- United Arab Emirates

- /

- Banks

- /

- ADX:ADIB

Is Now The Time To Put Abu Dhabi Islamic Bank PJSC (ADX:ADIB) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Abu Dhabi Islamic Bank PJSC (ADX:ADIB). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Fast Is Abu Dhabi Islamic Bank PJSC Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Abu Dhabi Islamic Bank PJSC has managed to grow EPS by 27% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

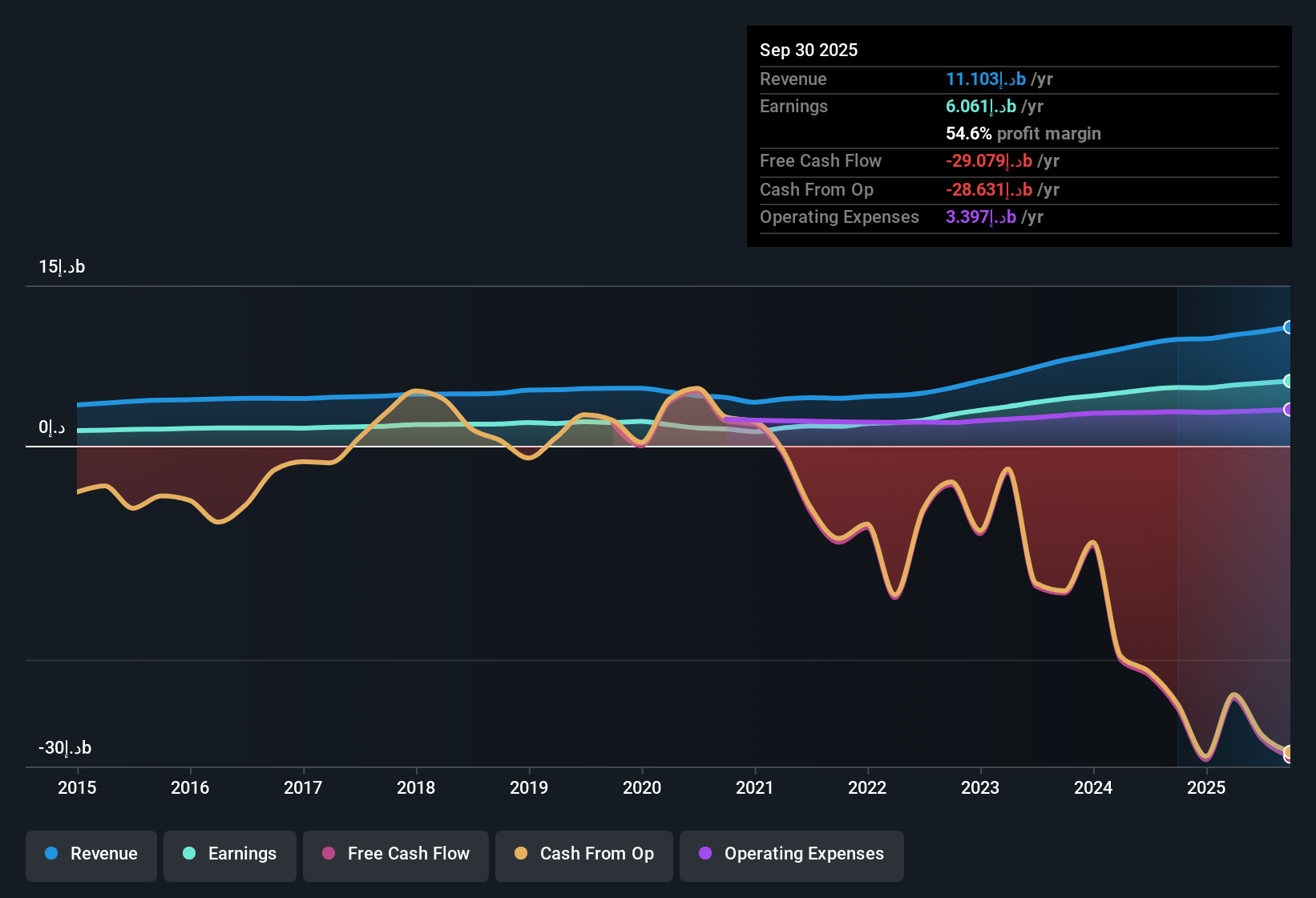

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It's noted that Abu Dhabi Islamic Bank PJSC's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. Abu Dhabi Islamic Bank PJSC maintained stable EBIT margins over the last year, all while growing revenue 12% to د.إ11b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

See our latest analysis for Abu Dhabi Islamic Bank PJSC

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Abu Dhabi Islamic Bank PJSC's future EPS 100% free.

Are Abu Dhabi Islamic Bank PJSC Insiders Aligned With All Shareholders?

Owing to the size of Abu Dhabi Islamic Bank PJSC, we wouldn't expect insiders to hold a significant proportion of the company. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Indeed, they have a considerable amount of wealth invested in it, currently valued at د.إ1.3b. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Is Abu Dhabi Islamic Bank PJSC Worth Keeping An Eye On?

You can't deny that Abu Dhabi Islamic Bank PJSC has grown its earnings per share at a very impressive rate. That's attractive. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. You still need to take note of risks, for example - Abu Dhabi Islamic Bank PJSC has 1 warning sign we think you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Emirian companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:ADIB

Abu Dhabi Islamic Bank PJSC

Provides banking, financing, and investing services in the United Arab Emirates, rest of the Middle East, and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives