- United Arab Emirates

- /

- Industrials

- /

- ADX:MODON

Investors in Modon Holding PSC (ADX:MODON) have seen stellar returns of 256% over the past five years

When you buy a stock there is always a possibility that it could drop 100%. But when you pick a company that is really flourishing, you can make more than 100%. For instance, the price of Modon Holding PSC (ADX:MODON) stock is up an impressive 256% over the last five years. Also pleasing for shareholders was the 22% gain in the last three months.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

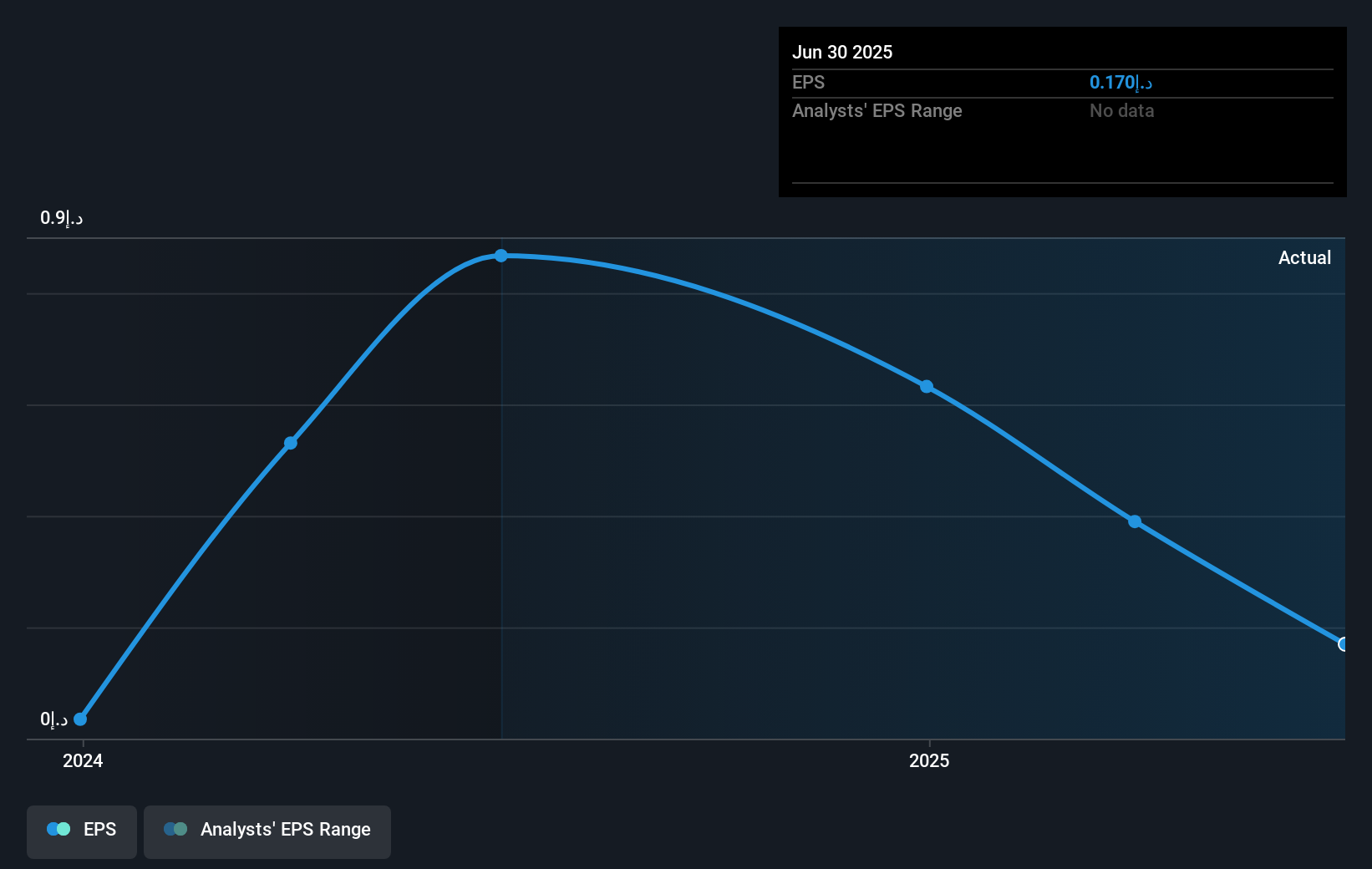

Over half a decade, Modon Holding PSC managed to grow its earnings per share at 0.02% a year. This EPS growth is slower than the share price growth of 29% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Modon Holding PSC's key metrics by checking this interactive graph of Modon Holding PSC's earnings, revenue and cash flow.

A Different Perspective

Modon Holding PSC provided a TSR of 17% over the year. That's fairly close to the broader market return. It has to be noted that the recent return falls short of the 29% shareholders have gained each year, over half a decade. Although the share price growth has slowed, the longer term story points to a business well worth watching. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Modon Holding PSC you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Emirian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:MODON

Modon Holding PSC

Engages in the real estate, hospitality, and investment activities in the United Arab Emirates and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives