the non-life insurance sector in Turkey.

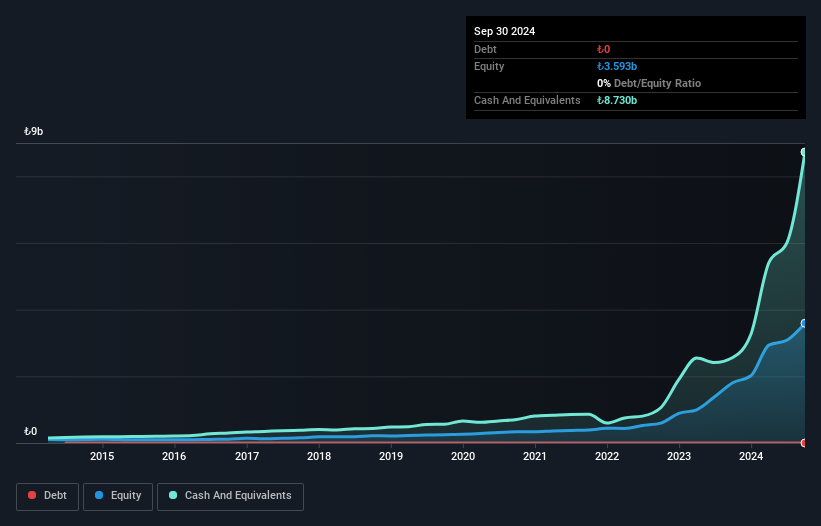

Ray Sigorta Anonim Sirketi, a nimble player in the insurance sector, has shown impressive growth with earnings soaring by 101% over the past year, outpacing the industry’s 40.7%. The company is debt-free for five years and boasts high-quality earnings. Its price-to-earnings ratio of 13.5x suggests good value compared to the TR market's 21.3x. Despite a dip in net profit margins from last year's 22.5% to this year's 15.3%, recent results highlight strong performance with second-quarter net income at TRY1,309 million and basic earnings per share rising to TRY8 from TRY1 last year.

Sinpas Gayrimenkul Yatirim Ortakligi (IBSE:SNGYO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sinpas Gayrimenkul Yatirim Ortakligi A.S., originally established as Sinpas Insaat Anonim Sirketi in 2006 and transformed into a Real Estate Investment Trust (REIT) in 2007, focuses on real estate investments with a market capitalization of TRY17.84 billion.

Operations: Sinpas Gayrimenkul Yatirim Ortakligi generates revenue primarily from residential real estate developments, amounting to TRY12.64 billion.

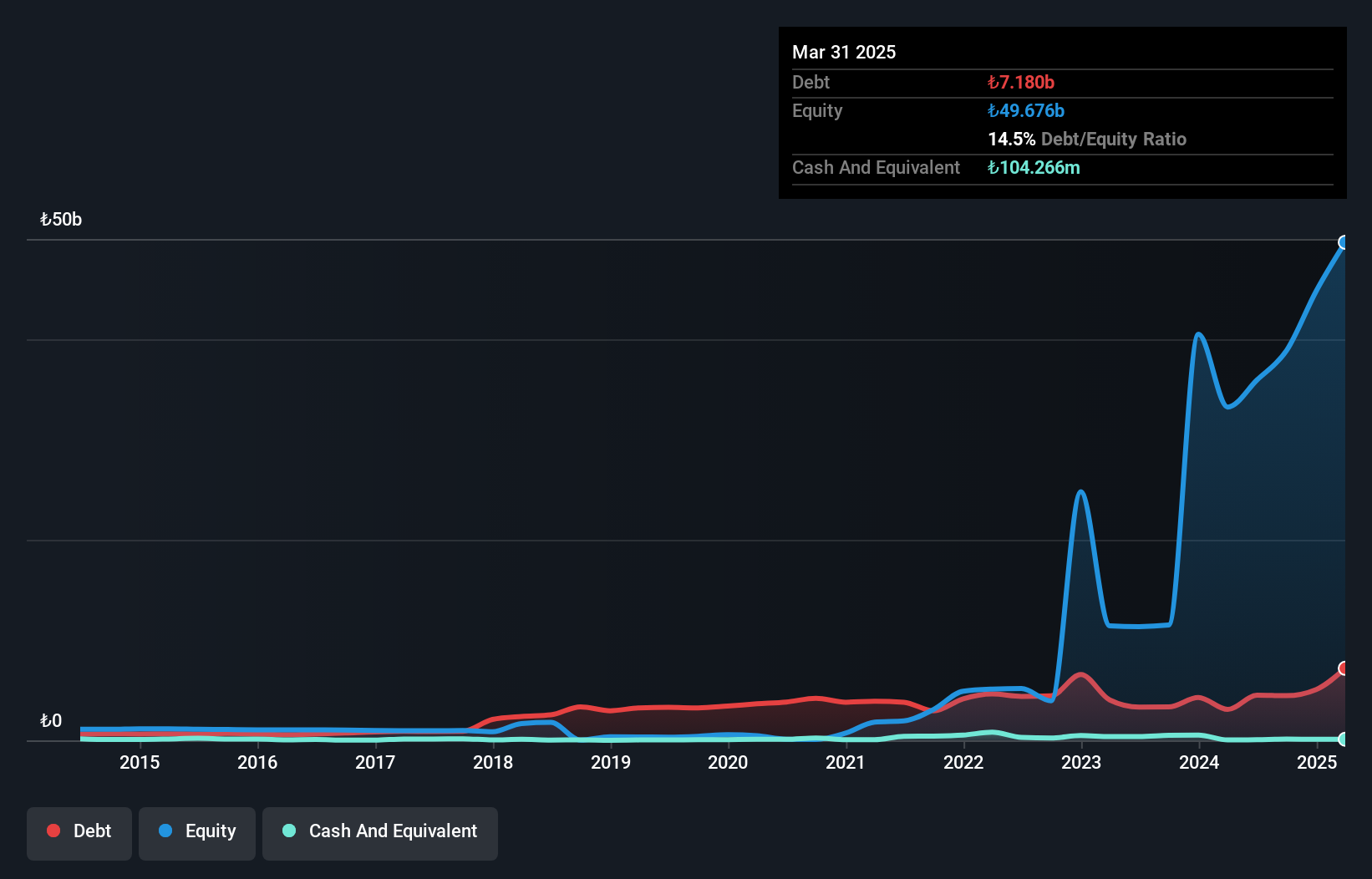

SNGYO, a smaller player in the Middle East real estate sector, has shown impressive earnings growth of 86.4% over the past year, significantly outpacing the industry average of 4.9%. A notable TRY5.3 billion one-off gain has skewed recent financial results, but even without this boost, their performance is commendable. The company's debt-to-equity ratio improved dramatically from 806.1% to a satisfactory 14.5% over five years, indicating better financial health and management's focus on reducing leverage. However, interest coverage remains tight at 2.1 times EBIT, suggesting room for improvement in handling debt obligations efficiently.

Where To Now?

- Unlock our comprehensive list of 225 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:SNGYO

Sinpas Gayrimenkul Yatirim Ortakligi

Sinpas Insaat Anonim Sirketi (Sinpas Insaat), which was established on 22 December 2006 with the aim of transforming into a Real Estate Investment Partnership (REIT), applied to the Capital Markets Board (CMB) with the request to transform into a REIT and following the approval of the relevant request, it was transformed into a REIT by being registered in the trade registry on 3 May 2007 and its title was changed to Sinpas Gayrimenkul Yatirim Ortakligi A.S.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives