- United States

- /

- Water Utilities

- /

- NasdaqGS:YORW

York Water (NASDAQ:YORW) Has A Somewhat Strained Balance Sheet

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk'. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, The York Water Company (NASDAQ:YORW) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for York Water

What Is York Water's Debt?

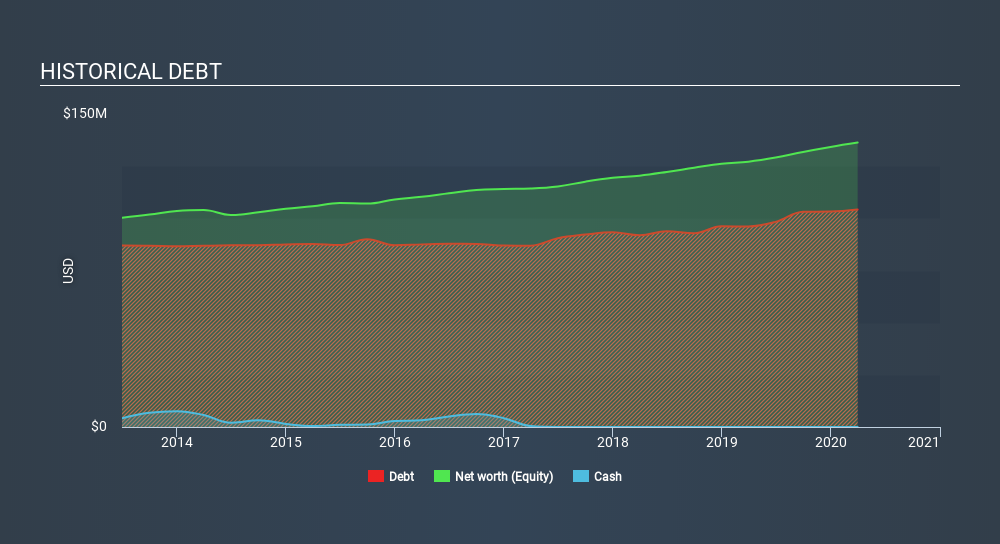

As you can see below, at the end of March 2020, York Water had US$104.3m of debt, up from US$96.1m a year ago. Click the image for more detail. And it doesn't have much cash, so its net debt is about the same.

How Strong Is York Water's Balance Sheet?

According to the last reported balance sheet, York Water had liabilities of US$15.7m due within 12 months, and liabilities of US$217.5m due beyond 12 months. On the other hand, it had cash of US$2.0k and US$6.91m worth of receivables due within a year. So it has liabilities totalling US$226.2m more than its cash and near-term receivables, combined.

York Water has a market capitalization of US$612.5m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

York Water has a debt to EBITDA ratio of 3.4 and its EBIT covered its interest expense 4.5 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. We saw York Water grow its EBIT by 6.3% in the last twelve months. Whilst that hardly knocks our socks off it is a positive when it comes to debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine York Water's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, York Water recorded negative free cash flow, in total. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

York Water's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered cast it in a significantly better light. For example, its EBIT growth rate is relatively strong. We should also note that Water Utilities industry companies like York Water commonly do use debt without problems. When we consider all the factors discussed, it seems to us that York Water is taking some risks with its use of debt. While that debt can boost returns, we think the company has enough leverage now. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 1 warning sign for York Water that you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade York Water, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:YORW

York Water

The York Water Company impounds, purifies, and distributes drinking water.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives