- United Arab Emirates

- /

- Hospitality

- /

- ADX:ADNH

Middle East Hidden Gems 3 Small Cap Stocks with Strong Potential

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating tariffs and market volatility, the Middle East's stock markets have shown resilience, with Saudi Arabia's bourse recently experiencing its largest intraday rise since March 2020. As regional indices like Dubai and Abu Dhabi also post gains, investors are increasingly turning their attention to small-cap stocks that exhibit strong fundamentals and potential for growth in this dynamic environment.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Sure Global Tech | NA | 13.90% | 18.91% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.77% | -3.48% | -12.95% | ★★★★★★ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Abu Dhabi National Hotels Company PJSC (ADX:ADNH)

Simply Wall St Value Rating: ★★★★★★

Overview: Abu Dhabi National Hotels Company PJSC focuses on owning and managing hotels within the United Arab Emirates, with a market capitalization of AED 6.93 billion.

Operations: The company generates revenue primarily through its hotels, catering services, and transport services, with respective contributions of AED 1.40 billion, AED 1.26 billion, and AED 304.09 million. The net profit margin is a key financial metric to consider when analyzing its profitability trends over time.

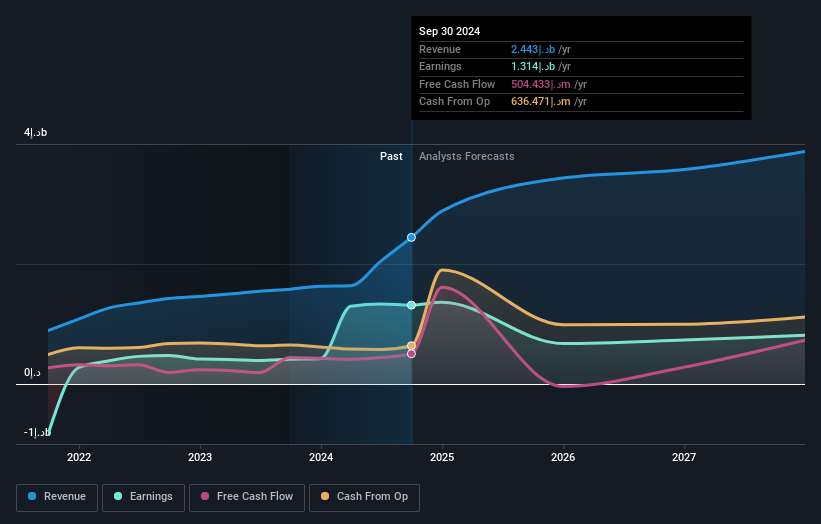

Abu Dhabi National Hotels Company PJSC, a notable player in the hospitality sector, has shown impressive earnings growth of 214% over the past year, significantly outpacing the industry average of 8.7%. The company’s net debt to equity ratio stands at a satisfactory 3%, reduced from 26.3% five years ago to 16.1%, indicating sound financial management. Trading at an estimated 60% below fair value suggests potential for investors seeking undervalued opportunities. Recent financial results highlight a robust performance with sales reaching AED 2.89 billion and net income climbing to AED 1.33 billion compared to the previous year's figures.

Al Ansari Financial Services PJSC (DFM:ALANSARI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Al Ansari Financial Services PJSC, along with its subsidiaries, functions as an integrated financial services company in the United Arab Emirates and internationally, with a market capitalization of AED7.34 billion.

Operations: Al Ansari Financial Services PJSC generates revenue primarily through its integrated financial services operations. The company reported a market capitalization of AED7.34 billion.

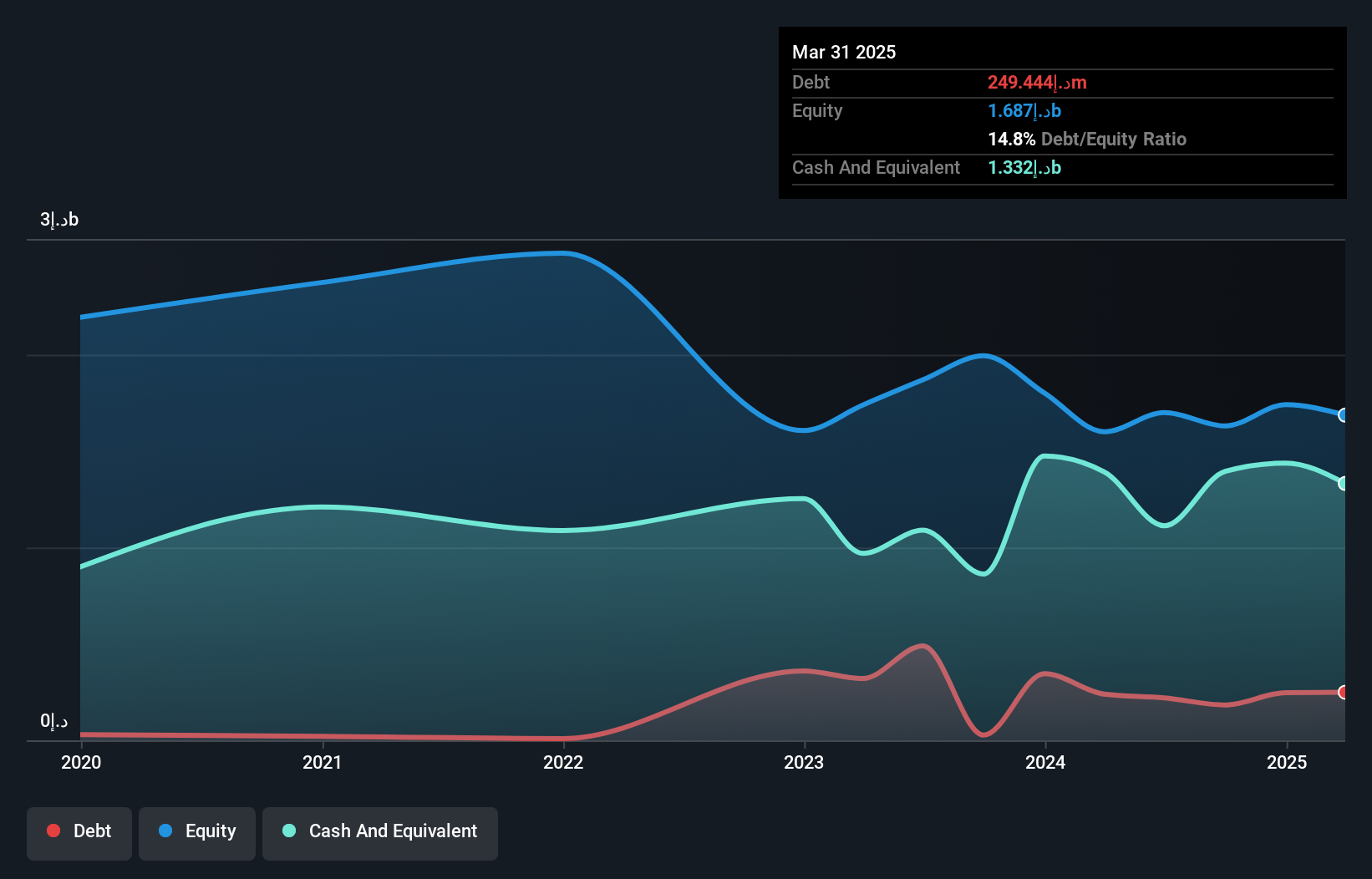

Al Ansari Financial Services PJSC, a key player in the Middle East's financial landscape, is navigating a dynamic market with strategic moves. Despite facing challenges like increased competition and new corporate taxes that have impacted net profits (AED 405.85 million for 2024, down from AED 495.19 million in 2023), the company is poised for growth through digital transformation and regulatory changes favoring traditional players over fintechs. With a Price-To-Earnings ratio of 18.1x below the industry average and ongoing strategic acquisitions such as BFC, Al Ansari aims to boost revenue and EBITDA while managing operational costs effectively.

Lapidoth Capital (TASE:LAPD)

Simply Wall St Value Rating: ★★★★★☆

Overview: Lapidoth Capital Ltd, with a market cap of ₪3.89 billion, operates through its subsidiaries to offer drilling and related services in Israel.

Operations: Lapidoth Capital generates revenue primarily from its drilling and related services in Israel. The company's financial performance is reflected in its market cap of ₪3.89 billion.

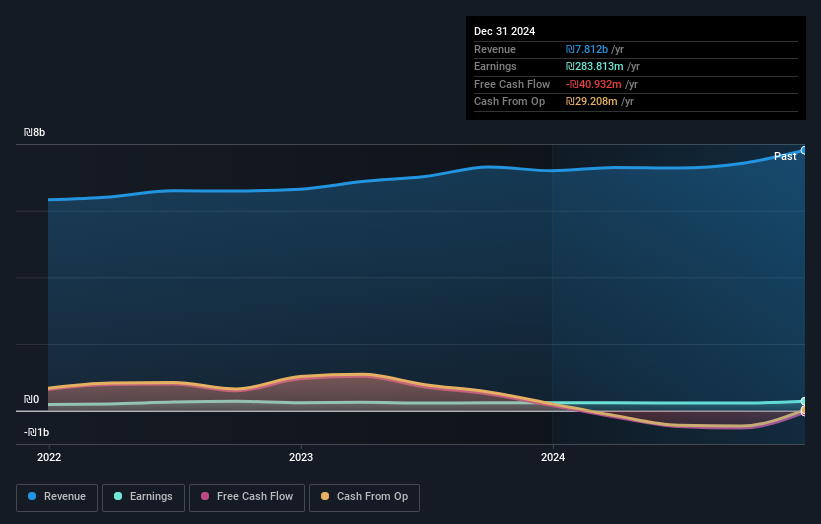

Lapidoth Capital, a small cap player in the Middle East, demonstrates solid financial health with its interest payments well covered by EBIT at 4.8 times. The company's net debt to equity ratio stands at a satisfactory 10.6%, showing prudent financial management. Over the past five years, earnings have grown impressively at an annual rate of 18.3%, although recent growth of 19.4% lagged behind the Energy Services industry average of 26.2%. Despite not being free cash flow positive, Lapidoth's high-quality earnings and reduced debt from 54% to 49% over five years highlight its potential for stability and growth in the sector.

- Click here to discover the nuances of Lapidoth Capital with our detailed analytical health report.

Gain insights into Lapidoth Capital's past trends and performance with our Past report.

Key Takeaways

- Explore the 247 names from our Middle Eastern Undiscovered Gems With Strong Fundamentals screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:ADNH

Abu Dhabi National Hotels Company PJSC

Owns and manages hotels in the United Arab Emirates.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives